ERCOT CEO Pablo Vegas said last week that the “interesting dynamic” of solar energy helped the Texas grid operator meet record demand during its most recent winter storm.

“We continue to see strong solar performance being a very critical part of the resource mix,” he told ERCOT’s Board of Directors during its Feb. 27 bimonthly meeting. “We had very strong solar generation during the days of this winter event.”

ERCOT set a record for solar production at 14.84 GW during the storm’s peak Jan. 16, accounting for about 23% of system demand at the time. That mark has since been extended several times to just shy of 17.20 GW.

As of January, the grid operator had 22.26 GW of solar capacity. According to ERCOT data, another 13.15 GW of capacity is projected to be operational in 2025.

Wind production varied between 1.9 GW and 24.4 GW during the storm. Of course, demand was tightest during calm mornings before the sun rose. Vegas said “incredibly strong performance” from the thermal fleet, storage providing about 1.5% of total energy needs during the storm’s peak periods, and conservation calls helped make up for the missing renewables.

“We were right along the lines of what would be expected [for thermal outages] during that time of year and significantly improved over the performance we saw during Winter Storm Elliott,” Vegas said. “Batteries … are a growing resource on the grid that’s going to continue to be a growing component of the resource mix during those times of need.”

The grid operator set five new winter peaks during the storm, the record peak coming at 78.31 GW early Jan. 16. That was a 5.9% increase over the previous mark of 73.96 GW set during the December 2022 storm, itself a 27.7% increase over the prior record.

“So, a pretty significant increase over that period of time,” Vegas said.

He also applauded the collaboration and preparation across the industry for the grid’s performance during the storm.

“That was different than in prior storms,” Vegas said. “The planning and preparation was far more extensive and much earlier than we’ve experienced in prior storms.”

Ögelman to Retire from ERCOT

Vegas devoted part of his CEO’s report to the board in recognizing his “dear friend and colleague” Kenan Ögelman, who is retiring from ERCOT on March 30.

As vice president of commercial operations, Ögelman has overseen market operations, settlement and retail operations, and market design and development. He also led or supported several important initiatives, including various ancillary service products, Lubbock’s integration into the ERCOT market, real-time co-optimization, scarcity pricing reforms, and securitization of credit and financing after the deadly 2021 winter storm.

“Not only were the mechanics of the development and the elegance of the solutions attributable to Kenan’s leadership, but his ability to bring consensus together in these conversations was something that was really remarkable,” Vegas said. “Honestly, the most difficult thing about working with Kenan is pronouncing his name correctly, because there is nothing difficult about working with Kenan.”

For the record, Ögelman’s name is pronounced Keh-naan Oh-gell-mun.

Jupiter Power’s Caitlin Smith, who chairs the Technical Advisory Committee (TAC) where Ögelman represents ERCOT, offered her thoughts during her update to the board.

“I’ve known him, I think, my entire career in this industry,” she said. “He’s a great friend and mentor and I know that the stakeholders will miss him in this role.”

The board and stakeholders present gave Ögelman a round of applause.

He is the most senior executive to leave the ISO after Winter Storm Uri since then-CEO Bill Magness resigned.

Ögelman joined ERCOT in 2015 from CPS Energy, where he was director of energy market policy and chaired TAC from 2011 to 2013. Previously, he was a senior economist for the Texas Office of Public Utility Counsel, which represents residential electric consumers.

