WASHINGTON ― Working at a state transportation department used to be pretty humdrum, according to Tim Sexton, who started his career at the Department of Transportation in Washington state.

“Transportation used to be departments of highways or departments of roads,” said Sexton, who now is assistant commissioner for sustainability, planning and program management at Minnesota’s DOT. “Now you have some states … saying, ‘You know, we can do more,’ and what we’re saying is, anything that touches transportation, and especially transportation and climate, we want to have a role in and want to try to lead on … and it’s partly out of self-initiative, but also partly because our hand is being forced.”

Sexton was one of four panelists speaking about how to build clean, sustainable transportation systems, at the 2nd Annual U.S. Tech for Climate Action Conference. The conference’s tech focus notwithstanding, the transportation panel was less concerned with specific technologies and more interested in digging into the research, policies and public-private partnerships needed to ensure access to clean, convenient mobility across a broad range of urban and rural environments.

“As we start to look at state goals for decarbonizing the economy, transportation plays a role” as a top emitter of greenhouse gases at both national and state levels, Sexton said of Minnesota’s more holistic approach. “We look at this as a three-legged stool of vehicles, operations and fuels. A low-carbon fuel standard … could be a big part of the solution, too, so let’s get involved with that.”

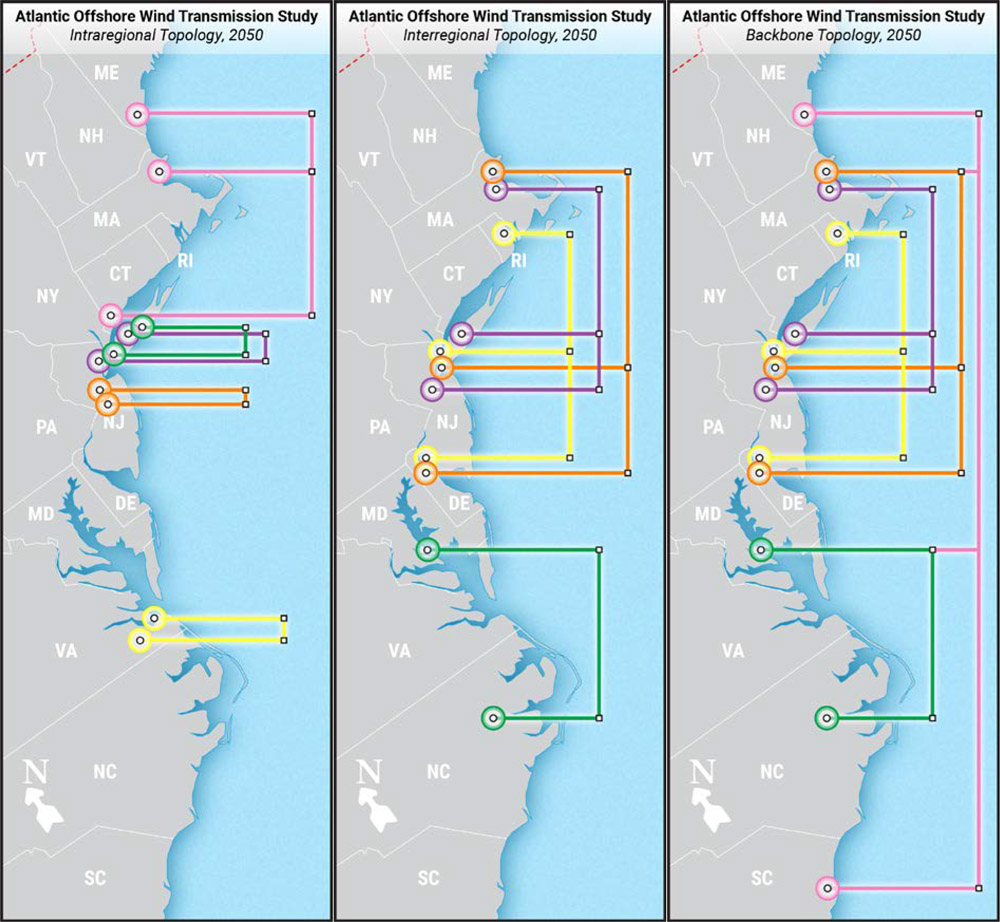

The Minnesota DOT also has waded into the politically sensitive topic of locating transmission along existing transportation rights-of-way, Sexton said. “The biggest obstacle to transmission is property rights, and if you have linear corridors that mirror our highways, that could really facilitate a lot of transmission,” he said. “How do we support that in a way that balances competing needs?”

