NV Energy would gain significantly more economic benefits from participating in CAISO’s Extended Day-Ahead Market (EDAM) than SPP’s Markets+, new analysis from the Brattle Group shows.

The analysis was included in slides referenced — but not presented — by the utility during an RTO markets workshop hosted by the Public Utilities Commission of Nevada on March 4. An NV Energy official said the utility will review the findings with the commission at a future workshop, the date for which has not been determined. (See Nev. Commission to Tackle Rules for RTO Membership.)

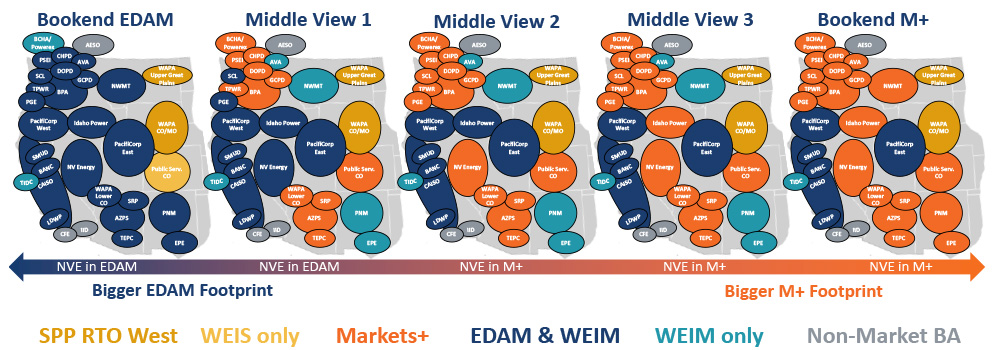

The Brattle study looks at financial outcomes for NV Energy based on five market footprints, with benefits measured against a business-as-usual scenario that assumes membership in CAISO’s Western Energy Imbalance Market remains unchanged.

Brattle said it conducted the simulations underpinning the study using a nodal production cost model of the Western Interconnection “with added market functionality, such as contract-path transmission.”

The study looks at performance in 2032, “which aims to reflect the first decade of markets operations, representing both an intermediate year in the near future and a year with reasonably high renewable penetration in the” Western Interconnection, Brattle said.

In the “Bookend EDAM” scenario, which assumes nearly all utilities in the Western Interconnection participate in the EDAM, NV Energy would gain about $62 million in annual benefits from higher transfer revenue and lower annual production costs (APC). In that scenario, the utility would facilitate a sharply increased amount of trade between with Southwest and California, while also helping to transfer more low-cost generation from California and the Southwest to the PacifiCorp-East and Idaho Power balancing authority areas.

NV Energy would reap the most benefits — $149 million — from the “Middle View 1” scenario, in which EDAM contains all entities that already have announced for that market, plus Seattle City Light, Portland General Electric, Idaho Power and NV Energy. In that scenario, the Bonneville Power Administration and most of the Northwest’s publicly owned utilities, Puget Sound Energy, and all Arizona BAAs join Markets+. NV Energy sees fewer transfers here than in Bookend EDAM, but it also has less competition for low-cost renewable generation, reducing its purchase costs by about $50 million.

The “Bookend Markets+” scenario assumes NV Energy is participating in Markets+ along with all Northwest and Southwest (including New Mexico) entities, putting a seam between PacifiCorp-East and CAISO and PacifiCorp-West. In that scenario, NV Energy earns $16 million in benefits based on transfer revenues and lower APC but loses access to low-cost generation in the EDAM.

The “Middle View 3” scenario keeps NV Energy in Markets+ but removes the Avista, NorthWestern Energy, El Paso Electric and PNM BAAs, reducing the Nevada utility’s annual benefits to $9 million based on lost revenue and increased purchase costs in the smaller footprint.

But NV Energy would incur net losses from participating in Markets+ in “Middle View 2,” which assumes Idaho Power joins EDAM, “cutting off a major pathway” between the Southwest and Pacific Northwest, with flows between areas restricted to just 200 MW. In that scenario, energy flows with Idaho decline by about 3,000 GWh a year.

Takeaways

Among Brattle’s suggested “key takeaways” from the study: NV Energy’s estimated benefits would be highest in the EDAM, “largely due to the opportunity to sell additional generation at higher prices and buy at excess solar at lower prices.”

The study also found that the scale of NV Energy’s benefits is heavily influenced by the market footprint’s shape “due to its large amount of transfer capability and centrality” in the Western Interconnection.

“NVE benefits tend to be higher when it is central to the market and facilitates transfers within the market (e.g., in Bookend M+ case, in which NVE facilitates transfers between the PNW and SW; or Bookend EDAM case, in which NVE facilitates transfers between CAISO and the SW),” Brattle said.

Conversely, benefits decline for the utility when it sits on the margin of Markets+, the analysis found.

Brattle noted also that NV Energy would suffer negative impacts from shifting out of the WEIM and into Markets+ “as it loses access to excess renewable supply from CAISO in real time and sees lower prices for [real-time] sales.”