A dispute around the January cold snap that forced Northwest utilities to sharply increase electricity imports to meet surging demand has become a proxy for the broader contest between CAISO and SPP over their competing Western day-ahead markets.

The debate over exactly what played out on the Western grid during the Jan. 12-16 winter freeze comes amid growing tension in the Western electricity sector as stakeholders await word from the Bonneville Power Administration in April about whether it favors joining CAISO’s Extended Day-Ahead Market (EDAM) or SPP’s Markets+. It centers on whether CAISO and its Western Energy Imbalance Market (WEIM) played a key role in supporting the Northwest during the storm or other factors were more important.

The weather event that drove Northwest temperatures close to historic lows while pushing loads to nearly record highs coincided with a confluence of other developments that stressed the region’s grid. Those included: derates on the Pacific AC and DC interties; an 800-MW forced outage at Montana’s coal-fired Colstrip plant (until Jan. 13); and a fault that caused Washington’s Jackson Prairie natural gas storage facility to sharply reduce its sendout on Jan. 13, prompting pipeline operator Williams to declare a force majeure that cut deliveries to interruptible customers, including some power generators.

Those developments unfolded within the context of unusually low water levels in the region’s hydroelectric system, which has required BPA to operate the Columbia River system at minimum flows to ensure sufficient capacity behind the Grand Coulee Dam for spring fish operations.

A Feb. 8 assessment of the weather event by the Western Power Pool (WPP) showed how dire conditions became on the region’s grid. Reliability coordinator RC West placed four Northwest balancing authority areas into varying levels of energy emergency alerts (EEAs), including one EEA 3, a critical threat level that requires preparations for rolling blackouts to maintain system stability. (See WPP: Cold Snap Showed ‘Tipping Point’ for Northwest Reliability.)

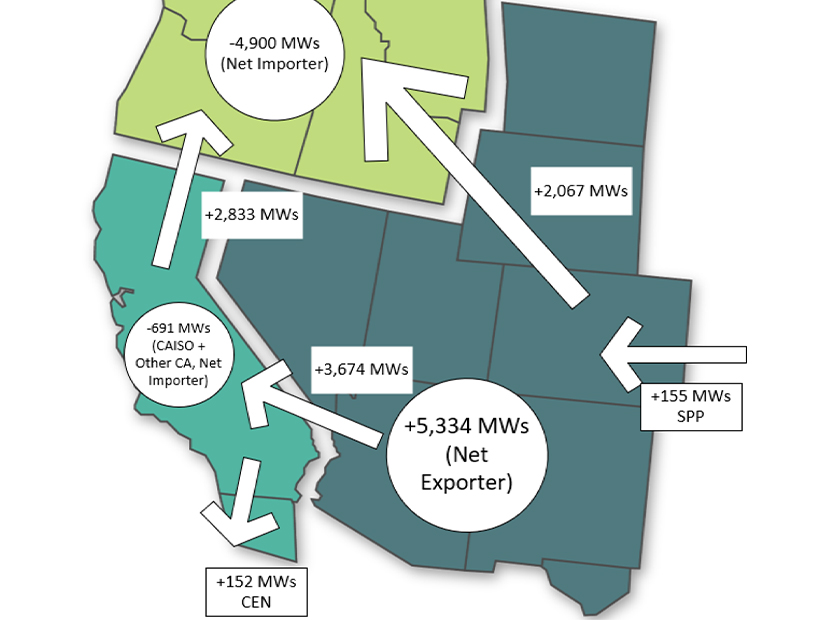

Relying on interchange data reported to the Energy Information Administration (EIA), WPP’s report showed the Northwest was a net importer of 4,900 MW of energy per hour during the five-day freeze.

And while the report showed that CAISO and other California BAs exported an average of 2,833 MW to the Northwest during the event, it also noted that the data indicated the California BAs themselves were net importers, suggesting most of the imports rescuing the Northwest originated from the Rockies and Desert Southwest — not California.

“The same interchange data shows the Desert Southwest/Rockies BAs were net exporters of approximately 5,334 MW on average,” WPP wrote. “Those exports from the Desert Southwest/Rockies region supported CAISO and other California BAs, as well as 2,833 MW of imports to the Northwest on the Pacific AC Intertie.”

Congestion Conflict

The Portland, Ore.-based Public Power Council (PPC) amplified that theme in a Feb. 23 letter to BPA Administrator John Hairston urging the agency to choose Markets+ when it issues its day-ahead market “leaning” in April. (See Northwest Public Power Group Endorses Markets+ over EDAM.)

The PPC told RTO Insider it conducted its own analysis “using data from a variety of sources including … EIA, CAISO OASIS and other publicly available sources.” It also reviewed data from WPP and Energy GPS.

