PJM’s Independent Market Monitor on Nov. 7 filed a complaint with FERC against the RTO arguing that its Capacity Performance (CP) construct for incentivizing generation performance during emergencies through penalties and bonuses is overly punitive and undermines reliability (EL24-12).

The Monitor told the commission the penalty rate calculation, based on the cost of new entry (CONE), should be revised to be based on the Base Residual Auction (BRA) clearing price instead. The penalty rate would be set to the clearing price per megawatt-year divided by the number of intervals in 30 hours for each interval a resource is unavailable, with an annual stop loss set at 1.5 times the resource’s annual capacity revenues.

While the capacity market overhaul PJM filed with FERC on Oct. 13 would set the stop loss at 1.5 times capacity revenues, the Monitor noted that it would base the penalty rate on CONE and argued that it would continue to expose market sellers to “excessive nonperformance penalties.” The Monitor also said the proposal ties too many changes to the Reliability Pricing Model (RPM) too quickly for the markets to properly adjust to, increasing uncertainty and the risk that unintended consequences may be introduced. (See PJM Files Capacity Market Revamp with FERC.)

“Because PJM has repeatedly failed to propose rules that would correct its flawed market design, this complaint is necessary to remove the flawed rules for penalty rates in the existing rules, adopt just and reasonable replacement rules, and maintain the existing schedule for RPM auctions,” the Monitor said.

The IMM argued that lowering CP penalties has broad stakeholder support, noting that the Members Committee endorsed an identical change to the penalty structure. PJM’s Board of Managers, however, opted to file changes only to the triggers that initiate a performance assessment interval (PAI), during which generators are subject to penalties for underperforming. While no proposals received sector-weighted support during the Stage 4 meeting of the Critical Issue Fast Path (CIFP) process Aug. 23, the Monitor said its proposal to base CP penalties on capacity revenues was the only one to receive more than 50% support. (See PJM Stakeholders Vote Against All CIFP Proposals.)

During the discussions at the Markets and Reliability Committee in May, stakeholders calculated the changes would result in a penalty rate of $394/MWh and a stop loss of $17,744/MW-year, compared to a status quo penalty of $3,177/MWh and stop loss of $142,952/MW-year, based on 2023/24 clearing prices.

Revising the penalty calculation would reduce market risk and the potential for PJM to be involved in lengthy litigation in the event major penalties are incurred in the future, while also creating market certainty for the next two delivery years in a way that is straightforward for market participants to understand, the Monitor argued. It requested its proposal go in effect for the 2025/26 delivery year, as well as the following one.

The Monitor said the high penalties have undermined the goal of the CP construct of incentivizing performance during emergencies and instead created artificial risk that resulted in increased costs for consumers without a corresponding reliability benefit.

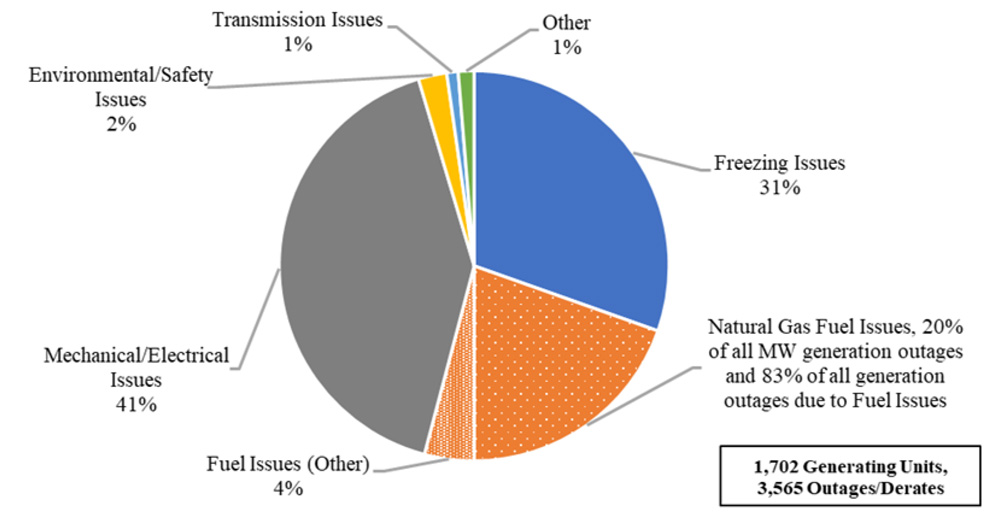

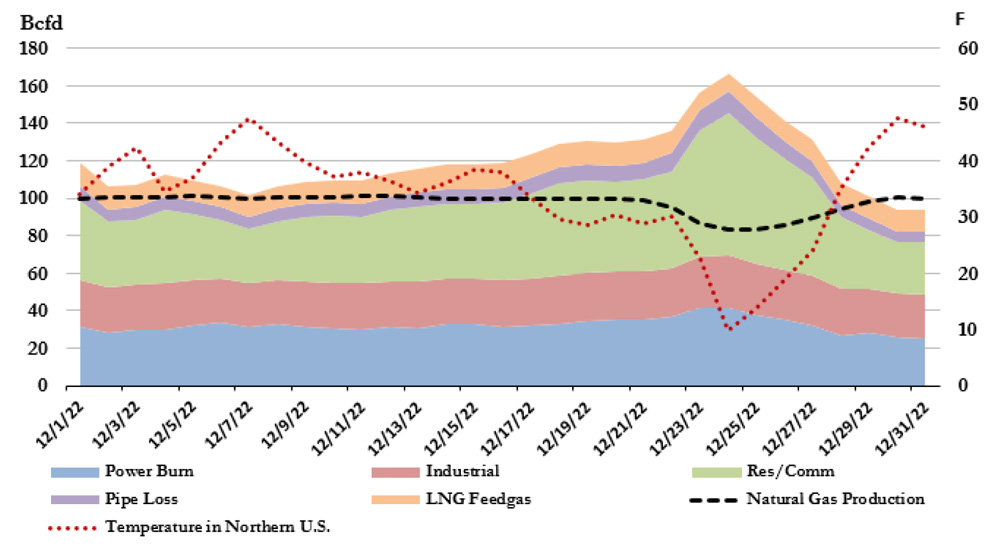

“Abstract discussions of incentives and penalties led some to the conclusion that if high prices provide incentives at times, then even higher prices or extreme penalties are even better incentives. One of the lessons of the winter storms Uri [of February 2021] and Elliott [of December 2022], in very different market designs, is that extreme prices and penalties do not have the intended incentive effect and do have a destructive effect, in the energy market and in the capacity market,” the Monitor said.

The RTO itself has identified flaws in the penalty rate, the Monitor argued, pointing to its response to the 15 complaints that generation owners filed in the wake of $1.8 billion in penalties being assessed against market sellers because of their underperformance during Elliott. (See Settlement over PJM Elliott Penalties Receives Broad Support.)

“PJM nominally defended its actions related to determining the existence of PAI, associated penalties and acceptable excuses,” the Monitor said. “Yet PJM implicitly agreed that the combination of high penalties and unclear rules made the results of nonperformance assessments during Winter Storm Elliott unworkable when, after multiple detailed and extensive complaints were filed at the commission raising specific questions about PJM’s implementation of the PAI rules, PJM proposed to immediately begin settlement judge proceedings and, after actively participating in those proceedings, entered into and filed a settlement agreement.”