NEW ORLEANS — After being forced to turn away attendees from 2023’s Gulf Coast Power Association MISO–SPP Forum, the association set up shop this year in a name-brand hotel near the French Quarter. All the better to welcome more than 330 attendees, a record, for discussions that focused primarily on the energy transition.

“Here we are in a real hotel,” said R Street Institute’s Beth Garza, chair of the GCPA board, in kicking off the March 4-5 conference.

During a friendly opening chat between MISO’s and SPP’s CEOs, Barbara Sugg said maintaining resource adequacy and addressing “massive” load growth during the transition comprises the nucleus of RTO operations today.

Sugg said she sympathized with SPP members having to make decisions about resource retirements while also facing potential capacity deficits. SPP needs to ensure it has “enough of the right resources,” Sugg said, noting adequate future reliability attributes “are just not there yet” in generation lining up for the grid today versus what’s retiring.

“For us, it’s all about the energy transition,” MISO CEO John Bear said, adding that MISO has a good feel for what its members hope to accomplish over the next 15 years.

He said MISO is preoccupied with transmission planning, a market redesign and completing a market platform upgrade to handle a great deal more variability. MISO is also working on a complete redesign of control room operations, he added.

“Besides that, we’re not very busy,” Bear joked.

Bear said before, MISO operations were a “simple exercise,” with MISO carrying enough reserves to get the footprint through a predictable afternoon peak. Today, Bear said, MISO must secure many more types of operating reserves to handle weather conditions that “vary significantly by day.”

“We’ve got to watch closely new technology, but it’s still out there” in the distance, Bear reminded attendees. He said though new technologies are promising, they’re not yet developed enough to be able to take over for scores of retiring baseload generation resources. He emphasized that MISO needs to maintain a fleet of dispatchable generation resources to supplement weather-dependent resources.

However, Bear said he’s optimistic about the potential for iron-air battery storage, once an unwieldly and forgotten technology of the 1970s. He said MISO is set to add three 5- to 15-MW iron-air batteries in the coming years.

LSEs Describe Tough Situation

Mike Wise, senior vice president of regulatory and market strategy at Golden Spread Electric Cooperative, said load-serving entities are in a “real challenging environment.” He said the fleet transition for LSEs is like a bad version of an ’80s beer commercial. He said instead of the “more taste, less filling” slogan conveying two competing positives, LSEs face a “more cost, less reliable” reality with only disadvantages.

Wise blasted SPP’s recent FERC filing hiking its planning reserve margin requirement from 12% to 15%. Golden Spread, American Electric Power, Xcel Energy and several cooperatives have protested the proposal in a joint filing. Wise said SPP simply cannot dictate a planning reserve margin 25% higher than six months ago. He said the RTO and market participants need to slow the transition down so “we don’t destroy” today’s system.

“You’re putting loads between a rock and a hard place: … can’t find it, can’t build it. What are you going to do?” he asked rhetorically. “These are unmanageable numbers.”

Wise said new natural gas combustion turbines are the most attractive choice for affordable and reliable power that earns a consistent capacity credit.

“We’re forced into making 30- to 40-year decisions very quickly,” 1803 Electric Cooperative COO Ron Repsher said of resource planning. Despite the obstacles, he said the relatively new cooperative will continue to pursue self-built generation and not rely solely on power purchase agreements with independent power producers.

Repsher said while it’s true that 1803 customers want environmentally friendly power when they are polled, they also indicate they’re unwilling to shoulder more costs to implement it.

“What that really means is they want reliability. First and foremost,” he said.

Entergy Director of System Planning Samrat Datta said the transition is complicated by resource adequacy risks, large load additions, and ever-evolving rules from RTOs and federal agencies. He said Entergy intends to meet its sustainability goals “because our customers want it.”

Jim Dauphinais, an attorney representing multiple industrial customers in MISO, said customers not only are concerned over a large-scale reliability failure, but RTO market rules “moving very quickly.” He said the costs of market rule changes “trickle down very quickly” to customers and he said they’re concerned about an overinvestment in grid facilities.

