The U.S. Department of Energy released a study of offshore wind transmission last month,1 which it said charts a path for a reliable and affordable electric system with HVDC backbone transmission interconnecting offshore wind projects along the East Coast.2 (See DOE Study Adds to Case for Interregional Offshore Grid.)

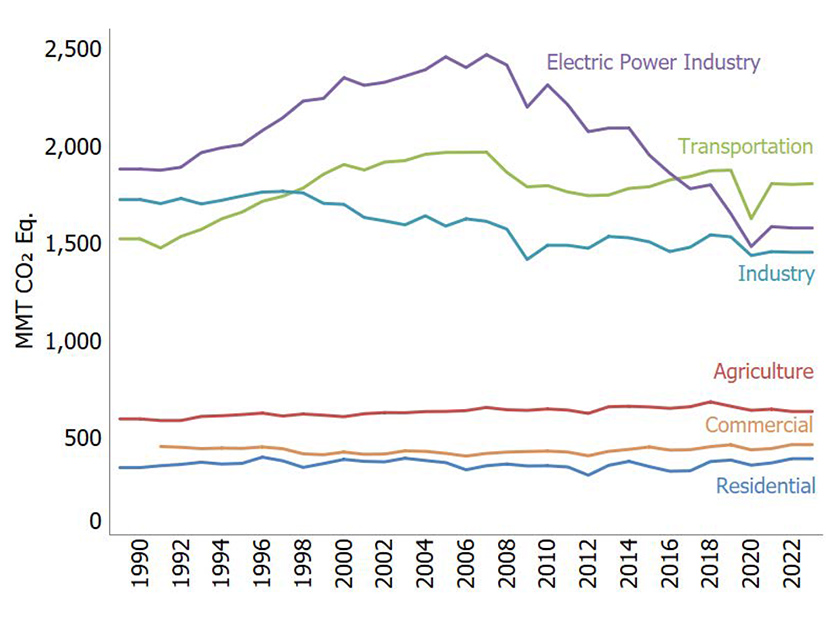

For starters we need to be clear: In no way does this study establish, or even claim, that offshore wind makes economic sense. Of course it couldn’t, for reasons I’ve given before,3 which are reinforced by all the news of the past year or so.4 Instead, we should be building onshore wind and, where economic, transmitting it from west to east.

What the study actually claims is that hypothetical offshore wind projects of 85 GW along the East Coast, if interconnected among themselves with an offshore transmission “backbone,” would have a positive cost-benefit ratio relative to 85 GW of wind projects separately interconnected to shore with “radial” lines.

In other words, the study claims that if we were to spend $96.3 billion5 on radial transmission lines for 85 GW of offshore wind, it would make sense to spend another $20 billion for offshore north-south HVDC transmission lines to interconnect everything offshore — and, oh yeah, based on year 2050 projections of everything.

Now let’s get to some specific problems with the study.

Legal and Commercial Barriers

Because offshore wind is so expensive, it happens only with large customer (and taxpayer) subsidies through a given state procurement program. For example, in New Jersey’s latest procurement, the developer is receiving $131/MWh in offshore wind renewable energy credits (ORECs) with a price escalator.6 Such procurements effectively or literally require all the wind generation to be delivered to the procuring state.7

Even if a developer were legally able to divert some generation elsewhere, it would have no reason to do so under programs like New Jersey’s where all project revenues are credited back to customers.8 And even if there were no revenue-crediting requirement, a developer isn’t going to divert wind generation elsewhere, such as to New York, except in hours when it could get more than $131/MWh.9 This rarely occurs, and when it does, it is likely that energy prices in New Jersey also would be high.

Energy Price Differences

Assuming the above legal and commercial barriers didn’t exist, let’s examine the study’s principal economic benefit claim: There are huge price differences between different East Coast regions such that there are huge customer savings to be had from moving power up and down the East Coast for injection onshore at different points. “In modeled estimates using the radial topology in 2050, price differences between suitable POIs [points of interconnection] for offshore wind averaged over $100/MWh”;10 for example, “approximately $130/MWh on average between ISO-NE and SERC.”11

This appears to be a mistake. For the year 2050, DOE’s Energy Information Administration projects average generation sector prices of $66.8/MWh in New England and $54.7/MWh in SERC East (South Carolina and the non-PJM portion of North Carolina).12 That is a difference of about $12/MWh, not $130/MWh. The biggest regional price difference is between New England and PJM-East (which contains New Jersey and the Delmarva Peninsula) with a difference of about $16/MWh.13 So there are no $100/MWh average regional price differences that an offshore transmission backbone could arbitrage for the benefit of customers.14 And even if there were, stakeholders subsidizing their state’s wind projects would be none too happy for their wind to be diverted elsewhere in times of high prices.