While the letter’s case against CAISO’s EDAM (and in favor of Markets+) focused largely on governance issues, the PPC highlighted the January cold snap, conveying concerns about how congestion revenue is allocated in the ISO’s WEIM.

“During the recent winter event in the Northwest, Northwest load imported resources largely coming from the Southwest and wheeling through CAISO,” the PPC wrote. It then spotlighted a complaint among some Northwest entities about how the ISO allocated transmission congestion fees generated during the event.

“CAISO’s congestion policies resulted in over $100M of congestion revenues being collected by the CAISO BAA, despite most of the generation serving the Northwest coming from outside California. The policy creating this result is explicitly maintained in the CAISO EDAM,” the PPC said.

CAISO responded to that contention in a Feb. 27 email to RTO Insider, saying the $100 million in congestion rent stemmed from the need for the ISO to hold back some energy flows to avoid damaging the Northwest grid because of the transmission outages in Oregon.

“Despite the assertions in the PPC letter, the ISO does not collect congestion rent for itself,” the ISO said. “It distributes it to holders of congestion revenue rights (CRRs). CRRs are mechanisms that guard against high congestion prices. They are available to a variety of market participants, including load-serving entities in the Pacific Northwest.”

CAISO noted that it is unique among Western grid operators in its technical capability for managing congestion in the day-ahead time frame.

“As a result, CAISO cannot ignore transmission constraints; it must avoid sending energy to areas where it cannot be received,” it wrote.

In a March 1 message to RTO Insider, Lauren Tenney Denison, PPC director of market policy and grid strategy, said her organization recognizes that CAISO distributes the congestion rents it collects to CRR holders within the ISO.

“While entities outside of the CAISO BAA can hold CRRs, it is our understanding that to the extent that Northwest load-serving entities were able to meaningfully hedge against the congestion charged over the California-Northwest Interties during the cold snap, they would need to have purchased CRRs from the CAISO via auction for the portion of the path within CAISO’s BAA,” Tenney Denison said.

The issue, she said, is that Northwest LSEs with ownership or capacity rights on the northern half of the interties will not receive any of the congestion revenue.

“We would like to emphasize that these assets were built based on regional coordination and with the historical mission to create benefits for both the Northwest and Southwest,” Tenney Denison said.

The PPC is asking that the value created by AC and DC interties between California and the Northwest — “as manifested here by congestion rent allocation” — be “shared equitably” by those who have invested in the lines, she said.

Tenney Denison said the PPC also understands CAISO reasons for re-dispatching around system constraints during the event.

“We look forward to additional discussion on where those constraints were observed and whether those constraints were the result of physical flows or CAISO modeling assumptions,” she said.

She added that “it is unclear when CAISO took actions to re-dispatch around these constraints whether those actions were taken as a balancing authority area, or the market operator based on CAISO’s comments.”

‘It Came from Everywhere’

Fred Heutte is a senior policy associate with the Northwest Energy Coalition (NWEC), which has been a vocal advocate for Northwest participation in a single Western market based on EDAM. In an interview, Heutte emphasized caution about reading too much into the EIA interchange data cited by the PPC and WPP, contending the numbers don’t provide sufficient insight into how power actually flowed across the system during the cold snap.

“Because all the interchange data just really does is say, ‘How much generation did you have inside your balancing authority? How much demand did you have? And, therefore, what’s the net difference?’ It doesn’t tell you that much,” Heutte said. “And especially in the Northwest, where things are very complicated. We have lots of different balancing areas.”

Heutte said the WEIM collects a “tremendous amount” of data that will take time to examine to identify exactly how power flowed during the event. But he also downplayed the importance of where the energy originated.

“I think a couple of things are really clear: that the AC intertie brought us a lot of power when we desperately needed it, and the Energy Imbalance Market was really crucial to that,” he said. “Because the market doesn’t just provide power from Point A to Point B, it optimizes the dispatch over a very wide area.”

“To me, personally, the notion of ‘where does the energy come from’ is it came from everywhere,” Heutte said.

Heutte additionally pointed to the “load and resource diversity” benefit of a market as broad as the WEIM is now.

“Because when it’s super cold up here, it’s not as cold in Southern California and Phoenix [and] Las Vegas,” he said. “If it’s really hot there, it might not be so hot here. So, load diversity helps provide some of the additional resources that the transmission in the market can then move around.”

But the PPC has drawn a different conclusion about the role of the WEIM during the freeze.

“Over the week of the cold event, CAISO’s public data shows they were a net importer during the evening peak when electricity demand is the highest,” Tenney Denison said in the March 1 email. “Other public analysis performed by the Western Power Pool and Energy GPS reaches the same conclusion. CAISO also publishes EIM transfer data that shows while the EIM did facilitate transfers to the [Pacific Northwest], comparing to the level of transmission flows published by BPA demonstrates most of the energy flowed outside of the EIM market.”