Colin Tetreault, senior manager for climate change and sustainability services at EY, formerly Ernst & Young, agreed that the past 10 to 15 years have seen “a better understanding of an evolutionary thesis of what we’re solving for.”

“We used to think about kind of single-passenger conveyance, or how do we move a car from point A to point B,” Tetreault said. “That model [and that] decision calculus [is] changing … to how do we move goods, ideas, people and services safely, effectively, affordably, efficiently and equitably?”

The equity and environmental justice focus in transportation policy also is a major change, he said. “When you think about access to food, to health, to education, it is a … travesty that people do not have good access to transport and what that does to hinder community- and state-level growth. … These things don’t exist in a vacuum because they are layered together,” he said.

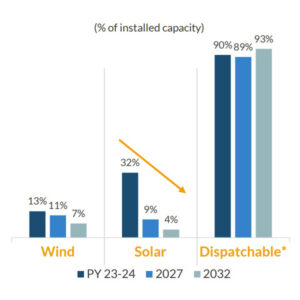

“Converting to EVs is not sufficient … to get us to net zero by 2050,” said Gretchen Goldman, director of climate change research and technology at the Department of Transportation, referring to President Joe Biden’s goal for economywide decarbonization. “And so that means also investing in transit … and really making sure that we’re diversifying in mode choice in lots of ways.”

A priority for DOT is focusing on different contexts and different communities, and how to apply new technologies “because it’s not going to be the same as what it looks like in urban spaces and similarly on tribal nations and lands.”

Greening Rideshares in NYC

In New York City, combining transportation equity and decarbonization has meant looking closely “at modes of transportation that are used on a day-to-day basis in everyday lives of New Yorkers, but are simultaneously modes of transportation that we have control over,” said Isabelle Thomas, policy adviser for living streets and public spaces.

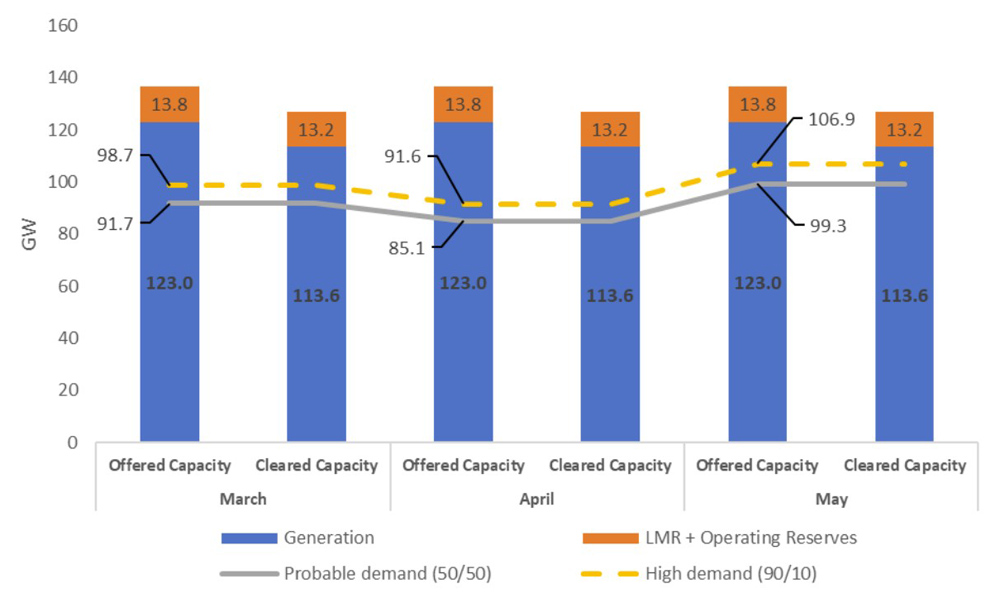

Exhibit A, Thomas said, is the Green Rides Initiative, which has set a target for all vehicles in the city’s rideshare fleet ― taxis, Ubers and Lyfts ― to be either zero emission or wheelchair accessible by 2030. For 2024, 5% of “all high-volume for-hire trips” will have to be zero-emission or wheelchair accessible, rising to 15% in 2025 and 25% in 2026 and then increasing by 20% per year to reach 100% by the end of the decade, according to a city website.

Overseen by the city’s Taxi and Limousine Commission, the initiative means “we’ve already taken care of a part of what is a 78,000-vehicle fleet that’s on our streets every day,” Thomas said.