IMM Again Critiques ECRS

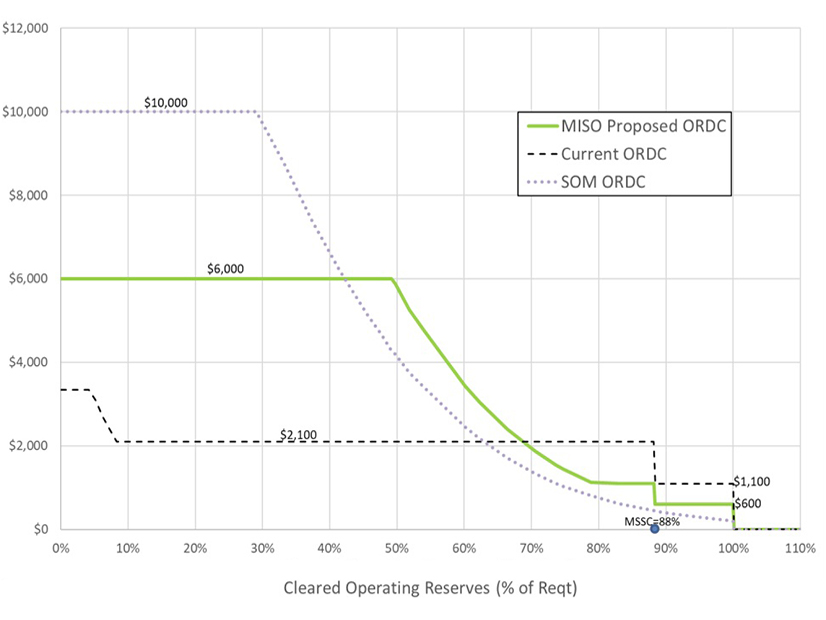

ERCOT’s Independent Market Monitor told the Reliability & Markets Committee that while the ISO managed the system reliably during the January storm and prices exceeded only $1,200/MWh, “excessively held” ERCOT contingency reserve service (ECRS) inflated prices during the event.

The IMM said prices cracked the $1,200 level even though reserves never fell below 5,000 MW during the storm and the operating reserve demand curve never exceeded $90/MWh.

“What we saw was large amounts of held ECRs likely drove some of that higher real-time pricing, particularly on Jan. 16,” Wen Zhang, the IMM’s deputy director, said, adding efficient prices could have lowered wholesale energy costs by about $90 million.

“This indicates that the concerns we raised about ECRS are still present,” she said.

The IMM has said ECRS, the newest ancillary product added in June, likely cost between $675 million and $750 million for 2023. It says the product created artificial supply shortages that produced “massive” inefficient market costs of about $12.5 billion last year.

The monitor has been discussing potential changes to ECRS’ deployment. (See ERCOT Board of Directors Briefs: Dec. 19, 2023.)

Board Approves RR Remanded by PUC

The board agreed with the R&M committee’s and staff’s recommendations to approve a nodal protocol revision request (NPRR1186) regulating energy storage resources (ESRs) that was remanded by regulators back to the grid operator in January. (See “NPRR1186 Goes to Board,” ERCOT Technical Advisory Committee Briefs: Feb. 14, 2024.)

As directed by the Public Utility Commission, staff removed language that set penalties for batteries without sufficient state of charge to meet their obligations when deployed.

The directors also withdrew NPRR1209, which was designed to operate in tandem with NPRR1186’s compliance provisions.

Storage developers vigorously opposed NPRR1186 as it went through the stakeholder process last year. SOC requirements will be addressed by existing protocols and revisions still in the pipeline, staff said.

The directors confirmed Smith and Oncor’s Collin Martin as TAC’s chair and vice chair and approved Enerwise Global Technologies as an adjunct member. The ISO gives adjunct membership to entities that don’t meet the definitions or requirements to join as corporate or associate members.

The board also approved several other items that cleared the R&M committee Feb. 26 and previously were endorsed by TAC:

-

- Texas-New Mexico Power’s Pecos County Transmission Improvement Project, a $114.8 million, 138-kV effort addressing reliability needs under maintenance outage conditions near Fort Stockton in the Far West weather zone.

- The second phase of the Aggregate Distributed Energy Resources (ADERS) pilot project. ERCOT has cleared seven additional ADERS to go through the qualification and validation process of commercial operations, joining the two that already are participating in the wholesale market. (See “ADERs now up to 9,” ERCOT Technical Advisory Committee Briefs: Jan. 24, 2024.)

Its consent agenda included 11 nodal protocol revision requests (NPRRs), two changes to the settlement metering operating guide (SMOGRRs), a system change request (SCR) and single modifications to the load planning guide (LPGRR), nodal operating guide (NOGRR), planning guide (PGRR), retail management guide (RMGRR) previously endorsed by the Technical Advisory Committee that:

-

- NPRR1170: define when a qualified scheduling entity (QSE) representing a resource that relies on natural gas as its primary fuel source should notify ERCOT about gas supply disruptions.

