HOUSTON — A year ago, attendees at S&P Global’s CERAWeek warmly greeted U.S. Energy Secretary Jennifer Granholm with a standing ovation for her role in passing the Inflation Reduction Act (IRA) and its $369 billion in energy security and climate change investments.

Granholm’s CERAWeek audience offered only tepid applause during her annual appearance March 18, an apparent response to the Biden administration’s January permitting pause for new LNG terminal projects.

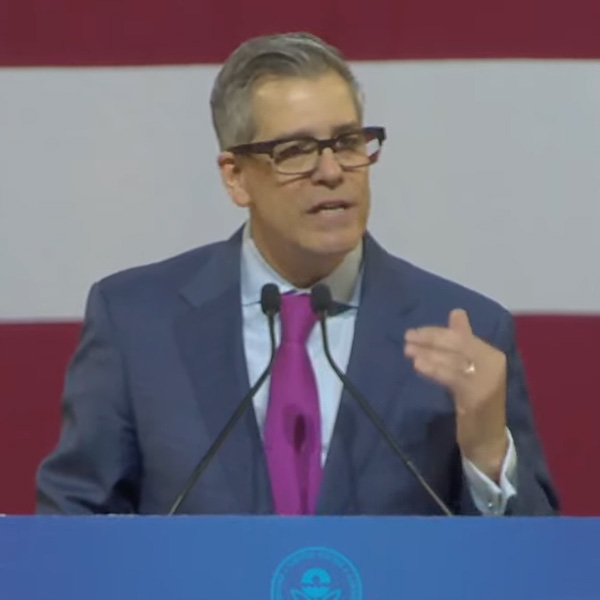

Acknowledging the elephant in the room, CERAWeek Chair Daniel Yergin began his interview with Granholm by asking her, “The LNG pause: What is it and what isn’t it?”

She responded by pointing out the pause was enacted to study the environmental effects of approved LNG projects. The U.S. remains the world’s largest LNG exporter at 14 million Bcf, Granholm said. She said an additional 12 million Bcf is under construction and 48 million Bcf has been authorized, with an additional 22 million Bcf authorized but waiting on final investment decisions.

“This pause does not touch any of that. This is just a pause to see what the future could bring,” Granholm said. “We have a responsibility under the Natural Gas Act to approve authorizations for LNG if they are in the public interest. This study is like other studies we’ve done in the past, just assessing where we are so that we can move forward.”

Turning to Yergin, she said, “Dan, I predict that when we sit here next year — she says with confidence — this will be well in the rearview mirror.”

Noticing the muted response in the ballroom, Granholm added, “I think that’s an applause line.”

U.S. Sens. Joe Manchin (D-W.Va.) and Dan Sullivan (R-Ala.) piled on later during appearances with Yergin and in a visit to the media center.

“The pause needs to be paused,” Manchin said, calling the move a “political gesture” and saying the environmental study has not yet been conducted.

He noted LNG production has gone from nothing in 2016 to 14 million Bcf today and natural gas prices are still $2/MMBtu or less.

“I’m afraid that the market will be shorted here. The United States consumer will pay more, or the economy in the United States could be threatened. None of that’s ever been discussed,” Manchin said. “The pause has to be stopped until the facts of what we’re dealing with support the target. You just don’t throw a curveball and scare the bejesus out of the markets and our allies.”

Sullivan said the pause was the talk of last month’s Munich Security Conference, where he co-led a bipartisan group of a dozen U.S. senators. He disputed recent comments Granholm made before Manchin’s Energy and Natural Resources Committee, when Sullivan said she “essentially said our allies weren’t that concerned [about the pause].”

“That’s not what we’re hearing in Asia and in Europe. Every ally that we spoke to [in Munich] had major concerns about the Biden administration’s LNG moratorium. I mean, the most senior German officials, [European Union] officials, everybody,” he said. “It’s not the time to be taking away one of the most critical weapons that we have provided our fellow allies in Asia and in Europe, and that’s American energy. A lot of us think it’s about domestic politics, but it’s having serious consequences with regard to our national security and the national security of our allies.”

