FERC on March 27 granted complaints by five utilities against CAISO, nullifying nearly $2 million in penalties for incorrect meter data reporting.

Idaho Power (EL23-94), Tucson Electric Power (TEP) (EL24-15), Direct Energy Business (EL24-11), Tacoma Power (EL23-103) and the city of Corona, Calif. (EL23-99), all submitted complaints last year challenging the application of CAISO tariff section 37, which spells out the ISO’s rules of conduct.

Under the section, if a scheduling coordinator fails to submit meter data 52 days after the trading date, the submission is considered late. Failure to submit revised meter data 214 days after the trading day for the resettlement statement that CAISO issues is considered an inaccurate submission. Either violation subjects a scheduling coordinator to a $1,000 penalty for each trading day after deadlines are missed.

Each of the complainants told FERC that CAISO was applying the provision too strictly for “minor, inadvertent” errors and that the errors had practically no effect on the markets, making the penalties unjust and unreasonable.

The commission agreed “that the penalties assessed are not commensurate with any potential damage caused by the inadvertent errors, which were properly reported upon discovery, promptly fixed and had a de minimis effect” on the markets.

The ISO also supported all the complaints, saying that until the rule is changed, it “supports relief for parties that receive excessive penalties under the existing tariff rules.” In May 2023, it opened the Rules of Conduct Enhancements stakeholder initiative to address issues including the potential for excessive penalties in certain circumstances.

Several of the complaints noted that the tariff provision does not allow CAISO discretion in waiving or reducing penalties.

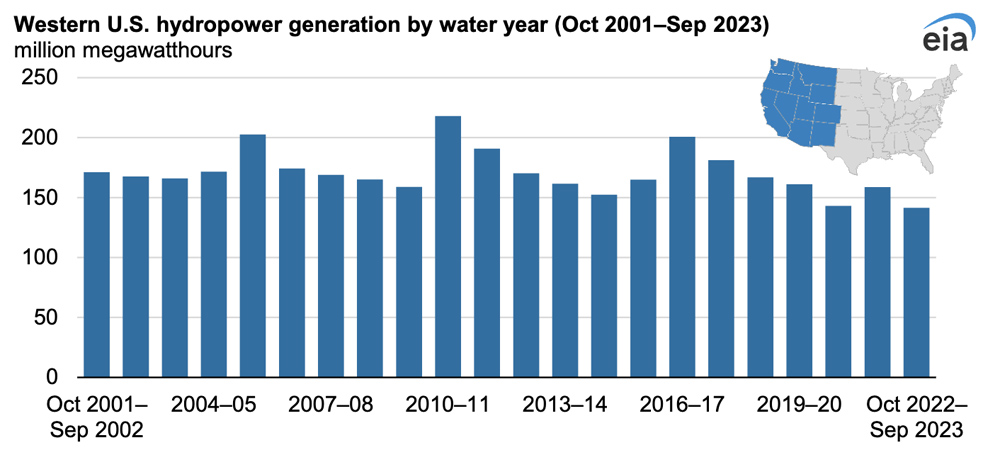

Idaho Power had appealed $639,000 in penalties for incorrect data associated with the Arrowrock Hydroelectric Project. In July 2022, the utility discovered that transmission line losses were being double counted in the meter data being provided to CAISO, leading to under-reporting of energy produced by Arrowrock. Idaho Power argued that because the quantity did not affect LMPs or market runs in the Western Energy Imbalance Market (WEIM), the penalties should be waived.

Tacoma’s reporting errors stemmed from setting its transmission system loss factor of 1.87%, which resulted in it under-reporting load by an hourly average of the same amount. It said the error occurred because of a misunderstanding in the treatment of line losses that occurred when it joined the WEIM. Upon noticing the error, it immediately reported it to CAISO and corrected it the next day.

Both Corona and Direct Energy challenged their respective $342,000 and $825,000 penalties for errors resulting from Southern California Edison changing its billing system, saying it acted in good faith by notifying CAISO of the error upon discovery.

Like Tacoma, TEP appealed penalties related to an inadvertent miscalculation during its integration into the WEIM. However, the utility did not submit settlement statements with its complaint; rather, it submitted nine CAISO notices of review, issued over the course of 2023, for periods of trading days in 2022.

FERC agreed to only waive the penalties — $191,000 — described in the last notice, issued Oct. 31, 2023; TEP filed its complaint in November. The other eight “do not provide sufficient information for us to determine whether the instant complaint was filed with the commission within 22 business days from the date of issuance of any of the corresponding settlement statements,” as required by the tariff, the commission said. It set the other penalties for paper hearing, ordering TEP to file evidence that it submitted its complaint in a timely manner.