The Western Area Power Administration’s Desert Southwest Region (DSW) pulled out of the second phase of developing SPP Markets+ after determining it would see few benefits from participating in either Markets+ or CAISO’s Extended Day-Ahead Market, the federal power agency told RTO Insider.

“For our Desert Southwest Region (DSW), the potential benefits of day-ahead market participation for either market are minimal; therefore, DSW has decided to not continue as a funding participant in the Markets+ development at this time,” WAPA said in an email March 5.

The agency said it will continue to monitor developments around both Markets+ and CAISO’s Extended Day-Ahead Market (EDAM).

“More information and a compelling business case would be necessary for the region to proceed with either day-ahead market option,” it said.

DSW operates the Western Area Lower Colorado (WALC) balancing authority in western Arizona and sells federal hydroelectric power and provides transmission service to nearly 70 cities, electric cooperatives, Native American tribes, government agencies and irrigation districts. One of its customers, Arizona Electric Power Cooperative (AEPCO), includes six distribution cooperatives and five public power entities that serve more than 420,000 residential, agriculture and corporate customers in Arizona, California, Nevada and New Mexico.

SPP Vice President of Markets Antoine Lucas informed the Interim Markets+ Independent Panel (IMIP) of DSW’s move March 1 shortly after the RTO received a letter from the agency stating its intent to withdraw from the effort and end its associated funding agreement. The announcement coincided with the IMIP’s approval of the Markets+ tariff, which is headed for a March 25 vote by SPP’s Board of Directors. (See MIP Sends Markets+ Tariff on to SPP Board.)

A WAPA spokesperson said agency officials involved with the matter declined RTO Insider’s request to release the letter. But a Jan. 31 internal slide presentation titled DSW Markets Update provided insight into the agency’s decision-making.

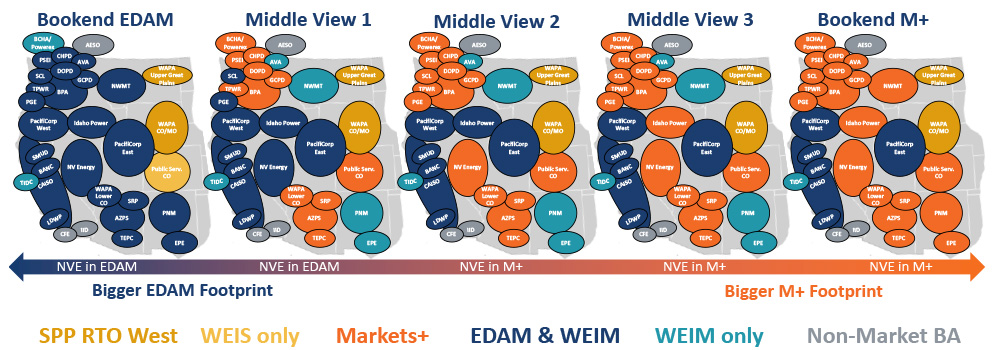

A section of the WAPA presentation appearing under the heading “AEPCO Update” reviews the results of the 2023 study that was commissioned by the Western Markets Exploratory Group (WMEG) and conducted by Environmental+Energy Economics (E3). The study examined potential costs and benefits associated with Western utility membership in Markets+ and EDAM under different scenarios reflecting various footprints in each market.

The 26-member WMEG had asked E3 to limit the scope of the study’s cost-benefit analysis to variable production costs and energy market prices, while not considering potential investment savings from lower capacity needs due to resource and load diversity, the ability to procure resources over a wider geographic area and coordinated regional transmission planning.

“Other market studies have shown those other benefit categories can create two to ten times the impact of production cost savings alone,” E3 cautioned at an Oct. 23 workshop hosted by the Bonneville Power Administration to present the results.

Results from the WMEG study indicated California would be the biggest financial beneficiary of a single day-ahead market covering the entire U.S. portion of the Western Interconnection, with most other entities in the West benefiting more from a two-market outcome. (See Study Shows Uneven Benefits for Calif., Rest of West in Single Market.)

The study showed that, under an “EDAM Bookend” scenario in which EDAM encompasses the West, California entities would save $80 million a year compared with business as usual, while most WMEG entities — including DSW/WALC (which excludes AEPCO) — would spend $20 million more.

