FERC on March 21 proposed preventing transmission providers from including charges associated with supplying reactive power in their transmission rates in the hopes of preventing unjust and unreasonable rates for end-use customers (RM22-2).

At its monthly open meeting, the commission issued a Notice of Proposed Rulemaking seeking comments from “all interested persons” on its proposal to revise Schedule 2 of its pro forma open-access transmission tariff to prohibit the inclusion within transmission rates of charges associated with the supply of reactive power within the standard power factor range of a generating facility. Generators set the standard power factor range in their interconnection agreements.

In addition, the NOPR would revise section 9.6.3 of FERC’s pro forma large generator interconnection agreement and section 1.8.2 of its pro forma small generator interconnection agreement to remove the requirement that transmission providers “pay an interconnection customer for reactive power within the standard power factor range if the transmission provider pays its own or affiliated generators for the same service.” This change would make the LGIA and SGIA consistent with OATT revisions.

Reactive power is “a critical component of” an electrical grid, FERC said in its NOPR, because it keeps system voltage within appropriate ranges, allowing the transmission system to reliably supply “real power,” which provides energy to end users. Generating facilities, transmission lines and equipment, power electronic equipment and load can either produce or absorb reactive power.

FERC ruled in Order 888 that transmission providers must incorporate six ancillary services into their OATTs, including the reactive supply and voltage control supplied by generators. However, the commission indicated in 2021 that it was considering updating its approach to compensating reactive power capability, seeking industry input in a Notice of Inquiry. (See FERC Seeks Comments on Reactive Power Compensation.)

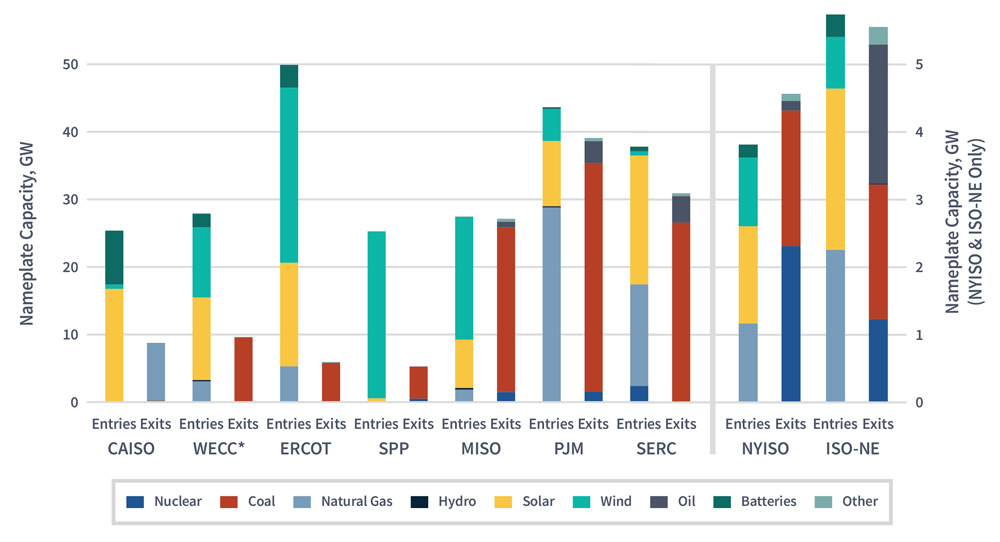

Order 888 assumed a resource mix that overwhelmingly comprised synchronous generators, but as FERC pointed out in its NOI, much of the new generation coming onto the grid consists of nonsynchronous inverter-based resources such as wind and solar facilities. The commission said it was “facing challenges in evaluating proposed reactive power rate schedules” because most of the filings for such schedules were made by owners of nonsynchronous resources.

The NOPR also mentioned Order 2003, which said generators are not owed compensation for providing a standard range of reactive power as that is a condition of interconnection (ER23-523). FERC cited Order 2003 last year in approving a request from MISO transmission owners to eliminate it and voltage control charges from their own and unaffiliated generation resources. (See FERC Ends MISO Compensation for Reactive Power Supply.)

Responding to comments that argued “that separate reactive power compensation is necessary to maintain reliability,” FERC observed that providing reactive power is “already required by a generating facility’s interconnection agreement” and suggested that requiring additional payment would not affect this.

The commission also noted that some commenters said the payments they received for reactive power helped them obtain financing to make needed improvements to generating facilities. In response, FERC argued that “resource developers continue to develop new generating facilities in regions without such payments.” Rather than recovering reactive power costs through transmission rates, the commission suggested that entities use “energy and capacity sales, since competition between generating facilities may incentivize efficiency.”

Comments on the NOPR are due 60 days after its publication in the Federal Register, with replies due 90 days after publication.