A heat-pump water heater for a low-income homeowner in DeSoto, Ga. A National Guard Armory renovated with high-efficiency, all-electric heating as a small-business and nonprofit incubator in Owosso, Mich. Solar panels, window and roof upgrades, and aging-in-place upgrades for an affordable senior housing project in Miami.

These projects and thousands more like them, funded through community lending institutions, received a $20 billion boost April 4, as EPA announced the eight organizations it has selected to receive grants from its Greenhouse Gas Reduction Fund (GGRF). Grant amounts range from $400 million to $6.97 billion.

Created by the Inflation Reduction Act, the GGRF aims to “create a national clean financing network for clean energy and climate solutions across sectors, ensuring communities have access to the capital they need to participate and benefit from a cleaner, more sustainable economy,” EPA said. The awards represent “the single largest non-tax investment within the [IRA] to build a clean economy while benefiting communities historically left behind.”

The awardees have committed to use the money for projects that collectively will reduce or avoid 40 million metric tons of greenhouse gas emissions per year, while drawing in nearly $7 in private investment for every $1 of federal funds they receive over the next seven years, according to the announcement. In addition, more than 70% of the GGRF funds will go to low-income and disadvantaged communities, including more than $4 billion for rural communities and nearly $1.5 billion for tribal communities.

The Climate United Fund, which was selected to receive the largest GGRF award, plans to use its $6.97 billion to help finance 1 billion square feet of net-zero building space across residential and commercial sectors, including 188,000 units of multifamily housing. Other targets include deploying 150,000 zero-emission vehicles and more than 11 GW of renewable energy.

The group is a partnership between impact investor Calvert Impact, the Community Preservation Corporation — which invests in affordable housing in low-income neighborhoods — and the Self-Help Credit Union, located in Durham, N.C. The fund plans to invest both in community lending institutions and in specific projects.

“We are not aiming to just deploy more clean energy and green buildings in underserved places; we’re building up local lenders and local businesses that can support enduring, thriving, and equitable clean energy markets and communities,” according to a Climate United fact sheet.

Speaking at a rollout event for the GGRF in Charlotte, N.C., on April 4, Vice President Kamala Harris said the grants will address a key issue in building out a clean energy economy: limited access to capital in low-income and disadvantaged communities.

“In every community in our nation, there are, of course, extraordinary people with talent, ingenuity and the ability to help us take on the climate crisis,” Harris said. “In too many places, too many people with all that talent have still had limited access to capital to do the work they want to do, to start and grow a clean energy business.”

The GGRF awards mark “the first time in history we are providing tens of billions of dollars directly to community lenders to finance local climate projects,” she said. “We have taken this approach because we know we have the capacity … to empower communities to decide what projects they want, that will have the greatest impact from their perspective in the place they call home; and then we can invest in those projects in a way that will actually have value for the people who live there.”