NYC also is working on electrifying its school bus fleet by 2035, drawing on a combination of state and federal funds, Thomas said. On March 18, Mayor Eric Adams announced New York City had received $61.1 million in federal funds from the Infrastructure Investment and Jobs Act, which would be used to buy 180 new electric school buses (ESBs), quadrupling the total number of ESBs in the city’s fleet.

An additional $15 million from the U.S. DOT will go toward a “freight-focused” electric truck and vehicle charging depot to be located in the Hunts Point Food Distribution Center, one of the state’s busiest trucking hubs, according to the announcement’s press release.

Another key component of NYC’s strategy for transportation decarbonization, Thomas said, is ensuring all New Yorkers can find DC fast chargers within 2.5 miles of where they live or work.

Building a Used EV Market

Consumer engagement was a major factor for Minnesota’s adoption of California’s Advanced Clean Cars II (ACCII) rule, which requires that all new light-duty vehicles sold in the state be zero emission by 2035.

“We went around the state and everybody said, ‘We should have more electric vehicles in the state, but we can’t get them here. [We] have to go to another state because of where we are in the middle of the country.’ You had to go quite a way to get an electric vehicle,” Sexton said.

According to Conservation Minnesota, a nonprofit advocacy group, only about half the models of EVs available on the market are for sale in the state.

Public health and equity also were drivers for ACCII, Sexton said, “If we don’t have vehicles coming into the state, especially new vehicles, we’re not going to have a used vehicle market either, and without that used vehicle market, not everyone is going to be able to get into an EV.”

Sexton also talked about Minnesota’s approach to transmission siting along highway rights-of-way, working with a group called NextGen Highways to look at the opportunities and challenges. To begin with, rights-of-way are a “constrained resource,” he said. “There [are] not unlimited amounts of it. …

“There’s a lot of stuff buried alongside the road and underneath it, whether it’s water, sewer, fiber,” which requires “being really thoughtful about when, how [and] where are we allowed to access” these sites, Sexton said. Permitting these projects means making sure “you have evaluated all the options, and this is the best path,” he said.

According to a 2022 NextGen feasibility study, undergrounding HVDC and broadband lines in highway rights-of-way could help prepare Minnesota’s grid for transportation electrification ― and the installation of DC fast chargers ― while increasing opportunities for remote work, online learning and other online services. The result could be an overall decrease in vehicle miles traveled in the state, the report says.

Sexton sees potential in linking reduction of vehicle miles traveled to rethinking and reform of land use, such as making communities more pedestrian and bicycle friendly. “I don’t know if I want to live in a community [where] everybody has a car and everybody is driving and spending two hours one way to get to work,” he said. “Even if it’s not polluting, is that the way you want to live?”

Going Further, Faster

While providing unprecedented funding for a range of decarbonization initiatives, the IIJA and Inflation Reduction Act have posed challenges for state government agencies that have to interpret and implement the new programs. But, Sexton said, the direction coming from federal agencies is as important as, if not more important than, the money.

Panelists generally agreed that cross-agency and cross-stakeholder input and planning are essential parts of designing and implementing effective, successful programs. Tetreault favors working with regional economic development agencies, rather than industry trade groups.

Economic development agencies are more likely to look at “smart, equitable, clean and green jobs … [as] a growth vertical. Latching onto that in order to indicate there’s economic prosperity coupled with decarbonization tied to things like transportation, I think, carries a message further,” he said.

Minnesota has formed a Sustainable Transportation Advisory Committee, which includes regional development agencies, state and local government officials, and some of these agencies’ strongest critics, Sexton said. “We made the commitment that we would respond, not that we’d accept every recommendation, but we’d facilitate the conversations,” he said.

At the same time, Tetreault also stressed the importance of regulatory certainty for driving capital to specific markets, regardless of federal incentives. The best policies provide both carrots and sticks, he said. “Capital will follow certainty. It will stay where it’s treated well. [It] will continue to grow where it feels warm.”

In the face of the coming elections and potential regulatory changes, public-private partnerships could provide a way to use existing policy with capital, and provide a broader range of creative financing options, he said. State and sub-state contracts could include “things like disclosure [and] environmental performance standards,” he said.

“Providing a vector for the capital markets to have verifiable opportunities and then to keep [them] verifiable through good disclosure management systems … we can align public and private for quick reaction,” he said. “Working together, we go further, and we go faster.”