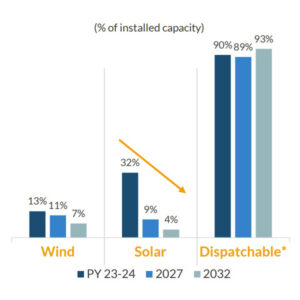

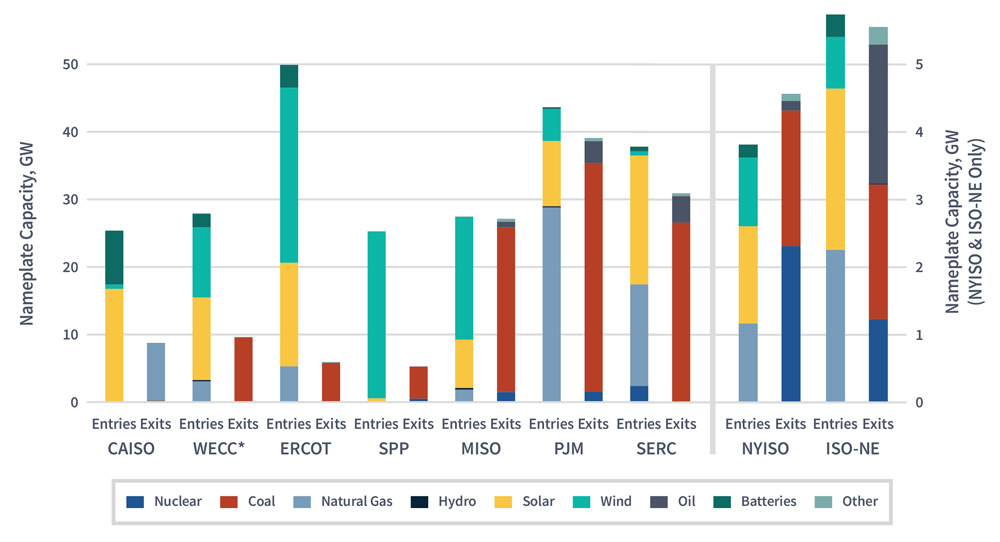

The Texas Public Utility Commission on March 19 adopted a rule establishing the Texas Energy Fund In-ERCOT Generation Loan Program, a $5 billion fund designed to bring new dispatchable power projects to the state.

The rule establishes the fund’s application process, project eligibility requirements, evaluation criteria and loan terms. The low-interest loans can be used for new dispatchable generation facilities or to expand existing facilities within ERCOT (55826).

Qualifying projects for the Texas Energy Fund (TEF) must add at least 100 MW of new dispatchable capacity to the grid. The PUC says the program can support up to 10 GW of new or upgraded generation capacity in ERCOT.

“As our state’s population and economy grow, so does the demand for electricity, and we must ensure Texans have the power they need, when they need it,” PUC Chair Thomas Gleeson said in a statement. “This rule lays a strong foundation for the Texas Energy Fund’s success and for future investment in the state.”

Speaking on a panel during the recent CERAWeek 2024 by S&P Global conference in Houston, NextEra Energy’s Michele Wheeler, vice president of regulatory and political affairs, said the market indicates the fund will be oversubscribed.

“We hope that’s the case,” she said.

NRG Energy’s interim CEO, Larry Coben, said in February the company plans to apply for up to $900 million in TEF loans to finance construction of two new natural gas-fired plants that would be available in 2026. Coben reiterated during CERAWeek that the two peakers and another baseload plant will add 1,500 MW to the Texas grid.

Companies can begin applying for the in-ERCOT program June 1. Initial disbursements for approved loans will be issued by Dec. 31, 2025.

However, supply chain issues could pose a significant roadblock, commissioner Jimmy Glotfelty said during the March 21 open meeting. He recounted a conversation he had during CERAWeek with a Siemens senior executive.

“He said, ‘Good luck with getting a combustion turbine before 2031,’” Glotfelty said. “If the market [is] seeing a massive delay in this major equipment, I think that is something that really has to be conveyed to the legislature and to us so that we don’t get in a bind.”

One of the TEF’s four programs, an early completion bonus, awards grants to new dispatchable generation facilities that meet certain planning requirements after June 1, 2023, and interconnect to the ERCOT grid before June 1, 2029.

The commission agreed with stakeholders to change the rule’s performance standards and ordered the revisions during the meeting. The performance availability factor (PAF) was reduced from 90% to 85% and the performance outage factor (POF) rose from 10% to 15%.

Gleeson said in a memo he was persuaded by commenters who said the performance metrics would be “very difficult to achieve” throughout the loan’s term for units operating under standard operating processes. The commenters said that because of the length of planned maintenance outages and “unforeseen operational issues” during the early years of a plant’s life, additional flexibility in the PAF and POF metrics is “both necessary and reasonable,” Gleeson said.