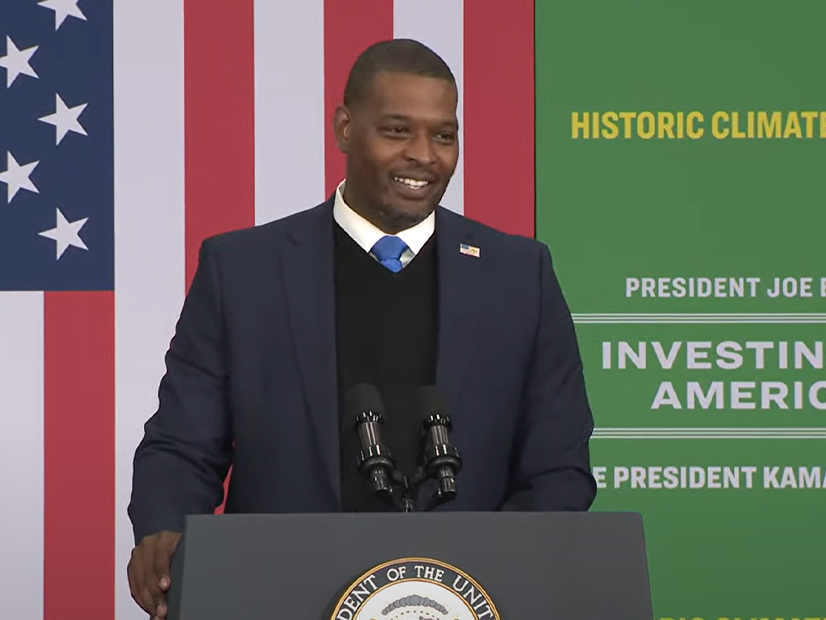

The funds also will be used to provide technical assistance and build capacity among community lenders, to “drive deployment of tens of thousands clean energy projects,” said EPA Administrator Michael Regan, who accompanied Harris to Charlotte. “And the good news is we’re not starting from scratch, because these [awardees] are not new to this work. These experts have already provided capital to families and small businesses across the country.”

Self-Help, for example, has spent several years working with a range of community groups to build 49 energy-efficient homes in Grier Heights, one of Charlotte’s historically black neighborhoods, said Donnetta Collier, financial capabilities manager.

“Our work guarantees that the homes’ heating and cooling bills will be under $48/month,” and all the homes were sold to residents with incomes below 80% of area median income, Collier said.

As part of Climate United, Self-Help hopes to scale its model to build more homes “by infusing billions into community lenders across the country,” she said.

The Awardees

The idea behind the GGRF dates back more than decade, when Sen. Ed Markey (D-Mass.) and then-Rep. Chris Van Hollen (D-Md.) first introduced legislation to create a national climate bank. Markey and Sen. Van Hollen continued to work on the legislation, which was finally incorporated into the IRA as the GGRF.

Quoted in the EPA announcement, Van Hollen hailed the awards as “a pivotal moment in America’s fight to confront the climate crisis while driving inclusive economic growth.”

The IRA provides $27 billion for the fund, divided between three programs, two of which will be funded by the $20 billion announced April 4.

The National Clean Investment Fund (NCIF) will award $14 million to three nonprofit groups, to establish “national clean financing institutions that will deliver accessible, affordable financing for clean technology projects nationwide,” with a particular focus on public-private investing and low-income and disadvantaged communities.

Climate United is one of the NCIF awardees, along with the Coalition for Green Capital ($5 billion) and Power Forward ($2 billion). All three have decades-long experience in funding community-level projects, according to EPA

The Clean Communities Investment Accelerator (CCIA) is investing $6 billion in five nonprofit community development financial institutions (CDFIs) to “establish hubs that provide funding and technical assistance to community lenders working in low-income and disadvantaged communities.”

The CCIA awardees are the Opportunity Finance Network ($2.29 billion), Inclusiv ($1.87 billion), Justice Climate Fund ($940 million), Appalachian Community Capital ($500 million) and Native CDFI Network ($400 million).

CDFIs are specialized lenders that focus on providing basic financial services to low-income and disadvantaged communities that may not have access to mainstream financial institutions, according to the U.S. Treasury Department, which certifies CDFIs.

The U.S. has more than 1,300 CDFIs, which together manage more than $222 billion in funds, according to the Opportunity Finance Network.

The Native CDFI will use its $400 million grant to help 63 community lenders across tribal lands “to fund renewable energy, energy-efficient upgrades and sustainability projects that will enhance well-being and create employment opportunities for native people,” according to the organization’s website.

Republican Rollback Efforts

GGRF’s third program, the $7 billion Solar for All initiative, will “finance clean technology deployment … in low-income and disadvantaged communities,” according to EPA, which said it will be announcing more information on the program later in the spring.

The current awardees were selected through a review process that included “dozens of federal employees — all screened through ethics and conflict-of-interest checks, as well as trained on the program requirements and evaluation criteria,” EPA said.

Following the announcement, the agency will negotiate award agreements with each of the selected organizations, which will set out performance metrics for emission reductions and other goals, according to a senior administration official speaking on background.

Under the IRA, EPA must complete negotiations and finalize agreements to award the funding by Sept. 30, at which point the federal dollars will be officially “obligated” and available to the grantees, the official said.

The House of Representatives on March 22 passed a bill, the Cutting Green Corruption and Taxes Act (H.R. 1023), that would roll back the GGRF. Three days before the 209-204 vote, President Joe Biden issued a statement saying he would veto the bill if it is passed by the Senate.