DALLAS — MISO’s imminent filing for a new capacity accreditation is a crucial first step to prepare for a more complex and challenging future, executives told attendees during March Board Week.

The added persuasion comes as MISO exited winter with no critical steps taken to maintain reliability.

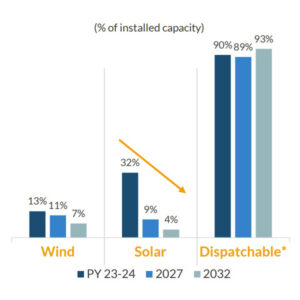

Executive Director of Market and Grid Strategy Zak Joundi said MISO’s growing reliability risks mean accreditation should be tied to resource’s output during hazardous periods. The RTO plans to file before the end of March to implement a probabilistic capacity accreditation, where capacity credits will be determined by individual past performance and a resource-class average performance during risky hours for different types of generation. (See MISO: New Capacity Accreditation Filing Imminent.) The accreditation style is marginal, using loss-of-load inputs instead of unforced capacity, and will chip away at solar generation’s capacity credits over the decade until they’re a fraction of what they used to be.

“Accreditation is one of the most important signals that we as an RTO can provide our members,” Joundi said.

“The accreditation MISO is moving towards filing is one of the most important it will make in years,” MISO Independent Market Monitor David Patton agreed.

“We have some controllable resources, but those are quickly disappearing,” Vice President of Operations Renuka Chatterjee added while talking about mounting risks during winter mornings by 2030.

Chatterjee said for roughly the past month, MISO has been monitoring low system stability during weekends due to unprecedented renewable output.

“I don’t want to scare folks. We are OK. We have tools to manage this. … But if we don’t do this work, we will be in worse shape by 2030,” Chatterjee said.

Winter Storm Performance Improves

MISO appears to be getting well versed in steady operations amid increasingly volatile weather.

Executive Director of System Operations Jessica Lucas said the RTO had no trouble handling a mild winter except for mid-January’s footprint-wide Arctic blast. The cold front delivered MISO’s 105.9-GW winter peak on Jan. 17. On that day, MISO South set a new winter peak at 32.6 GW.

The footprint also set a new wind generation peak of 25.7 GW on Jan. 17, where wind served 30% of load and buoyed the system above maximum generation alerts. (See MISO Holds Steady in Mid-Jan. Storm with Help from Wind.)

“It does look like we’re creating a pattern. Three years and every year, another 100-year storm,” Lucas said, referencing “déjà vu” winter storms in February 2021 and December 2022.

However, for this winter storm, MISO experienced just 5 GW in incremental unplanned outages, compared to 15-20 GW in added forced outages during the previous comparable winter storms.

MISO Director Barbara Krumsiek commended the grid operator for improved performance during the deep freeze.

“The first one, the first time is a shock to the system. But to see how MISO and its members have adjusted is gratifying,” Krumsiek said.

Lucas said MISO’s better prep is due in part to its availability-based accreditation that’s been in place for thermal generation for about two years.

She also said MISO’s new uncertainty management model flagged the winter storm span as high-risk days in advance, leading operators to increase the RTO’s short-term reserve requirements. Requirements averaged 5 GW over the event and climbed as high as 6 GW.

Patton praised MISO’s progress on uncertainty modeling. He said MISO has been more dynamic in procuring reserves, which mitigates risks and ultimately lowers costs.

“This is the kind of model that I wish Texas would incorporate,” he said. “I think [MISO is] on the forefront here.”

At the Gulf Coast Power Association’s early March MISO-SPP conference, Executive Director of Market Operations J.T. Smith also said MISO’s model augmented by machine learning did a solid job predicting which generation showed up during the mid-January Arctic blast.

Smith said a pressure gradient over MISO Midwest could mean an up to 10 GW difference in wind production and that a 50-mile discrepancy in a winter storm’s path over MISO South causes vast differences in demand.

“Our entire system is weather dependent,” Smith said.

MISO also recently secured a $3 million grant from the U.S. Department of Energy to explore more machine learning and modernize control room operations.

Patton said the RTO dramatically reduced its usual manual redispatch during the cold snap, instead allowing its transmission constraint demand curve to price generation to manage flows on the system. Patton said compared to the winter storm a year ago, this time MISO operators took 84% fewer out-of-market actions to manage congestion. He said if the latest storm had happened a few years ago, MISO operators probably would have made more commitments than necessary.

“Overall, the management of the system during Winter Storm Heather was really good,” Patton said. “MISO exercised good judgment in commitment decisions and avoided unnecessary uplift, deferring decisions until necessitated by offered lead times.”

Patton said MISO’s real-time revenue sufficiency guarantee payments totaled just $5 million, compared to the almost $90 million incurred in the February 2021 winter storm.