The pause is driving interest and potential investment in countries like Qatar, Sullivan said. In a letter he co-wrote with three other Republican senators intended for John Podesta, the administration’s senior adviser for international climate policy, Sullivan said the Middle Eastern country plans to expand its LNG production, which could result in control of 25% of the global market by 2030.

Noting that Russia reached out to Germany after the pause’s announcement, Sullivan said, “That is exactly the opposite of the policies that we’ve been trying to undertake in a bipartisan way after the brutal invasion of Ukraine, which is to enable our allies to get off Russian oil and gas. This is a strategy that is upside down in terms of what we’re trying to do as a country.”

Granholm and the senators did reach common ground on improving the energy infrastructure permitting process. a task that sometimes seems insurmountable.

“We keep talking about getting a permitting bill, we keep trying to have it, but it’s hard to get cooperation,” Granholm said. “There is some bipartisanship around permitting reform and moving quickly. We’re doing what we can on the executive side.”

As an example, Granholm said, the administration has instituted a two-year “shot clock” permitting transmission on public lands.

“We’d love to see that kind of shot clock for all kinds of permitting in the U.S.,” she said.

Asked about his energy committee’s objectives for the rest of the year, Manchin, who chairs the committee, said, “I’ve got to get permitting done. I’m doing everything we can. We want to get it done. And I think people are concerned about it. We are so close.”

Manchin said he enjoys not just the administration’s support, but the support of all stakeholders.

“Everybody’s supportive,” he said, “but what happens is everybody is supportive of any good idea, but they end up letting the perfect be the enemy [of the] good.”

“It’s critical to the country, critical to every state,” Sullivan said of the reform. “You talk to any mayor in America, you talk to any governor in America, it doesn’t matter what party, they know that it’s killing us that it takes some nine years to permit a bridge. It’s imperative that we get it done, and I do think there’s a political will. It just makes sense.

“There’s a whole bunch of ways in which we can tighten up our permitting system that makes our country stronger and all our research development projects … so I’m going to keep pressing it as long as I’m in the U.S. Senate.”

Back in the ballroom, Granholm said the IRA, described last year as a “big carrot,” is being “gobbled up voraciously” by investors.

“It’s just amazing how the tax credits are doing the work of reshoring manufacturing and making that happen,” she said, reminding attendees that the IRA is also a jobs program. “It’s really so gratifying to see that we now have an industrial strategy in this country and that we’re not just going to be passive bystanders to the loss of manufacturing jobs.”

She also announced the release of DOE’s latest Pathways to Commercial Liftoff report, focused on geothermal energy, and the new Regional Energy Democracy Initiative. REDI is meant to empower communities to work with businesses, community groups, academic institutions and philanthropists to “weave” equity and justice into DOE-funded clean energy projects.

The initiative will begin with a pilot program along the Texas and Louisiana Gulf Coast but could expand with DOE’s plans to award more than $8 billion for carbon-reduction and clean energy infrastructure projects.

“Ultimately, we have two clear goals: first, meet the needs of today, and second, move quickly and intentionally for the realities of tomorrow,” Granholm said. “It’s a question of will. I know there may be some in this room who would prefer to wait and see or to maybe push the burden of tackling climate change onto others. But let’s be clear. Consumers are calling for change. Communities are calling for change. Investors are calling for change.”

Granholm called on her audience to help manage the transition “responsibly and with urgency” and to provide opportunities for investors, communities and workers. She said they have the power to increase their companies’ investment returns and “heal our planet.”

“But make no mistake, what we are witnessing now, what we are participating in, is historic,” she said. Dropping a reference to the musical “Hamilton,” Granholm closed by saying, “You are going to be able to tell your grandchildren that you were in the room where it happens. It is a once-in-a-lifetime challenge and a once-in-a-lifetime opportunity.”