In addition to the In-ERCOT Generation Loan Program, the rule establishes TEF programs providing:

-

- completion bonus grants for new dispatchable generation projects that “consistently provide power generation over a 10-year period”;

- grants for companies to establish or secure back-up power resources; and

- grants to improve electric service resiliency and availability outside the ERCOT region.

- completion bonus grants for new dispatchable generation projects that “consistently provide power generation over a 10-year period”;

The Texas Legislature could provide additional TEF funding in future years, the PUC said.

PUC staff determined switchable resources providing energy to both ERCOT and SPP are not eligible for the fund, as they are not totally committed to the Texas market. However, they will be eligible for completion bonuses because the law does not make a distinction between ERCOT and non-ERCOT resources.

“We want 100% of the new capacity generated to be dedicated to the ERCOT market,” PUC staffer David Smeltzer said.

The TEF is a result of legislation passed last year (Senate Bill 2627). Texas voters overwhelmingly approved the fund in November as a constitutional amendment. (See 2023 Elections Bring Billions for Texas Gas, Dem Wins in Virginia, NJ.)

“Voters … made it clear that reliable electricity is a top priority,” the bill’s author, state Sen. Charles Schwertner (R), said. “We must expand and strengthen our on-demand, dispatchable power generation in order to deliver the reliable electricity all Texans expect and deserve.”

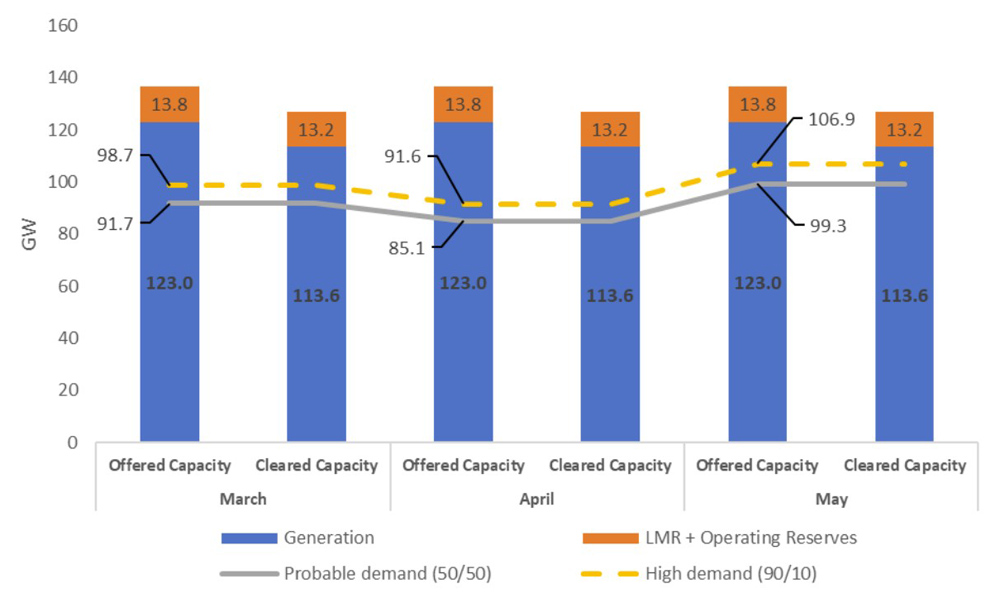

ERCOT Preps for Solar Eclipse

ERCOT COO Woody Rickerson told the commission the grid operator is preparing for the April 8 total solar eclipse and does not expect reliability problems, using lessons learned from October’s annular eclipse.

“ERCOT will pre-posture the system just like we did previously as necessary to meet both [solar’s] down ramp and the up ramp,” he said.

The eclipse will cross Texas from the southwest to the northeast between 12:10 p.m. and 3:10 p.m. CDT, with sun coverage ranging from 81 to 99%, ERCOT said. Solar generation is projected to dip as low as about 7.6% of its maximum clear-sky output at about 1:40 p.m.

“That’s a pretty big ramp down,” Rickerson said. “We are fortunate that this solar eclipse is occurring in April and not August.”

ERCOT is working with solar forecast vendors to ensure models account for the eclipse’s effect. Ancillary services will be used for additional balancing needs. The first market notices will go out March 28, with additional communications to the market following.

The ISO breezed through a test case in October. Solar production dropped from just over 7,000 MW to 1,474 MW as the eclipse’s “ring of fire” traversed Texas. Natural gas resources helped compensate for the solar drop, increasing generation by more than 4,000 MW increase. (See ERCOT Smoothly Handles Annular Solar Eclipse.)

Texas A&M University’s Smart Grid Center has made public a visualization of the eclipse’s effect on solar generation across Texas. ERCOT has about 22 GW of installed solar capacity.