“We can get ahead of the game and build facilities that are neither used nor useful,” Dauphinais said. “We can make progress toward clean energy, but we have to do it in a way that’s economical.”

Monitors Emphasize Importance of Pricing

Keith Collins, SPP’s vice president of market monitoring, said standby generation is undoubtedly undervalued and called for the industry to improve the quality of green energy.

“It’s one thing to have the four-hour battery. It’s another thing to have a four-day battery,” he said. “We need resources to be available.”

But “the market cannot get what is not valued,” Collins said, adding that premiums should be placed on attributes that promote flexibility, availability, resiliency and dependability.

“A gas resource that’s more secure should have more accreditation,” he said.

Carrie Milton of Potomac Economics, MISO’s Independent Market Monitor, said the RTO’s markets are “well structured” to reliably handle the clean energy transformation. MISO intends to pivot to a marginal, availability-based capacity accreditation and recently proposed to up its value of lost load from $3,500/MWh to $10,000/MWh.

Milton said the grid operator’s markets would benefit from longer-lease reserve product to handle uncertainties that arise over two to four hours and a look-ahead dispatch that anticipates instructions an hour ahead of time, rather than during five-minute intervals.

Although some “tweaks” will be needed along the way, Milton said, the MISO markets send strong price signals when generation is necessary.

“The nice thing about shortage pricing … is that every generator in that moment is going to try to get on the system,” she said.

But Collins said when neighboring RTOs choose different reserve pricing setups and values of lost load, those differences can complicate or even dissuade some power exports.

“That’s something of real concern that as different markets choose different designs, that can affect imports and interchanges,” he said.

State-of-the-art Opportunities

“You’re hearing about the doom and gloom we’re facing over the next five to 10 years. We’re here to talk about the solutions,” Southern Renewable Energy Association Executive Director Simon Mahan said in opening a panel on how hydrogen, offshore wind, carbon capture and small modular nuclear reactors can assuage a reliability crisis.

He asked panelists what makes them optimistic about their burgeoning technologies.

“We’re going through the ‘hype cycle’ for clean hydrogen,” Center for Houston’s Future CEO Brett Perlman said, citing 35 potential hydrogen projects in development around the Gulf of Mexico.

“It’s a testament to the developer-friendly mentality we have in Texas and Louisiana,” Perlman said. He said he thinks hydrogen is on the cusp of greater adoption and likened it to the atmosphere in Texas 20 years ago, when the state began adding wind and solar resources at a record rate.

Perlman also said tax incentives that put early hydrogen projects on equal footing with other generation builds are vital. Anthony Bodin, development director for RWE’s Gulf of Mexico offshore wind project, said the developer secured a federal lease last year to develop an up-to-2-GW offshore wind farm about 40 miles off the Louisiana coast. However, the “GoMex” project isn’t expected to be commercially operational until the mid-2030s.

“It’s going to take time, so we have to be patient,” Bodin said. “The potential for offshore wind is massive.”

Michael Curtis, Dow’s carbon and energy technology principal, said he’s hopeful the company’s development of a small modular reactor at its Seadrift Operations manufacturing site in Texas by 2030 will create a blueprint for other similar projects at industrial sites.

“Being first, there are a lot of eyes on us … Maybe in 15 years, we’ll see more of these projects actually up and running,” Curtis said. However, he added, a beleaguered enriched uranium supply chain presents obstacles to developing SMRs.

“Instead of giving out millions of dollars with an ‘M,’ we’re giving out billions of dollars with a ‘B,’ and that’s a real shift,” said Maria Duaime Robinson, director of the Department of Energy’s Grid Deployment Office.

Duaime Robinson said the department recently distributed about $7 billion and will hand out more than that in the coming years. She said despite some perceptions, DOE is making its investments in a “thoughtful fashion and not just throwing money at the problem.”

