Depending on which bill you are looking at — Senate Bill 1065 or House Bill 913 — Maryland drivers of both electric and gasoline-powered vehicles could soon be paying an extra registration fee to top up the state’s Transportation Trust Fund, a main source of operating income for its Department of Transportation.

But under SB 841, any extra fees based on how many miles vehicles actually drive on state roads would be prohibited.

The competing bills are just three of more than 70 energy-related proposed laws introduced in the first month of the Maryland General Assembly’s 2024 session, as tracked by the Maryland Clean Energy Center. The state’s legislative session officially lasts from Jan. 10 to April 8.

The pace of introductions reached semi-fast-and-furious in the past week — 43 bills in total — as lawmakers raced to meet the Feb. 5 deadline for new bills in the Senate and the Feb. 9 deadline in the House of Delegates. Bills can be introduced after these deadlines but will require approval from the Rules committees in their respective houses.

The range of bills and issues covered ― from registration fees for EVs, to tough emission-reduction targets for data centers, cryptocurrency miners and cannabis growers ― reflect the challenges policymakers face as they seek to balance the state’s ambitious clean energy goals and potentially growing budget deficits.

The bills on EV registration fees, both sponsored by Democrats, are a case in point. The Maryland Department of Transportation in December announced projected budget cuts of $3.4 billion because of falling revenues.

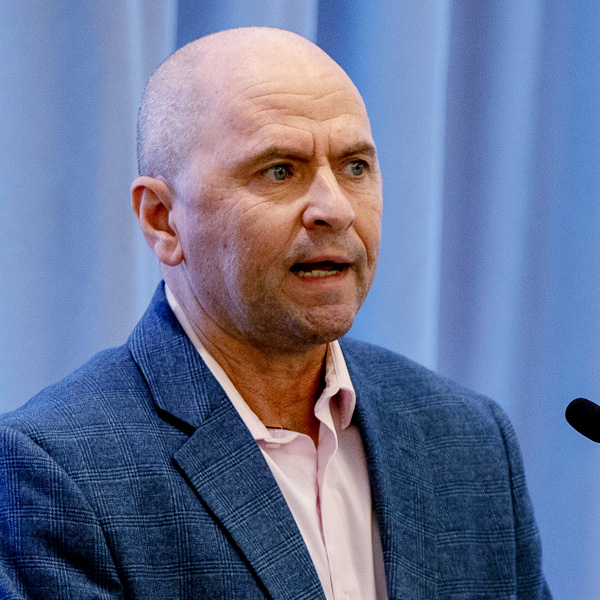

SB 1065, sponsored by Sen. Guy Guzzone, would add a $100/year registration fee for zero-emission vehicles to fill at least part of that gap and make up for falling gas taxes. If passed, Maryland would join the growing number of states across the country — almost 30, according to POLITICO — that have extra registration fees for EVs.

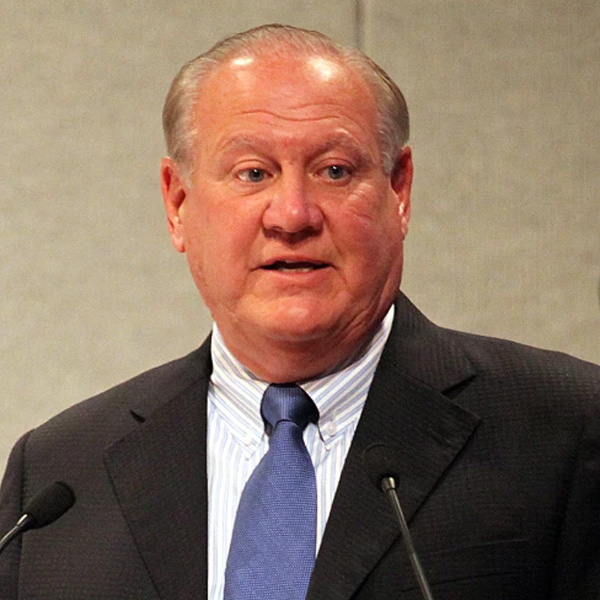

Del. David Fraser-Hidalgo’s HB 913 would keep the $100 fee for EVs but up the ante with a $75/year charge for other, non-electric vehicles.

A vehicle-miles-traveled tax is an additional strategy for raising revenues for transportation infrastructure being tried by a small number of states, but Sen. Justin Ready’s (R) SB 841 would cut off that option.

Other Republican bills similarly seek to slow or sidetrack action on the state’s transition to clean energy.

SB 1063, sponsored by Sen. Steve Hershey, would push back the state’s adoption of California’s Advanced Clean Cars II (ACCII) until the 2030 model year. ACCII requires all new vehicles sold in a state to be zero-emission by 2035, and Maryland’s adoption of the rule in September would allow it to go into effect for the 2027 model year, when 43% of new cars sold would have to be zero-emission. (See Maryland Moves Ahead with Advanced Clean Car and Truck Rules.)

HB 1240, sponsored by Del. April R. Rose, would ban the Department of the Environment (MDE) or the Department of Housing and Community Development from prohibiting natural gas or propane appliances in new construction or buildings undergoing renovations affecting 50% of their square footage. The bill also would ban any extra registration fees on gasoline-powered vehicles based on their use of gasoline.

With Democrats in solid control of both houses of the General Assembly, it is unlikely such bills will pass. But with budget deficits and other economic priorities taking precedence, clean energy laws may have a rough road to passage.

While Gov. Wes Moore (D) has committed the state to cut its emissions by 60% by 2031 and to provide residents with 100% clean power by 2035, only minor climate initiatives have been included in his fiscal year 2025 budget and the legislative agenda he brought to the General Assembly as part of his State of the State address.

