CARMEL, Ind. — MISO last week said its extensive analysis shows that its current $3,500/MWh value of lost load (VOLL) should be raised to $10,000/MWh.

The grid operator has made a renewed push in recent months to re-estimate its value of lost load after saying that its existing VOLL is dated, having been established in the 2008-2009 time frame. MISO’s current VOLL reflects the willingness of the lowest-income residential customers in the RTO’s footprint to pay for uninterrupted service.

During a Feb. 29 Market Subcommittee meeting, MISO’s Chuck Hansen said the $3,500/MWh limit “can currently curtail valid market prices.”

“When the system is in a more vulnerable state, prices should reflect the risk of diminishing reserves,” Hansen said.

Three years ago, MISO’s Independent Market Monitor recommended the RTO adopt a $10,000/MWh VOLL.

Hansen likened a well-thought-out VOLL to the “jolt” delivered from farmers’ electric fences, which aren’t meant to injure livestock.

“The goal isn’t to shock the cows; the goal is to just keep them in the field,” he explained.

Hansen said a raised value would almost counterintuitively moderate market volatility because market participants would take more actions to dodge the highest prices.

“With higher prices, we expect lower volatility and more preparation to avoid those kinds of real-time energy deficiencies,” he said.

Hansen said MISO’s current VOLL is “outdated and below industry willingness to respond to demand.” He said a reasonable VOLL would properly discourage market participants from “these ‘touching the electric fence’ situations” and “potentially make them more rare than they already are.”

New VOLL Means New ORDC

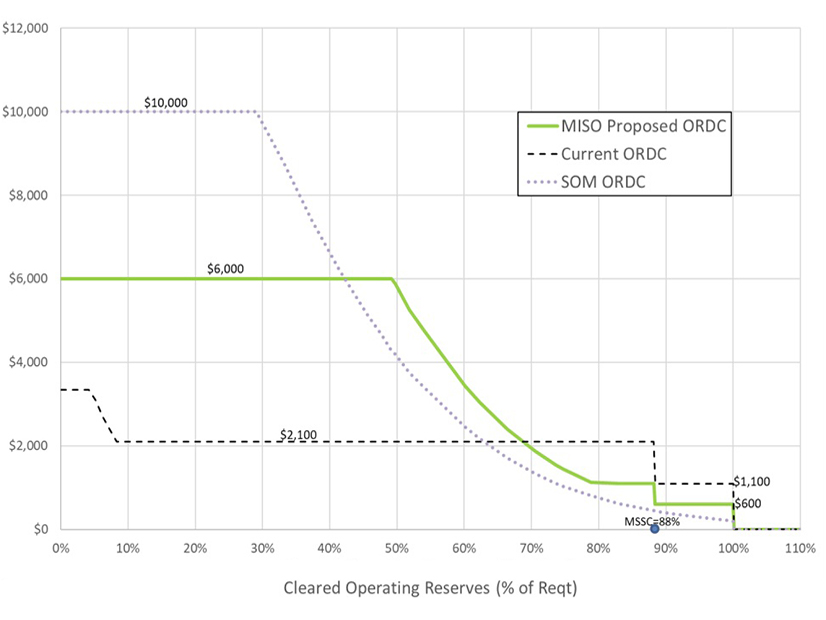

MISO said it also will seek to change how VOLL ties into its operating reserve demand curve (ORDC). MISO’s ORDC is linked to VOLL, and the current curve mostly sits at $1,100/MWh and $2,100/MWh across two large steps before it tops out at $3,500/MWh.

Despite proposing a $10,000/MWh VOLL, MISO wants its ORDC to peak at $6,000/MWh and stay there until about 50% of cleared operating reserves materialize. From there, the curve would slope downward until MISO can confirm more than 80% of its cleared operating reserves, at which point the curve would become two steps: $1,100/MWh until 88% of reserves show up and $600/MWh until 100% of reserves turn up.

If MISO already had the new curve in place, Hansen said more than 90% of MISO’s past shortages would have resulted in lower penalty prices. Most of the RTO’s operating reserve shortages occur at 88% of reserves or higher. Historically, MISO has never experienced an operating reserve shortage below 50%.

“This is not just about raising VOLL and making prices higher. On the right side of the curve, we thought it was appropriate to lower prices,” Hansen said.

Hansen said MISO would like to introduce an ORDC that is lower for small reserve shortages and results in higher prices for greater shortages.

“As reserves go away, we want prices to approach VOLL, but we don’t want prices to be so high that they reach VOLL well before load shedding is initiated,” Hansen said. Conversely, he added that the lower bound of the ORDC shouldn’t be so low that it’s cheaper for market participants to violate marketwide operating reserve requirement.

Hansen said MISO wants to continue to use an updated VOLL as a price cap for locational marginal prices, market clearing prices and during load shed events.

But he said MISO would like to sever the connection between VOLL and MISO’s emergency demand response offer cap. MISO has called on its emergency demand response only once, more than 15 years ago. Today, MISO’s emergency demand response averages less than 500 MW and is managed on a separate system from the RTO’s markets. The product was introduced before MISO debuted its ancillary service market, and owners are under no obligation to be available. Hansen said MISO has debated retiring its emergency demand response product and urges market participants to move their offerings under the RTO’s existing load-modifying resource and demand response programs.

Justification for $10K

Hansen said the current VOLL was established alongside the launch of MISO’s ancillary services market and “that number has not changed in 15 years.”

He said MISO has made hundreds of calculations to freshen its VOLL, including crunching numbers for different lengths of outages; nonsummer versus summertime periods; afternoon, evening or off-peak periods; and using different customer load classes, including small commercial, industrial, residential and manufacturing segments.

MISO found that for a one-hour outage occurring off-peak in summer, VOLL will run $4,337/MW for residential customers and up to nearly $81,000/MW for small commercial and industrial customers. For an eight-hour outage occurring off-peak in summer, a residential VOLL will run about $8,107/MW, while small commercial and industrial customers’ value runs more than $266,000/MW.

“We’ve been studying a range of numbers, many numbers,” Hansen said.

MISO found that its highest VOLL occurs during off-peak periods with small commercial and industrial customers the most exposed to risks of lost revenue. Larger commercial and industrial customers often have access to more capital to prepare to bounce back more quickly from an outage, staff said.

When MISO made its 2007 FERC filing to create VOLL, it used the average of the $1,470/MWh median value of its residential class and the $15,250/MWh lowest median value of the small commercial and industrial class. The resulting VOLL was weighted 85% toward residential customers.

Using that same 2007 calculation, Hansen said the 2023 VOLL for a summertime, one-hour outage occurring off peak should be $13,640/MWh.

“What we’re proposing is actually on the conservative side,” Hansen said.

Hansen reminded stakeholders that MISO isn’t in charge of which customers are affected by outages when it orders load shedding. The RTO simply tells local balancing authorities how many megawatts it needs off the system. MISO said a recent survey of its local balancing authorities shows that when instituting rolling blackouts, customers dropped on average are 48% residential, 30% large commercial and industrial, and 22% small commercial and industrial.

Hansen said a $10K VOLL reflects that industrial customer load is also shed alongside residential load during dire circumstances.