The 2023/24 winter season was one of NYISO’s most humdrum winters, characterized by high temperatures, low gas prices and below-average loads, according to a presentation shared with the Operating Committee on March 15.

Aaron Markham, NYISO vice president of operations, told the OC that “moderate temperatures led to moderate fuel prices for much of the season,” and the few “short-duration cold snaps” were not “super impactful.”

He added, however, that those cold snaps meant NYISO needed to burn “a fair amount of stored fuel” and saw “some gas system constraints,” but the ISO would “continue to monitor [fuel] replenishment” and study how to ensure fuel could be delivered more effectively for future peak days.

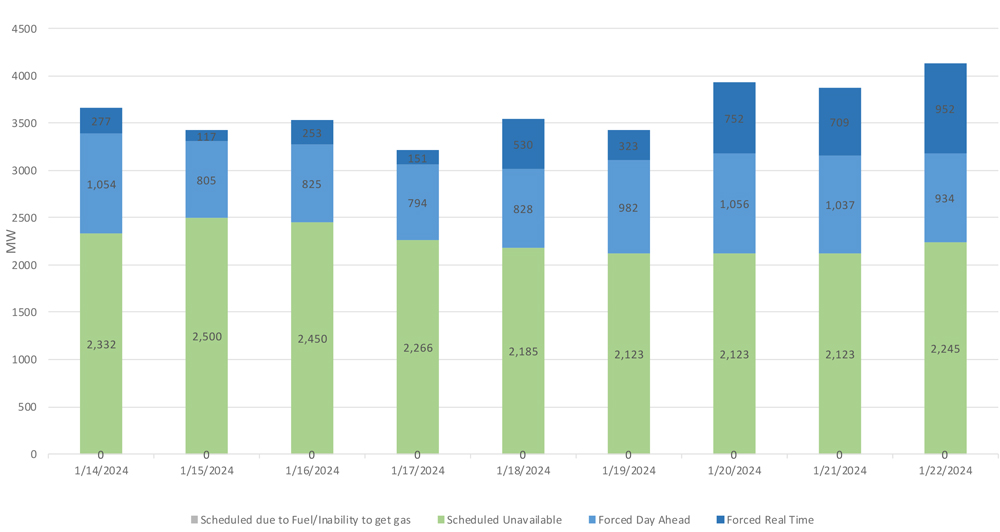

The season’s coldest period occurred around the Martin Luther King Jr. Day weekend, when load peaked at 22,754 MW on Jan. 17. It was still one of the ISO’s lowest winter peaks over the past 15 years and represents only one of three times during the month when load went above 22,000 MW, which usually occurs an average of 11 times during January.

During the Jan. 17 peak hour, New York’s load was served by an estimated supply mix of 26% natural gas, 14% oil, 17% hydropower, 20% imports from neighboring regions, 14% nuclear, 8% wind and 1% from other renewables.

Markham said one of the highlights for the winter season was the generation fleet’s “very good” performance, especially during the season’s peak load hour, when there was only about “150 MW of unavailable capacity from the day-ahead to real-time.” Additionally, intermittent production during peak days, although “still relatively low compared to the total demand,” continued to “see more contribution to meet demand.”

Markham also delivered the February operations report to the OC, saying the month “continued the trend of mild weather and no real strenuous operating conditions,” with a peak load of 20,981 MW recorded on Feb. 14.

He also mentioned that NYISO expects to “be able to manage” the April 8 solar eclipse and has asked its solar forecast vendor to ensure the eclipse’s impact on solar production is included in the next forecast delivered to the ISO. (See “NYISO Updates,” NY State Reliability Council Executive Committee Briefs: March 8, 2024.)

NYISO added 45 MW of behind-the-meter solar since its last monthly operations report. (See “January Operations,” NYISO Operating Committee Briefs: Feb. 15, 2024.)

Bear Ridge Solar Waiver Denial

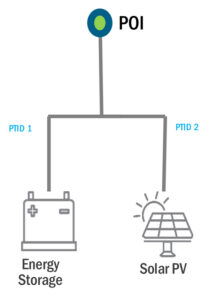

FERC on March 14 denied Bear Ridge Solar’s waiver request for remedial relief from certain NYISO interconnection tariff requirements, effectively removing the project from the ISO’s queue (ER22-2085).

Bear Ridge aimed to develop a 100-MW solar farm in Niagara County and requested an exemption from two of NYISO’s tariff requirements because of “unforeseen events” that were “beyond its control” and led it to “substantial difficultly” in adhering to state siting processes and critical regulatory deadlines.

As a result of its “failure to comply with the regulatory milestone requirements,” Bear Ridge’s project faced withdrawal from the interconnection queue and risked the loss of a $657,000 cash security deposit necessary to cover its share of the costs for transmission upgrades determined by NYISO to be required for the project’s interconnection.

Although sympathetic to Bear Ridge’s situation, FERC said that granting the waiver would be “retroactive in nature and is prohibited by the filed-rate doctrine” in the Federal Power Act.

In a joint concurrence, Chair Willie Phillips and Commissioner Allison Clements said that although they were bound by the filed-rate doctrine, “the outcome here is neither equitable nor commercially reasonable” and is “emblematic of other waiver proceedings in which an applicant did not foresee that it would miss a deadline before it occurred.”

They acknowledged that FERC’s procedures are rigid and prevent it from granting even a modest milestone extension, which would “avoid sending the project back to the starting gate,” even though Bear Ridge satisfied the regulatory milestone at issue two months after submitting its waiver request unopposed by NYISO.

The commissioners called on transmission providers to revise their tariffs to permit FERC to waive such deadlines to allow the commission “greater flexibility in addressing sympathetic cases such as this one,” recognizing that the outcome “does not advance the goal of getting new resources online as quickly and reliably as possible” and “causes needless inefficiencies and deprives NYISO’s customers of the benefits that such a project provides.”