Under a “Main Split” scenario, in which EDAM consists of California and PacifiCorp’s balancing authority areas, California would spend $247 million more, while the majority of WMEG entities would save $26 million. But DSW/WALC still would be a net loser in that scenario.

The “AEPCO Update” in the WAPA presentation outlines a handful of key takeaways regarding the WMEG study, offering the view that the study shows “modest” overall differences in production costs between the footprints and saying the “results vary significantly by entity.”

Another takeaway: that “one market is more efficient than two markets,” with two markets requiring additional transmission to be built between the Northwest and Southwest.

Perhaps the most significant conclusion is the view, raised by E3, that the WMEG study “did not consider benefits which can be significantly larger in impact than production cost savings,” including “coordinated generation and transmission planning and investment,” “resource procurement savings” and “reliability improvements during extreme weather or challenging operational conditions.”

The “AEPCO Update” also points out that DSW/WALC incurs losses in all but two WMEG scenarios. The first is the “Alternative Split 1,” in which the Northwest, Colorado and eastern Wyoming participate in Markets+ while the rest of the West joins EDAM. Under that scenario, the agency saves $8.3 million in 2026. “Alternative Split 2” is a variation on that scenario with even lower participation in Markets+. It saves DSW/WALC $4.8 million.

The presentation notes that the benefits in both scenarios result from increased wheeling revenue and net cost savings from California’s surplus solar.

The AEPCO portion of the presentation concludes with a slide labeled “Day-Ahead Market Strategy,” which states that the WMEG study results “are somewhat dated, but they reflect the limitations of DSW hydropower and realities of the current transmission footprint.” The slide also notes the cost and difficulties “of implementation/transition” related to joining a new market and “uncertainty” surrounding “which or whether either option becomes viable and/or more advantageous for DSW.”

“Conclusion is for DSW to wait for the foreseeable future,” the slide says.

EDAM Impact?

DSW’s decision to pull out of Markets+ comes amid an intensifying contest between Markets+ and CAISO’s Extended Day-Ahead Market (EDAM) ahead of the anticipated release of the Bonneville Power Administration’s market “leaning” in April. (See NW Cold Snap Dispute Reflects Divisions over Western Markets.)

DSW’s decision doesn’t exactly spell a victory for EDAM, but it does benefit CAISO by keeping DSW within the ISO’s Western Energy Imbalance Market, which the federal agency entered in 2023. Arizona utilities Arizona Public Service, Salt River Project and Tucson Electric Power all have been key participants in developing Markets+, and industry sources have told RTO Insider the Arizona group, along with the Bonneville Power Administration and Powerex in the Northwest, are leaning toward the SPP market.

It’s difficult to predict how DSW’s decision will affect other Southwest utilities’ choices. The agency operates about 3,100 miles of transmission lines, including the Parker-Davis Project, Intertie Project, Central Arizona Project and ED5-Palo Verde Hub Project — the last of which connects to one of the major electricity trading hubs in the Western U.S.

DSW’s WALC last year got $59.35 million in gross benefits from the WEIM over the three quarters it participated in the market, according to CAISO. Those benefits consist of “cost savings, increased integration of renewable energy, and improved operational efficiencies, including the reduction of the need for real-time flexible reserves,” the ISO says.

The Jan. 15 WAPA presentation shows DSW saved $8.6 million from April to October 2023 compared with the same period in 2022, against CAISO’s net benefits figure of $43.23 million for the first and second quarters of last year.

SPP spokesperson Meghan Sever said the RTO “understands each entity must decide whether participation in a market provides the most benefits for its customers.”

“While we respect any valuable Markets+ participant’s individual decision, SPP believes Markets+ is still a great option for a market that provides financial benefits and enhances electric reliability in the Western Interconnection,” Sever said. “We thank WAPA DSW for their participation in Phase 1 of Markets+ development and hope they will continue to be involved in the Markets+ stakeholder process.”

In its email to RTO Insider, WAPA said it “will remain engaged and assess potential opportunities for both day-ahead initiatives to ensure we are well positioned to continue providing the best service to our customers on a region-by-region basis.”