Oh, by the way, the study’s specific quantifications of customer energy savings are based on a production cost model.15 But, except for the Carolinas and Virginia, customers don’t pay production costs; they pay LMPs.

And the study also implicitly assumes, contrary to actual experience, that resources could and would be dispatched efficiently among regions.16

Resource Adequacy

The study’s second biggest category of claimed benefits is resource adequacy. The study claims $940 million of incremental annual resource adequacy benefit in 2050, relative to a radial transmission design.17 The prime example is that PJM could rely on wind off the Carolinas to be delivered to PJM during peak conditions so the RTO would need less internal generation capacity.18

This also appears to be a mistake. PJM has FERC-approved capacity market rules to ensure resource adequacy that require external generation resources to give operational control to PJM so that external resources are functionally equivalent to internal resources.19 Stakeholders in wind projects off the Carolinas are not going to give PJM operational control.

And if I might pick a nit, the study says Carolina wind would be delivered to “winter-peaking parts of PJM” and specifies Maryland.20 None of the coastal states in PJM are winter peaking, including Maryland.21

Modeling Assumptions

The study has a couple modeling assumptions that seem to put thumbs on the scale.

First, the study assumes “limited [new onshore] interregional transmission.”22 Yes, despite new onshore interregional transmission being all the rage these days, the study assumes nothing is built for the next 26 years.23 If new onshore interregional transmission were built, any price/cost differences would decline as more energy would be deliverable from low-cost areas to high-cost areas, and backbone offshore transmission would be less valuable.

Second, the study assumes “limited-access siting regimes for land-based wind and utility photovoltaics.”24 This assumption is not explained, but it seems safe to observe that if one assumes limited onshore renewable resources, offshore resources will look more attractive. This assumption is belied by the hundreds of gigawatts in proposed onshore renewable resources.25

Incremental Annual Cost

In developing its benefit-cost ratios, the study doesn’t provide detail for its capital costs.26 But the study does drop a footnote for its assumptions on converting capital costs to annual costs,27 and we can back into the annual costs. So, for example, comparing the radial scenario with the backbone scenario, we know that if claimed incremental “economic value” is $3,940 million28 and if claimed incremental “net annual value” is $2,470 million,29 then the implied annual cost is $1,470 million.

If the incremental capital cost is $20 billion and the annual cost is $1,470 million, then that means the assumed annualized cost percentage is 7.35%. But that is not realistic. For example, the annual carrying charge rate for transmission owners in PJM is about 11.8%,30 and annual O&M expense is on top of that.

Engineering Feasibility

I am no engineer, but there is an Argonne National Laboratory study that says HVDC systems can’t have more than five substations: “The number of substations within a modern multi-terminal HVDC transmission system can be no larger than six to eight, and large differences in their capacities are not allowed. The larger the number of substations, the smaller may be the differences in their capacities. Thus, it is practically impossible to construct an HVDC transmission system with more than five substations.”31 And National Grid describes major issues with multi-terminal HDVC systems.32

The DOE backbone design has 26 substations.33 How does that reconcile with the Argonne and National Grid analyses? I have no idea, but these are things the study should have addressed.

And there’s another potential engineering issue called the “most severe single contingency,” which involves the sudden loss of a single source of electric generation, generally around 1,200 MW. It is unexplained how aggregated offshore wind generation delivered onshore in excess of the MSSC would not trigger reliability and reserve issues.

What Else Could Possibly Go Wrong?

Spend $20 billion here, $20 billion there, and pretty soon we’re talking real money. And those who might rationalize spending “only money” on offshore wind backbone transmission should consider how much a focus on standard design among offshore transmission projects, in order to enable backbone transmission, might delay or even frustrate such projects.

In Conclusion

DOE should rethink this.

Columnist Steve Huntoon, principal of Energy Counsel LLP, and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.

[1] https://www.nrel.gov/docs/fy24osti/88003.pdf.

[2] https://www.energy.gov/articles/doe-reports-chart-path-east-coast-offshore-wind-support-reliable-affordable-electricity.

