BALTIMORE, Md. ― Some solar companies in the Mid-Atlantic have stopped looking for sites for utility-scale installations in the region due to the current backlog of renewable energy projects in PJM’s interconnection queue, according to Steve Swern, senior director for generator interconnection at Sol Systems, a Washington, D.C.-based developer.

The RTO is not expected to clear that backlog and start reviewing new applications possibly until 2026, Swern said Nov. 16 during a panel discussion on interconnection at the Solar Focus conference hosted by the Chesapeake Solar and Storage Association (CHESSA). “So how do I tell a corporate off-taker that, sure, we can site a project for you to deliver renewable energy in PJM. Is a [commercial operation date] by 2030 OK?”

A regional trade association, CHESSA’s members primarily are solar and storage developers in D.C., Maryland and Virginia — all in PJM’s 13-state service territory. When looking to site solar projects in the PJM footprint, Swern said, multiple strategies are considered, including bypassing the queue by approaching utilities to connect to their distribution grids.

The company intends to move ahead with projects it already has in the PJM queue but “is approaching utilities — transmission utilities, distribution utilities — to really push the envelope of how big can we build, what clients can we connect to, without involving the scrutiny, the oversight and the jurisdiction from the RTO,” Swern said.

Getting more solar on the grid is a critical issue in D.C., Maryland and Virginia, each of which has set ambitious targets for running their respective electric systems on 100% clean power ― by 2032 in D.C., 2035 in Maryland and 2050 for Virginia.

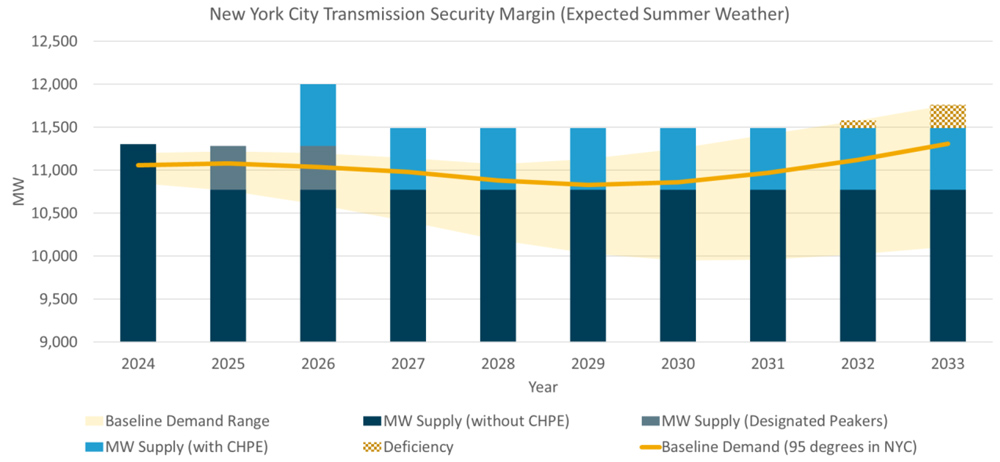

But reaching those goals likely will mean being able to import clean power from PJM. The nation’s capital, for example, has minimal generation within its 68 square miles, seven of which are water. PJM has warned Maryland of potential rolling blackouts if one of the state’s remaining coal plants, the 1,238-MW Brandon Shores generating station, is taken offline in 2025, as currently planned.

According to figures from PJM, its power mix is still more than 60% fossil fuels. On the carbon-free side, in 2022, nuclear accounted for about one-third of the RTO’s generation fuel mix, but wind and solar together stood at 4.9%. At the same time, solar, wind and storage make up almost all of the over 300 GW of projects in PJM’s interconnection queue, as reported by the Lawrence Berkeley Laboratory.

The grid operator is working on a Regional Transmission Expansion Plan aimed at adding the capacity needed for new renewables or other power that will replace retiring coal plants.

Like Swern, James Mirabile, the principal engineer for interconnection at Baltimore Gas and Electric (BGE), said getting renewables interconnected on distribution systems is an easier lift. In 2022, BGE had 91 projects totaling 139 MW in its interconnection queue, 35 MW of which went online that year. This year, to date, the queue has 87 projects totaling 165 MW and has interconnected 27 GW, he said.