- NPRR1179: ensure that QSEs representing resources with an executed and enforceable transportation contract procure fuel economically and file a settlement dispute to recover their actual fuel costs incurred when instructed to operate because of a reliability unit commitment (RUC). This change also would adjust the RUC guarantee to reflect the cost difference between the actual fuel consumed during the RUC-committed intervals and the fuel burn calculated based on verifiable cost parameters and would clarify that fuel costs also may include penalties for fuel delivery outside of RUC-committed intervals.

- NPRR1193: change the ERCOT-polled settlement (EPS) design-proposal form’s referenced location when it moves from the other binding document (OBD) list into the SMOG.

- NPRR1195: assign ERCOT-polled settlement metering facilities’ maintenance and repair responsibilities to the facilities’ owner if it is not a transmission and/or distribution service provider (TDSP).

- NPRR1199: revise the protocols to add definitions related to the Lone Star Infrastructure Protection Act (LIPA), a 2021 law that prohibits Texas businesses and governments from contracting with entities owned or controlled by individuals from China, Russia, North Korea or Iran if the contracting relates to “critical infrastructure.” The measure also adds language reflecting ERCOT’s statutory authorization to immediately suspend or terminate a market participant’s registration or access if the ISO has a reasonable suspicion that the entity meets any of the LIPA’s criteria, among other revisions.

- NPRR1206: clarify the QSEs required to have a hotline and a 24/7 control or operations center and reconcile the deadline by which QSEs representing resource entities that own or control resources must provide notice they are terminating their representation and the deadline that resource entities owning or controlling resources to change QSEs with a 45-day timeline.

- NPRR1207: permit the incidental disclosure of protected information and ERCOT critical energy infrastructure information during a tour or overlook viewing of the ERCOT control room provided to eligible persons who have signed nondisclosure agreements and complied with screening and other requirements before accessing the control room.

- NPRR1208: create a new daily ERCOT invoice report listing invoices issued for the current day and day prior at a counterparty level.

- NPRR1210: change the frequency of the next-start resource and the load-carrying tests from every five years to every four calendar years.

- NPRR1211: incorporate the OBD “Methodology for Setting Maximum Shadow Prices for Network and Power Balance Constraints” into the protocols.

- NPRR1213: amend requirements for distribution generation resources (DGRs) and distribution energy storage resources (DESRs) seeking qualification to provide ECRS. The NPRR also modifies requirements for ancillary service self-arrangement and ancillary service trades for DGRs and DESRs that provide nonspinning reserve on circuits subject to load shed.

- LPGRR074: align specific term language in the profile decision tree “definitions” worksheet with profile segment language that was added to the “segment assignment” worksheet with the Public Utility Commission’s 2022 approval of LPGRR069.

- NOGRR261: incorporate the OBD “Procedure for Calculating Responsive Reserve Limits for Individual Resources” into the nodal operating guide.

- PGRR109: require interconnecting entities associated with inverter-based resources to undergo a dynamic model review process before the commissioning date and mandate that resource entities owning or controlling operational IBRs undergo a review process before changing settings or equipment that could affect electrical performance and necessitate dynamic model updates.

- RMGRR179: add a communication method so TDSPs can use Texas standard electronic transactions to inform retail electric providers of record which electric service identifiers are affected by a TDSP’s mobile generation or temporary emergency electric energy facility deployment.

- SCR825: modify ERCOT’s current control room voice communication configurations to give QSEs and their subordinate QSEs greater flexibility when assigning agents, including allowing sub-QSEs to assign agents different from those used by the parent QSE.

- SMOGRR027: Move the EPS metering design proposal from the OBD list into the SMOG, standardizing the approval process, and amend the design proposal form to require more information identifying all distribution service providers that have the right to serve a project.

- SMOGRR030: Move the EPS metering facility temporary exemption request application form from the OBD list into the SMOG to standardize the approval process.