While the first day of FERC’s resource adequacy technical conference was focused almost entirely on PJM, the commission zoomed out on the second day, June 5, with several panels examining ISO-NE, MISO and NYISO. (See related story, FERC Dives into Thorny Resource Adequacy Issues at Tech Conference.)

In general, the grid needs to see fewer retirements and more new resources with the right characteristics to maintain reliability, said Todd Snitchler, CEO of the Electric Power Supply Association.

“That’s not to suggest that … if plant ‘X’ retires, it needs to be replaced with exactly the same type of unit [or] type of fuel source,” Snitchler said. “But the performance characteristics of the things that are coming on the system have to ensure reliability and do so cost effectively.”

The whole system needs new resources, whether it’s the power plants or new transmission and distribution, and Snitchler sees that need in three phases. The next five years are seeing load growth, but most of the new generation that will come online already is well down the development path. The five years after that are long enough that new capacity can help, while anything further out is too far ahead to forecast accurately.

“If we can meet the objectives for the first block and the second block, I think the third block becomes far less concerning,” Snitchler said. “And, so, as we look at these numbers and how we’re going to meet this short- and medium-term obligation to get resources on the system, I think that’s where the focus needs to be from all parts of the value chain.”

FERC Chair Mark Christie asked what needs to be done in light of the issues, which Snitchler answered by noting it’s been about 18 months since data center-led demand growth became the topic in the industry. Now it’s important to get the interconnection queues, siting and permitting right.

“At the end of the day, if we want to solve the problem, you’ve got to accelerate the projects that are ready to go in order to make sure that they can deliver the electrons that are needed to power the country,” Snitchler said.

FERC was holding the tech conference just before MISO and the Organization of MISO States released their annual survey of resource adequacy. (See related story, MISO, OMS Report Stronger Possibility for Spare Capacity in Annual RA Survey.)

Recent changes to the RTO’s capacity market, such as replacing the vertical demand curve with a sloped curve, have made MISO Independent Market Monitor David Patton, president of Potomac Economics, confident it will maintain reliability going forward. The old market design contributed to 6 GW of merchant power plants retiring in MISO, he said.

“The merchants retired,” Patton said. “It caused a one-year shortage in the Midwest, and then everybody figured out: ‘Hey, this is a real problem; our market isn’t facilitating investment.’ And they finally, after 15 years, adopted the reliability-based demand curve.”

The first auction cleared about 85 to 90% of the cost of new entry (CONE) when the old model would have cleared at 10%, Patton said. Now the market works for merchants, and rather than interfering with state integrated resource plans, it facilitates them, he said.

One other rule that should be universal is the marginal accreditation of resources, Patton argued, because that provides IRP planners and merchant developers with the right information on the grid’s needs.

“Once you implement the marginal accreditation, I think you can have a high degree of confidence that both the markets and the planning processes in regulated states will adjust to conform to the reliability attributes that drive what we need and facilitate the investment that we need,” Patton said.

“Correctly aligned” market rules would be good for development because it would offer more certainty, American Municipal Power Vice President Steven Lieberman said. But none of the organized markets offers enough certainty, he argued.

“These capacity constructs provide at most a one-year price signal,” Lieberman said. “Nobody’s building generation for a one-year price signal. And if it’s a seasonal design, you’re not building it because the price in the summer was high. Here, you’re building because you have a long-term view.”

Patton disagreed with that assessment, pointing to the one domestic market FERC does not regulate: ERCOT, with its energy-only market.

“They don’t provide anything beyond the day-ahead market, right?” Patton said. “And yet, people are still investing. They’re investing because they understand the market design and they can forecast market revenues of different types of units going out 20 to 30 years in the future. And that’s why it’s important for the capacity constructs to be efficient.”

The prices in capacity markets can be forecast decades into the future, but investors discount those prices heavily because of regulatory uncertainty. They might not be here in another decade or two, Patton said.

“But if we get to the point where we have well-structured capacity markets that that are robust and durable, where we’re not creating the concern that maybe they’ll go away, or maybe they’ll fundamentally change, then I think investors can rely on their expectations, and those expectations will fuel bilateral contracts,” he added.

One resource that ERCOT has been able to attract — as has California — is energy storage, American Clean Power Association Vice President Carrie Zalewski said.

“I think we just need to pause for a second and recognize the powerhouse, the Swiss Army knife, that storage is,” she added. “It’s fast; it’s flexible; it’s dispatchable. It allows for frequency regulation, grid stability, virtual inertia [and] black start. The technology continues to get better; it gets more efficient.”

Zalewski also argued FERC should not disregard many of the projects in the queues that will be ready to go and help over the next critical period.

“Those projects are in a much better place than starting over from scratch and building something new,” she added.