For BGE and other Maryland utilities, the process for getting those projects online is “very highly regulated,” Mirabile said, and the state’s Public Service Commission has set up an interconnection working group charged with updating the rules.

The most recent update will go into effect Jan. 1, 2024, when all renewable projects will be required to use smart inverters with settings “that include a volt-var curve instead of a fixed power factor,” said Mirabile, who is a member of the working group. Such updated settings provide a flexible way for inverters to react dynamically to variations in voltage on the system, which can occur as more renewables come online, Mirabile said in an email to RTO Insider.

BGE and four other utilities have submitted the smart inverter settings they will require for projects to the PSC, which approved the proposed settings on Nov. 21.

The working group also has sent recommendations to the commission to reform cost allocation for distribution system upgrades, Mirabile said. Traditionally, when a project requires a distribution system upgrade for interconnection, the project developer carries the full cost.

The working group is proposing a model where the project developer is allocated part of the cost, with the remainder “spread across future interconnecting customers,” he said. If approved, the proposed update would be “a major change in the way we price jobs.”

The Aggregation Work-around

The backed-up interconnection queues at PJM and other RTOs and ISOs across the country are rooted in the wave of renewable projects seeking interconnection on systems that were “set up in such a way to not handle a large influx,” Swern said.

Approved in July, FERC’s Order 2023 (RM22-14) is aimed at pushing grid operators toward some basic structural changes, such as doing cluster studies of projects seeking interconnection rather than on a case-by-case basis and attempting to weed out speculative projects by upping financial requirements for developers. (See FERC Updates Interconnection Queue Process with Order 2023.)

But implementation of the order is on hold as FERC considers multiple requests for a rehearing on the rule.

FERC previously approved reforms PJM had proposed to its interconnection process, similar to Order 2023 — cluster studies and stricter financial requirements — which the RTO rolled out in July. According to Susan Buehler, PJM’s chief communications officer, 40,000 MW of projects have been approved but not yet built.

Bahaa Seireg, senior director of energy storage at the American Clean Power (ACP) Association, said utility-scale energy storage projects are caught in the same slow interconnection queues. While an increasing number of states, including Maryland, have set targets for adding energy storage projects to the grid, Seireg said, it can take five years to work through transmission-level interconnection processes at an RTO or ISO.

In May, Gov. Wes Moore (D) signed a law setting a goal for the state to have 3,000 MW of storage online by the end of 2033.

Seireg sees a possible workaround for the interconnection problem in aggregation that breaks down the traditional divide between distribution and transmission. “Now, you can actually interconnect [solar and storage] to the distribution grid and aggregate resources … add them to distribution substations, aggregate them and bid them into the wholesale market,” he said.

“That allows for some temporary reprieve from PJM,” he said.

Sol Systems sees another “prime opportunity” for getting projects interconnected quickly at municipal utilities and electric cooperatives. These smaller, nonprofit utilities often are unregulated and “have a lot of flexibility in the decisions they make, in the projects they move forward and how costs are allocated,” Swern said.

He also pointed to grid-enhancing technologies — such as advanced conductors and dynamic line ratings — as another option for maximizing the capacity of existing lines. “These are very low-cost solutions that help give grid operators higher granularity to thermal capacity of wires in a very specific location, [which] allows projects to operate … at full bore without being curtailed,” he said.

The Information Gap

But the panelists all see major gaps in the information developers need to site and design projects that can get interconnected as quickly as possible.

“Where we see a major stumbling block for interconnection is the quality of data, the existence of the data and the ability to use that to make informed decisions,” Swern said. In some cases, just figuring out where transformers are located means sending out trucks to map an area, he said.

Some utilities now have online “hosting capacity” maps, showing what lines in their service territories have excess capacity, but Swern said, not all maps are created equal. “Some of them just give you a color-coded map; some of them actually allow you to click on the feeder itself and see what’s the ability to connect [distributed energy resources]; some you can get a load profile … for the past two years,” he said.

At BGE, the best way for a developer to check out the available capacity of distribution lines at a site is to contact Mirabile directly, and he will do a pre-application analysis, he said. It’s reliable but not self-service, he admitted.

Swern sees a more fundamental obstacle to interconnection in the misalignment of “spheres of control … or jurisdiction.” Federal, state, county and local governments all “have specific targets, mandates, goals for deploying renewables or retiring fossil assets … and there isn’t a good way to align all of those different things.”