Durham McCormick, a partner at McGuire Woods, said the monetary awards contained in the Inflation Reduction Act don’t operate under a carrot-and-stick mentality. Instead, he said the IRA’s tax credits and grants are equivalent to smacking the industry with a “giant carrot.”

McCormick said new types of resources must come online for the U.S. to meet the Paris Climate Accord’s emissions goals. He said he foresees more renewable curtailment and increased battery storage over the next decades to keep generation and load lined up.

Electric-gas Harmonization not Rocket Science

Bob Gee, co-chair of the 2022 Gas-Electric Harmonization Forum for the North American Energy Standards Board, called for more transparency into gas pipelines and “more timely collection” of granular information regarding their operational status.

Perhaps because his keynote address came during the first day’s last session, the former Texas Public Utility Commission chair chose hot dog vendors as his analogy.

“A certain degree of transparency is required when your business serves the public, whether you are an electric or gas utility or a hot dog seller,” Gee said. “But today, we have more transparency in how Nathan’s makes hot dogs and what goes into them than we do on certain intrastate pipelines, such as available capacity. This is significant because if I don’t like Nathan’s hot dogs, I can buy one from another hot dog maker. In the intrastate pipeline industry, there is no Oscar Mayer pipeline.”

Gee, former FERC Chair Pat Wood and Sue Tierney, DOE’s assistant secretary for policy under President Bill Clinton, spent more than a year working to produce their report at the request of FERC and NERC. “Houston, We Have a Problem” laid out 20 recommendations to improve coordination between the electric and gas sectors, although five revealed “widely divergent opinions” between the industries.

A separate FERC-NERC report on the December 2022 winter storm said gas-supply failures have contributed to three of the five most recent power outages since 2011. (See FERC-NERC Elliott Report Calls Winter Outages ‘Unacceptable’.)

“Despite this increasing interdependence between our natural gas and electric power delivery systems, we have yet to significantly overhaul the way these two industries interact and rely upon one another, and thus remain at risk,” Gee said.

He said the gas-electric system has its weaknesses because the gas infrastructure originally was designed to supply local distribution companies, not to serve power markets. “Over the last 20 years, this interdependence has doubled. But with that interdependence, our needs for attention and responsiveness have increased,” Gee said.

“We ignore the long-term consequences of this dynamic relationship at our peril.”

The forum report’s title is a reference to the historic 1970 Apollo 13 mission. “Houston, we have a problem,” were astronaut Jack Swigert’s words back to Mission Control after an oxygen tank ruptured and disabled the spacecraft’s electrical and life-support systems. The crew relied on the lunar module’s backup systems to return safely.

“NASA dusted itself off, fixed its quality-control systems, and successfully completed four more manned lunar missions in the succeeding two years,” Gee said. “Unlike Apollo 13, harmonizing the gas-electric divide isn’t rocket science. We can do this.”

Just Transition for the Disadvantaged

Sanya Carley, co-director of the Kleinman Center for Energy Policy at the University of Pennsylvania, delivered a sobering reminder that many in the U.S. cope with overwhelming poverty and are overlooked in the energy transition.

Carley said U.S. utilities carried out about 2.62 million disconnections in 2022, according to utilitydisconnections.org. She said disconnections disproportionately affected households of color, households with children under age 5, households that rely on medical equipment or households with homes in disrepair.

According to information from the U.S. Energy Information Administration, one in three households reports difficulty affording energy bills while keeping their homes at comfortable temperatures. One in three households also struggles to pay bills.

New low-carbon technologies are adopted predominantly by wealthy and white households. The associated financial tax incentives flow disproportionally to them, Carley said, arguing for a reassessment of subsidies.

“Energy systems have always created winners and losers and this energy transition will be no different unless there are deliberate and coordinated efforts otherwise,” she said.

Carley said she has visited communities that were “very heavily rooted” in coal production, calling them “mono-economies.” She described coal companies going under and “completely removing” an entire town’s tax base, leading to cascading effects where breadwinners lose salaries and no longer can afford to dine out, leading to a “degradation of the entire economy.”

