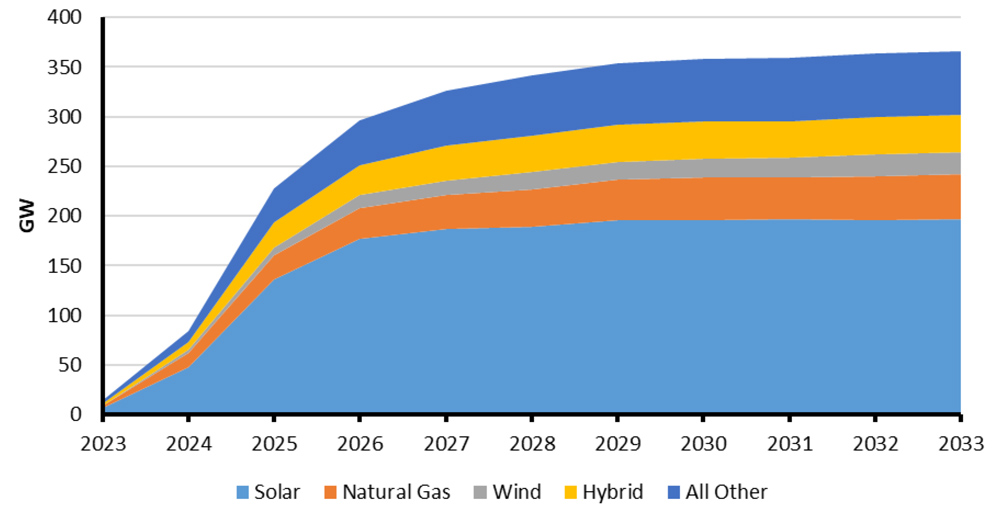

The U.S. may need 700 to 900 GW of clean, firm power to decarbonize the grid even as electricity demand increases, and next-generation geothermal power could pump out anywhere from 90 to 300 GW of that total, according to a new report from the Department of Energy.

The report is the latest in DOE’s Pathways to Commercial Liftoff series, aimed at providing a road map for commercializing and scaling critical but still emerging clean power technologies. Previous reports have focused on advanced nuclear, clean hydrogen and virtual power plants.

Traditional geothermal wells are located over existing underground sources of heated brine or other fluids, which produce steam to run turbines; they are, by their nature, limited to specific, often unique geographies. Next-generation geothermal seeks to tap previously inaccessible geothermal heat even deeper underground via injected fluids.

While still “nascent,” the technology has “a unique value proposition,” the report says.

“It is clean, firm, flexible; requires a small land footprint and no additional energy input; and is exposed to minimal supply chain risk. It is among the few options that can provide the clean firm power necessary to enable widespread deployment of variable renewables, such as solar and wind energy.”

Referring to geothermal as “the heat beneath our feet,” Energy Secretary Jennifer Granholm sees next-gen geothermal as an opportunity for the U.S. to “lead the clean energy future with continued innovation on next-generation technologies … [by] cracking the code to deploy them at scale.”

“With strong public-private partnerships, we can lower costs for this hot technology to expand access for cleaner, more reliable power to communities across the nation,” Granholm said in a press release announcing the report.

DOE uses next-gen geothermal as an umbrella term for two kinds of emerging geothermal technologies:

-

- enhanced geothermal systems (EGS), which use “commercial directional drilling and hydraulic fracturing capabilities developed by the oil and gas industry to target and create fractures in hot, impermeable rock, allowing fluid to flow where it previously could not”; and

- closed-loop or advanced geothermal systems (AGS), which circulate fluids in boreholes in closed pipes.

With both types, the heated fluids brought to the surface are used to create steam to drive turbines, similar to traditional geothermal.

While DOE estimates about 40 GW of traditional geothermal resources now exist across the U.S., enhanced geothermal could provide up to 5,500 GW, according to the report.

DOE believes next-gen geothermal could achieve commercial liftoff — that is, expand at scale and at a competitive price — by 2030 and provide 90 GW of power or more by 2050. Additional advances in technology and available land could drive that total as high as 300 GW, the report says.

The Opportunity

DOE sees an enormous market opportunity for next-gen geothermal. It can be used for not only clean, flexible and dispatchable power, but as a form of long-duration storage, collecting heat when demand is low and then releasing it when demand is high.

Next-gen plants could also be “a useful grid asset and a potential generation source for other power users like behind-the-meter industrial centers with high electricity demand, data centers or direct air capture facilities,” the report says.

The value of geothermal is already being recognized in premium prices. Both traditional and next-gen geothermal projects are signing power purchase agreements for between $70 and $100/MWh, the report says. For example, when the California Public Utilities Commission mandated procurement of 1 GW of clean, firm power by 2026, part of that was 262 MW of geothermal, the report says.

The U.S. currently has 3.7 GW of geothermal generation, 0.4% of the country’s total capacity. The entire geothermal fleet consists of 93 plants located in California, Nevada, Oregon, Idaho, Utah, New Mexico and Hawaii. At 900 MW, the Geysers in Northern California is the largest geothermal complex in both the U.S. and the world.

Next-gen technologies are emerging at a time when older geothermal plants are retiring. The life cycle for geothermal plants is about 30 years, the report says. Between 2016 and 2021, seven new geothermal plants, totaling 186 MW, came online, while 11 older plants retired, taking 103 MW off the grid.

To reach commercial liftoff, “industry must demonstrate that the engineering capabilities [for next-gen projects] can be deployed in greenfield conditions ― i.e., locations with no existing geothermal resources,” the report says. Successful demonstration projects in five to 10 geologically diverse locations would help to reduce technological and resource risk and unlock private investment, the report says.

DOE estimates that deploying these demonstration projects, totaling 2 to 5 GW across four to six states, will require $20 billion to $25 billion in public and private investments.

The department wants to be a catalyst. It recently announced $60 million in funding for three enhanced geothermal demonstration projects located in California, Utah and Oregon. The three projects include one being developed near the Geysers in California, one in Utah using hydraulic fracturing technology and the third in Oregon on the side of the dormant but still active Newberry Volcano. (See DOE to Fund Enhanced Geothermal Demo on Oregon Volcano.)

DOE is also supporting efforts to cut the upfront costs of next-gen technologies through its Enhanced Geothermal Earthshot, which has targeted slashing the cost of EGS by 90% to $45/MWh by 2035 ― a critical benchmark also cited in the Commercial Liftoff report.

According to the report, current demonstration projects have been able to cut project development costs by almost 50%. Fervo, the company behind the Utah demonstration project, recently announced it had cut its drilling costs from $9.4 million per well to $4.8 million.

Challenges and Solutions

DOE sees five major challenges for next-gen’s commercial liftoff, as well as a range of possible solutions:

-

- high upfront costs and risks, which are constraining funding for development and limiting expansion into new locations. Solutions include “new financial products to reduce drilling costs, such as public-private cost-share agreements and drilling insurance programs,” along with market signals, like premium-priced PPAs, which could spur investment in early deployments.

- perceived and actual operational risks for deployments, which could be mitigated through the strategic siting and data sharing from 10 or more early deployments.

- long and unpredictable development cycles driven by permitting and interconnection bottlenecks, requiring streamlining of permitting processes, such as making technology changes that would allow certain permitting steps to occur simultaneously.

- existing business models that undervalue next-gen geothermal technologies. Possible solutions include policies that support higher-cost, higher-value power and new offtake models that allow developers to use heat for multiple used and value streams.

- potential community opposition will require projects to follow environmental and seismic best practices, including “early, frequent and transparent” community engagement.