The only major energy-related line item mentioned in his budget message Jan. 17 was $90 million for implementing Maryland’s Climate Pollution Reduction Plan. Issued by the MDE on Dec. 28, the plan’s topline message is that reaching those goals will require $1 billion in new state funding every year through 2031. (See Md. Emission-reduction Plan: High Ambitions, No Funding.)

Similarly, while the governor’s recently launched State Plan includes “making Maryland a leader in clean energy and the greenest state in the country,” the only energy-related bill (SB 474/HB 579) in his accompanying legislative agenda proposes to streamline the permitting of “critical infrastructure,” such as backup generators for data centers.

“The Moore-Miller administration is continuing to work with the state legislature to meet Maryland’s energy goals while also protecting the state’s environment,” an administration spokesperson said in an email to NetZero Insider. “The governor looks forward to supporting legislation, and initiatives that will help Maryland secure its clean energy future.”

The General Assembly’s recent track record includes some major climate and clean energy wins, such as the Climate Solutions Now Act of 2022, which set the state’s 60% emissions reduction target. In 2023 the legislature passed laws making Maryland’s community solar pilot program permanent (HB 908) and adopting a Clean Trucks rule (HB 230) that, similar to ACCII, phases in sales of zero-emission medium- and heavy-duty trucks.

Democrats Go Big

This year, Democrats have once again introduced ambitious bills now waiting for committee hearings.

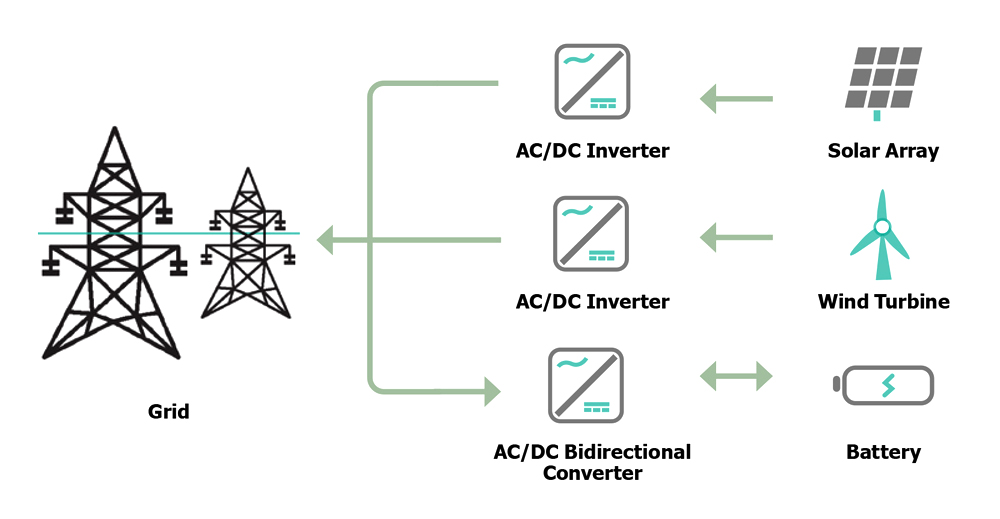

HB 1112, sponsored by Del. Lorig Charkoudian, would require the Maryland Public Service Commission to “determine whether the deployment of energy storage devices could help to avoid or limit a reliability-must-run agreement with an energy generating system or facility in the state under certain circumstances.” The PSC could require utilities to acquire storage, either as owner or through a third-party contract, as an alternative to keeping fossil fuel-fired generation online.

The bill is clearly aimed at circumventing situations like PJM’s current efforts to keep the Brandon Shores coal-fired plant online past its planned 2025 closure.

SB 861, sponsored by Sen. Karen Lewis Young, aims to cut emissions at “high-energy-use facilities,” such as data centers, cryptocurrency operations or cannabis growing farms. These facilities tend to have high energy demands that can put stress on local distribution systems.

The bill would set a baseline emissions level of 0.428 metric tons of carbon dioxide per megawatt-hour of electricity used and require these facilities to cut emissions 60% by 2027, 80% by 2030, 90% by 2035 and 100% by 2040.

HB 1272, sponsored by Del. Dana Stein, would take a first, small step toward funding the Climate Pollution Reduction Plan with its authorization for the MDE to establish an economywide cap-and-invest program. Maryland already receives millions of dollars from its participation in the Regional Greenhouse Gas Initiative, the regional cap-and-trade program that sets limits on greenhouse gas emissions from power plants in New England and the Mid-Atlantic. An economywide program could cover all major industrial emitters in the state.

SB 959, cross-filed with HB 1256, is a complex package that combines the introduction of time-of-use rates as the default choice for electric utilities’ residential customers with demand-management strategies, such as the use of aggregated residential energy storage and managed charging of EVs or electric school buses. The goal, according to the bills’ sponsors, Fraser-Hidalgo and Sen. Brian Feldman (D), is to promote “beneficial electrification” by encouraging consumers to shift energy use to off-peak hours, thus cutting peak loads on distribution systems and their own energy bills.

But not all bills sponsored by Democrats may be considered climate-friendly. A second bill sponsored by Stein, HB 990, would exempt manufacturing facilities in the state from complying with any emission-reduction rules, such as Maryland’s Building Energy Performance Standard, which requires buildings larger than 35,000 square feet to cut their emissions 20% below 2025 levels by 2030 and reach net zero by 2040.

The bill would prohibit state agencies from establishing rules requiring manufacturers to cut emissions below 2023 levels, especially if doing so would cause significant cost increases above 2023 levels for the state’s manufacturing sector. However, the bill would not exempt manufacturers from complying with greenhouse gas reporting requirements or emission reductions related to RGGI.