MISO Director Phyllis Currie joked that she heard Patton complimenting MISO’s actions repeatedly.

“Excellent. Then I must have missed something,” Patton said with a laugh.

The IMM said over the winter, regional transfer generally flowed from South to Midwest. However, when the cold blast struck, flows shifted from Midwest to South.

The IMM said drought conditions in the Manitoba Hydro service territory caused South-to-North flows over the winter. Ordinarily, MISO imports power from the hydroelectric utility. Members of late have been consistently exporting power across the border.

Total congestion over the mid-January storm totaled almost $153 million, Patton reported.

Patton said while overall congestion was more manageable during the latest winter storm, MISO did receive incorrect transmission flow data from a market participant, contributing to a transmission violation and MISO having to declare a safe operating mode to redispatch generation in PJM to get flows back in line with the rating.

“This raises substantial concerns regarding the information some participants provide to MISO, which can impact reliability,” Patton said. “The same participant failed to provide SCADA data on a nuclear unit, which impacted MISO’s response to it tripping offline in mid-February.”

Patton declined to name the market participant.

“If this was going on, this would make me very unhappy, trying to operate the system without full and accurate data from all participants,” Patton said. He flagged the issue as a “big concern.”

He also said that over Jan. 15 and 16, MISO “effectively ran out of generation” in the Southeast Texas load pocket; the area racked up severe congestion and prices jumped to $1,500/MWh. Patton said the situation subsided when a generator in the area that’s “almost entirely connected to ERCOT” decided to direct its output into MISO.

Patton singled out the generator for consistently failing to show up in MISO during times of need despite participating in its capacity auctions. Patton said MISO should strike that generation from its capacity totals, and that the RTO should make the adjustment before its upcoming capacity auction, so it doesn’t count on generation that won’t materialize.

MISO set a solar output record of 4.4 GW on Feb. 19, where panels managed 6% of load. The grid operator has had 12 new solar peaks over the past year as members swiftly add solar installations.

MISO also said wind generation made its first appearance in the South during the winter quarter, with the debut of the 185-MW Delta wind farm in Tunica, Miss. A 180-MW wind farm, Nimbus, is planned to begin operations next year in rural Arkansas.

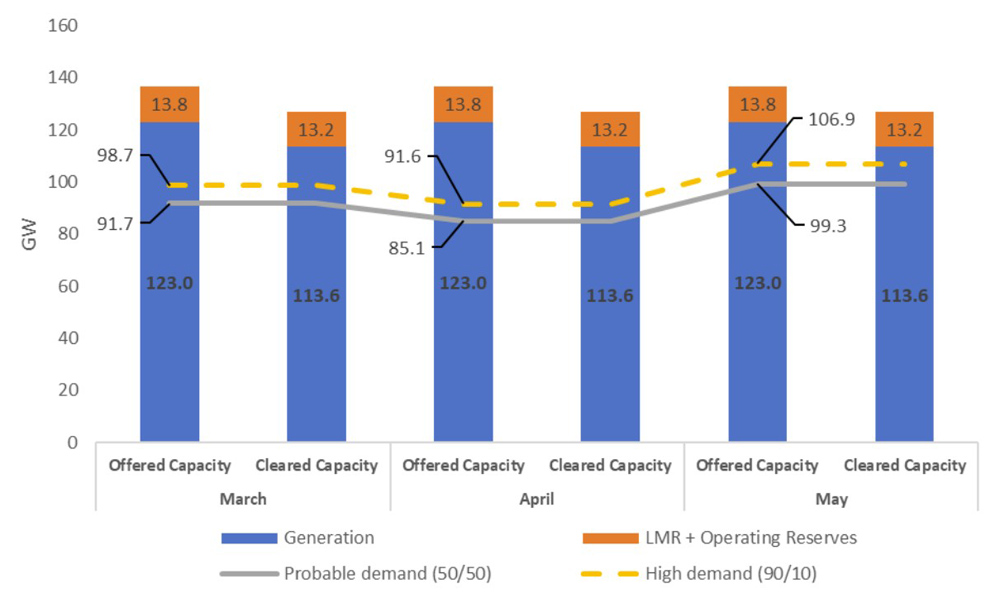

Looking ahead, MISO said even high demand over the spring shouldn’t present challenges. Although MISO expects demand could top out at nearly 107 GW in May, the grid operator’s 113.6 GW of cleared capacity throughout spring appears sufficient.

MISO is also planning for a rapid drop in output and then recovery among its growing solar fleet April 8, when the solar eclipse tracks across its footprint. Lucas said MISO likely will need greater-than-usual ramping capability and more congestion management efforts that afternoon.