Carley said she’s spoken to community members who reported feelings of grief, bitterness and being used by the nation when coal was king. She said during 2020 and 2021, autoworkers told her they were being deceived about the electric vehicle boom. They said the EVs they were building were unaffordable and lacked adequate charging infrastructure once they’re on the road, Carley said.

Nevertheless, she said, the workers felt they’ve earned the right to build the next generation of automobiles, having given their youth and oftentimes health to build gas-powered vehicles.

“Inequities in the energy system are inevitable, yet avoidable with deliberate action,” Carley argued.

Evaluating FERC Order 2023

“The era of flat demand is over!” declared Chelsea Howard Robben, an executive director of regional origination for NextEra Energy, during a panel discussion on FERC Order 2023 and its incorporation by grid operators.

Referring to the never-ending hunger for energy by the oil and gas sector and electrification, Robben said, “This is an exciting time for our industry. As we see these demand growth opportunities, let’s capitalize on it.”

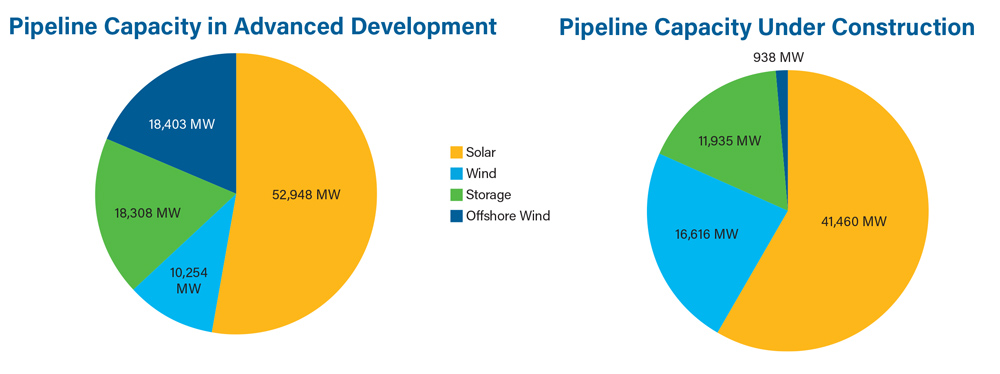

Order 2023 is designed to do just that. It requires transmission providers to study projects in clusters, penalizes those that don’t complete the studies on time and adds requirements discouraging speculative projects to unclog jammed interconnection queues. (See FERC Updates Interconnection Queue Process with Order 2023.)

“I know both SPP and MISO have stated goals to shrink that process to a 12-month process, but we still have interconnection queues that are five and seven years old,” Robben said.

FERC special counsel Kim Smaczniak said transmission planning must be forward-looking rather than reactive, saying the future is going to look very different from the past.

“When we see the pace of retirements and the volume of generation that is seeking to interconnect, ensuring that that new capacity can come online quickly and safely is essential to ensure the reliable, affordable grid,” she said. “Doing a better job of looking ahead to understand the future supply and demand conditions is, in my view, a no-brainer. We need to ensure transmission investments float infrastructure that will make the grid more reliable and resilient.”

“Having a well-functioning interconnection queue means we can get through it quickly. We know what our upgrade costs are going to be. It’s incredibly important to my company,” said Nicole Luckey, senior vice president of regulatory affairs for Invenergy. “We were really pleased with Order 2023. I think there are little tweaks here and there that we’ve certainly raised, but we think implementing cluster-based studies across the U.S. is going to make for a more efficient interconnection process.”

Kayla Messamore, vice president of strategy and long-term planning for Evergy, said her company has some concerns with the order’s penalty structure. Were SPP to pay a penalty for missing a deadline, she said, its nonprofit status would mean the members would end up covering the costs.

“So that’s the main concern. … But in general, I think it’s great,” she said. “We have 4,000 MW of renewables that just Evergy is trying to add over the next 15 years. So, we have a lot of reasons to want the queue to move more quickly and to avoid future backlogs.”