Co-located Storage Resources

The NYISO Business Issues Committee on March 13 approved proposed tariff changes to allow energy storage resources (ESRs) co-located with a dispatchable generator behind a single point of interjection to participate in the markets.

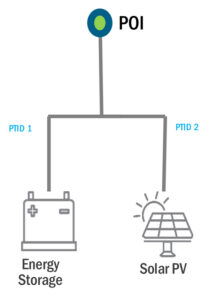

The revisions would expand the list of resources eligible to be included in the ISO’s co-located storage resource (CSR) models. The proposal is part of the wider ongoing hybrid storage resource (HSR) effort, which was approved by stakeholders in 2022 with the aim of incentivizing developers to couple generators with ESRs and integrating aggregated HSRs into NYISO’s markets. (See “Hybrid Storage Resources,” NYISO Management Committee Briefs: Dec. 21, 2022.)

Each unit within the expanded CSR model will have a distinct single point identifier, bid, schedule, settlement and its own participation model. The ISO already has updated the CSR model to include additional use cases, such as limited run-of-river hydro and landfill gas, but these changes will require further modifications and an additional compliance filing to align with FERC Order 2023.

NYISO has been developing changes to its energy market products, including a hybrid pricing scheme for CSRs and a ramping product, to account for the capabilities of fossil fuel peakers slated for retirement in 2025. Recently, it announced plans to study how hydrogen could fit in its marketplace as an emissions-free generator co-located with a load resource and whether this could be facilitated through new or modified participation models. (See Hydrogen Getting Resource-specific Rules in NYISO Markets.)

NYISO will seek approval from the Management Committee of its proposals at the March 27 meeting and plans to file them in the second quarter of this year.

PSEG Power’s Howard Fromer sought clarification on the timeline, asking if the changes approved in 2022 already had been presented to the ISO’s Board of Directors.

Katherine Zoellmer, a market design specialist with NYISO, responded that the board has not yet reviewed the previously approved changes but will do so once the CSR proposal is approved.

February Market Operations

NYISO Senior Vice President Rana Mukerji presented the February market operations report to the committee, noting that the month’s average locational-based marginal price (LBMP) of $31.33/MWh was lower than January’s $65.76/MWh and the $55.47/MWh observed in February of the previous year. He attributed these declines to the higher temperatures experienced throughout this year’s milder winter conditions.

February’s average energy cost was 0.6% higher than the previous year, increasing from $52.36/MWh to $52.70/MWh.

Mukerji also noted the continued decline in natural gas prices. The natural gas index price at Transco Z6 NY was $1.71/MMBtu in February, down from $6.37/MMBtu in January, with year-over-year gas prices declining by 73.2%.

Vote on Net EAS Revenue Proposal Postponed After Stakeholder Protests

The BIC was slated to vote on NYISO’s proposals to use five-minute real-time LBMPs for estimating the net energy and ancillary services (EAS) revenue earnings of peaking plants as part of the capacity market demand curves reset determination, but it was postponed after stakeholders expressed multiple concerns.

NYISO’s proposal would allow the use of a five-minute real-time dispatch (RTD) in the net EAS model and expand the existing allowable adders for net ancillary services revenue not determined by the model to include potential net real-time energy revenues.

The ISO argued that the operating characteristics of certain technologies as they evolve may warrant the consideration of using five-minute real-time prices instead of hourly prices for estimating net EAS revenue. This adjustment would provide NYISO with the flexibility to modify how these technologies are treated in each reset.

The reset is a quadrennial process for reviewing and adjusting the demand curves in NYISO’s capacity market to ensure they accurately reflect current costs and market conditions in New York.

According to a stakeholder who agreed to speak with RTO Insider on the condition of anonymity, NYISO decided not to proceed with a vote on the proposal because of concerns it would be rejected, after it received many emails from stakeholders complaining about the rapid pace of the proposal process — two weeks from proposal to stakeholder approval — and a lack of analysis on the potential market impacts of the proposed tariff changes.

Stakeholders had requested an evaluation of the proposals’ impacts by NYISO’s Market Monitoring Unit (MMU) at previous meetings, but the ISO proceeded with the expectation a vote would occur at the morning’s BIC meeting.

At the Installed Capacity Working Group’s meeting later that afternoon, the MMU presented its preliminary assessment and methodology for examining the ISO’s proposal to use five-minute real-time prices in the net EAS revenue model for energy storage and assessing the potential to develop an alternative solution for considering the potential impact of five-minute real-time prices if the model continues to use only hourly prices.

Mark Younger, president of Hudson Energy Economics, captured the confusion and reluctance expressed by many stakeholders, saying, “The concern I have, at the moment, is that we don’t know enough about what you’re proposing to do, nor all of the [proposal’s] details, to go ahead and bless putting it into the tariff.”

Doreen Saia, an attorney with Greenberg Traurig, echoed that sentiment, saying, “I just don’t get it” and “to me, it seems inherently flawed.”

NYISO intends to maintain the schedule for the 2025/29 DCR and initiate the reset no later than this month. It will seek stakeholder approval of the proposed concepts at the BIC’s March 19 and MC’s March 27 meetings, but the MMU indicated its final analysis of the proposals would not be completed and presented until April.