CAISO told RTO Insider it is close to issuing a “comprehensive” report on the winter event, which should be out as early as this week.

“The report will cover the dynamics of the WEIM and will provide a detailed analysis hour-by-hour of how the WEIM was able to economically re-dispatch resources to find the least-cost solution considering all the physical constraints on the system to move power across the West,” ISO spokesperson Anne Gonzales said. “That will include analysis of power flowing through California from the Desert Southwest to serve the high demand in the Northwest. The report will provide detailed information showing the actual transfers through the WEIM across the region.”

For its part, BPA has only obliquely weighed in publicly on the issues around the cold snap. In a Jan. 31 news release, the agency described how it helped keep the region powered through sophisticated maneuvers that managed to maintain targeted water levels while meeting a level of demand not seen since the time when energy-hungry aluminum smelters dominated the economy of the Columbia River region.

When asked to comment on the ongoing dispute about the winter event, including CAISO’s response, BPA spokesperson Nick Quinata said, “We’re aware of the situation and have no comment.”

Delayed Decision Urged

BPA’s reluctance to weigh in on the debate is understandable, given that its day-ahead market decision is at the heart of the larger conflict around whether the West will end up with one or two organized electricity markets.

Multiple industry sources not authorized to speak for attribution on behalf of their organizations have told RTO Insider that BPA has been favoring Markets+ throughout its public exploration of day-ahead markets, launched last July. During day-ahead market workshops hosted by BPA, agency officials themselves have expressed a preference for SPP’s approach to market governance.

And while BPA has emphasized that it has not yet identified a preferred day-ahead market — or whether it will join one at all — it has been a key participant in the process for developing Markets+. It has also been conspicuously absent as an active contributor to the West-Wide Governance Pathways Initiative, an effort kicked off by state regulators last year to create the framework for a single Western market that builds on the WEIM and EDAM.

Sources also say Northwest utilities Idaho Power, Portland General Electric (PGE) and Seattle City Light — the PPC’s largest member by customer base — are leaning toward commitments to EDAM.

Asked to comment, Idaho Power spokesperson Brad Bowlin said, “We don’t have a schedule for a public announcement. No recommendation has been made to our board of directors yet. Once that happens, depending on the outcome, we will have some work to do communicating with our regulators prior to any formal announcement.”

PGE spokesperson Andrea Platt responded that the utility “recognizes the potential value in a day-ahead market, as well as the barriers to achieving a full RTO for the West.”

“While PGE continues to evaluate participation in both the Extended Day-Ahead Market (EDAM) and Markets+, we are also actively engaged and support the West-Wide Governance Pathway[s] Initiative, which continues to explore ways to build on the benefits of the Western Energy Imbalance Market and realize the potential for a broader footprint in EDAM and enable a path forward for a potential West-wide market,” Platt said. PGE Director of Transmission and Market Services Pam Sporborg is co-chair of the Pathways Initiative’s Launch Committee.

Regarding City Light, utility Regional Affairs Manager Josh Walter also is a member of the Launch Committee. The utility, which manages its own BAA, told RTO Insider Feb. 28 that it backs BPA’s exploration of day-ahead market participation but “does not support endorsing Markets+ at this time” due to “the lack of essential information and the number of unknown variables.”

“City Light urges BPA to give careful consideration prior to making any market leaning. Doing so now would be premature, given undetermined and unresolved critical foundational issues including market footprint, transmission connectivity and governance,” spokesperson Jenn Strang said in an email. “City Light remains committed to creating a pathway to independent governance for the West and urges BPA to include the work of the West-Wide Governance Pathways Initiative in their market determination.”

With six-state utility PacifiCorp already committed to EDAM, a Markets+ consisting of just BPA and British Columbia’s Powerex in the Northwest and possibly a few entities in the Desert Southwest risks isolation and fragmentation. Under those conditions, it would not be as effective as the WEIM is in managing stressed conditions like the January cold snap, according to Heutte, who also recommends that BPA delay its decision.

“If Markets+ succeeds in moving forward with a lot of support across the West, [there will be] a Northwest zone and a Southwest zone with no direct connection from transmission,” he said. “It’ll have to transfer power across the grid of other entities that are not in Markets+, and that dramatically shrinks the load and resource diversity that’s actually available” in the West.

Along with BPA, Arizona Public Service has been a visible participant in developing Markets+ but, Heutte warned, “We have yet to see how enthused the Southwest utilities are really going to be about” the SPP market.

“One possibility is we’ll end up with something that doesn’t really come close to the performance of a much bigger market, and I think that’s a pretty legitimate issue here,” he said.