[3] Offshore wind is more than twice as expensive as onshore wind and is a highly inefficient use of renewable energy subsidies. https://www.energy-counsel.com/docs/we-see-through-a-glass-darkly.pdf, citing https://www.lazard.com/media/kwrjairh/lazards-levelized-cost-of-energy-version-140.pdf, slide 3, showing $40/MWh for onshore wind versus $86/MWh for offshore wind (midpoints of the ranges). The most recent Lazard levelized cost of energy analysis is $49/MWh and $106/MWh, respectively, https://www.lazard.com/media/typdgxmm/lazards-lcoeplus-april-2023.pdf, slide 2. My earlier column criticized subsidies/mandates for offshore wind and showed that for every dollar of subsidy, we can get 11 times as much onshore wind as offshore wind. http://energy-counsel.com/docs/Offshore-Wind-Edifice-Complex.pdf.

[4] An excellent article covering this news, as well as discrediting the jobs argument for offshore wind, is here, https://www.cato.org/regulation/spring-2024/false-economic-promises-offshore-wind

[5] In a couple footnotes, 25 and 29, the study says “million” instead of “billion.” This is confusing.

[6] https://www.offshorewind.biz/2024/01/25/new-jersey-selects-3-7-gw-of-new-offshore-wind-projects-awards-inflation-adjusted-orec-contracts/.

[7] For example, in New Jersey the points of landfall and interconnection are required to be in New Jersey. https://njoffshorewind.com/third-solicitation/solicitation-documents/Att-5-Application-Requirements.pdf, page 13. In New York the requirement is explicit, https://www.nyserda.ny.gov/All-Programs/Offshore-Wind/Focus-Areas/Offshore-Wind-Solicitations

[8] https://njoffshorewind.com/third-solicitation/solicitation-documents/Att-5-Application-Requirements.pdf, page 18.

[9] ORECs are only paid for wind energy delivered to New Jersey. https://njoffshorewind.com/third-solicitation/solicitation-documents/Att-4-Offshore-Wind-Economic-Development-Act.pdf, page 17.

[10] https://www.nrel.gov/docs/fy24osti/88003.pdf, page ix.

[11] https://www.nrel.gov/docs/fy24osti/88003.pdf, page 47.

[12] https://www.eia.gov/outlooks/aeo/tables_ref.php, comparing Tables 54.7 and 54.10 in year 2050 for generation sector prices in 2022 cents per kilowatt-hour and converting to dollars per megawatt-hour.

[13] From north to south, EIA projects average generation sector prices in 2050 to be: $66.8/MWh in NPCC-New England, $61.8/MWh in NPCC-New York City and Long Island, $50.7/MWh in PJM-East, $50.8/MWh in PJM-Dominion, and $54.7/MWh in SERC-East. Tables 54.7, 54.8, 54.10, 54.13 and 54.14.

[14] Perhaps the study meant to say that there are some hours with at least a $100/MWh price difference and that the average price difference of those hours is more than $100/MWh, which of course it would be by definition. Who knows?

[15] DOE Study, page v and footnote 2.

[16] https://www.brattle.com/wp-content/uploads/2023/10/The-Need-for-Intertie-Optimization-Reducing-Customer-Costs-Improving-Grid-Resilience-and-Encouraging-Interregional-Transmission-Report.pdf; https://www.rtoinsider.com/75385-stakeholder-soapbox-greatest-machine-needs-tune-up/

[17] DOE study, Table 19 on page 77.

[18] DOE study, page 70.

[19] https://elibrary.ferc.gov/eLibrary/filedownload?fileid=E921C275-FFCB-C00E-9D23-7D6D72D00000

[20] DOE study, pages 67 and 70.

[21] https://www.pjm.com/-/media/library/reports-notices/load-forecast/2024-load-report.ashx, Tables B-1 and B-2. Taking Maryland as the example given in the study, the summer peak loads for the furthest year out, 2039, are 7,495 MW for Baltimore Gas and Electric and 6,870 MW for Potomac Electric Power Co., relative to their respective winter peak loads of 6,803 MW and 6,081 MW.

[22] DOE study, page 9.

[23] DOE study, page 12.

[24] DOE study, page 9.

[25] https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_LTRA_2023.pdf, Figure 16.

[26] Basic stuff like number of substations, total transmission miles, etc.

[27] DOE study, page 77, footnote 37.

[28] DOE study, Table 19 on page 77.

[29] DOE study, Table 20 on page 77.

[30] https://www.pjm.com/-/media/committees-groups/committees/teac/2023/20230711/20230711-informational—market-efficiency-analysis-assumptions—july-2023.ashx

[31] https://publications.anl.gov/anlpubs/2008/03/61117.pdf, page 42.

[32] https://www.nationalgrid.com/sites/default/files/documents/13784-High%20Voltage%20Direct%20Current%20Electricity%20%E2%80%93%20technical%20information.pdf, page 6. An interesting story is here, https://spectrum.ieee.org/multiterminal-hvdc-networks

[33] DOE study, page 52.