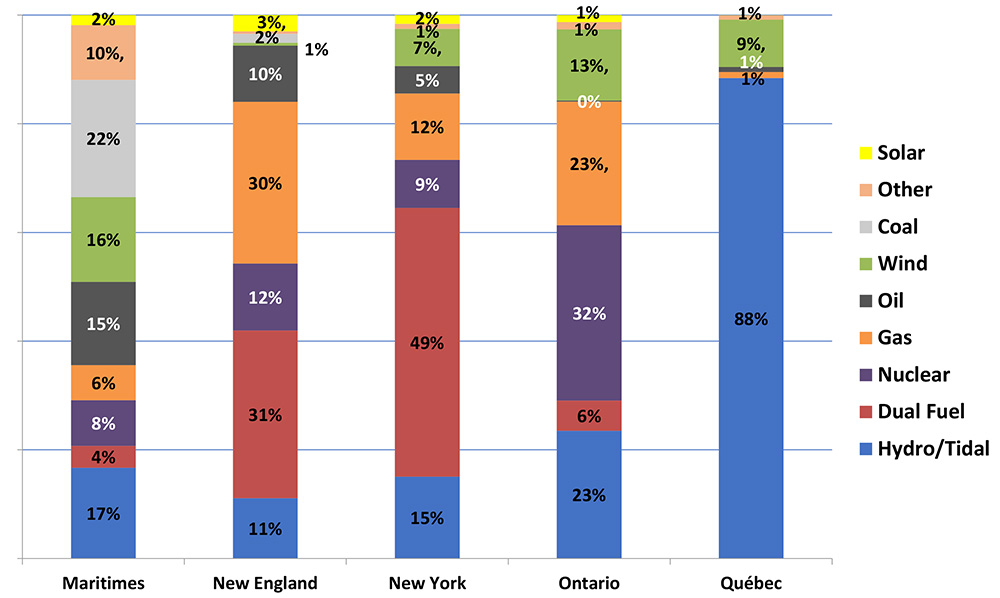

ISO-NE and NYISO

The two organized markets operating in the Northeast are not hotbeds of data center development, but they are facing their own resource adequacy issues.

NYISO is expecting a combination of large loads, increasing electrification and constraints on the supply side to lead to narrowing reserve margins, COO Emilie Nelson said.

“We’re also seeing a shift in what we must solve to continue to provide that reliable electric grid,” Nelson said. “One of the significant changes we’re preparing for in New York is to move from a summer-peaking to a winter-peaking system.”

NYISO expects its winter peak to go up by 14 GW by 2040, which will put more pressure on a natural gas system already strained to meet demand from power plants and heating during cold snaps.

ISO-NE faces the same problem. Recent analyses give the RTO into the early 2030s before its winter resource adequacy leads to reliability problems, noted Connecticut Department of Energy and Environmental Protection Commissioner Katie Dykes. There is enough time to avoid those problems, she said, but the region’s preferred answer on the supply side has some major issues of its own.

“We’ve had some very disappointing and challenging news on the offshore wind front, not just in terms of interest rates and general inflationary pressures, but now a federal executive order and tariffs and uncertainty around tax credits that’s making the path for that resource, which is very valuable for addressing winter reliability, have a more uncertain path,” Dykes said.

On the positive side, the states in New England have been cooperating on ensuring a reliable, affordable grid that meets their policy goals.

“I think one of the most important things will be to continue to have a clear path here at FERC,” Dykes said. “In terms of ensuring that we don’t see new barriers like a resumption of MOPR [the minimum offer price rule] or something like that, that would challenge the abilities for states and the ISO to work together on these solutions that we urgently need to deploy.”

It’s harder to build in New England, and it would be very difficult to get new pipelines in place to deal with the winter reliability issues in the next five years, said Philip Bartlett, chair of the Maine Public Utilities Commission.

“The states have come together and decided we want to build some transmission up into northern Maine to unlock resources that are there,” Bartlett said. “That’s a great benefit, particularly given the delay in offshore wind. But the earliest that’s likely to come online is 2035. So that is a long-time horizon when you’re dealing with resource adequacy challenges.”

Ideally, the states and the RTO will work together to develop a process that will evaluate resource adequacy and explore the tools the region has to address it, Bartlett said.

“If the states decide we want to go all-in on a particular resource or particular transmission approach, we need to figure out how to fast-track them to get it moving faster through the ISO process,” he added. “I think states need to think about, as we’re doing some of our state procurements, how does that fit in with resource adequacy? Should we be bumping up, for example, investments in storage or in certain kinds of other resources or demand response or other tools that could help us buy some time to deal with the problem?”

Michelle Gardner, NextEra Energy Resources’ executive director for the Northeast, agreed the region needed to think broadly when it comes to resource adequacy. Unlocking northern Maine, with its cheaper land and renewable resources, will help, she said.

“I think we need to take advantage of every tool in our toolbox,” Gardner said. “I think we need to take advantage of every effort to move forward.”