NEW YORK ― In recent years, fossil fuel industry leaders have been extremely careful and strategic with the words they use when talking about the role that, in their view, the industry should play in the global energy transition. Public messaging has argued for a “low-carbon” future, rather than no carbon or even net zero.

A series of presentations and panels on the second day of the annual BloombergNEF Summit last week provided a measure of the industry’s success in crafting a narrative based on a “balanced” and well-paced transition that includes cutting its most egregious emissions ― methane ― and scaling carbon capture and storage technologies.

For methane, the focus is first on accurately measuring emissions that clearly have been underestimated and then developing best practices that will allow the industry to certify that its natural gas is “responsibly sourced.”

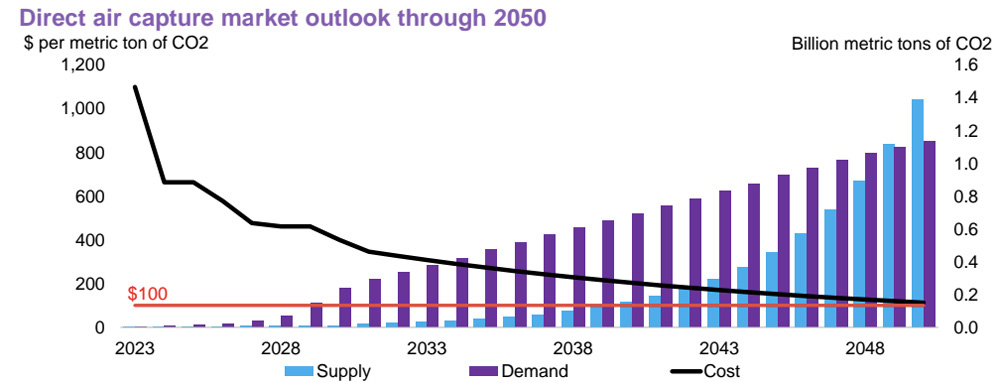

Scaling carbon capture is simultaneously a more pressing and difficult challenge. BNEF predicts the still-emerging sector for direct air capture (DAC) must be able to suck 1 billion tons of carbon dioxide out of the atmosphere by 2050, but the current pipeline of projects will capture only 11 million tons by 2030.

CCS, used for capturing emissions from fossil fuel plants and other hard-to-abate industrial facilities, has a stronger pipeline, with federal and private backing for a range of projects, from a demo at a U.S. Steel plant in Indiana to a major multistate effort gathering emissions from 57 ethanol plants.

The subtext throughout was that the industry’s approach to decarbonization is bottom-line-driven and based on its traditional business models.

The Industry Argument

Her job title notwithstanding, Anna Mascolo, executive vice president of low-carbon solutions at Shell, deftly avoided the term “low carbon,” talking instead about a “balanced” transition to “lower-carbon” technologies. Similarly, she spoke of Shell’s “traditional business,” not fossil fuels, oil or gas.

The energy transition “is not a switch you can do on [or] off,” Mascolo said in an onstage discussion April 17 with Alix Steel, co-anchor of Bloomberg Markets. “We need to deliver energy today for our customers and then help them transition towards the lower-carbon options.”

Joining Mascolo and Steel, Jeff Gustavson, president of Chevron New Energies, argued for a longer-term, all-of-the-above energy transition. “The energy system has always been in transition, and typically, it’s not one energy source completely replacing another source,” he said.

Both Shell and Chevron have set targets for becoming net-zero businesses by 2050.

But as the demand for energy and the global population continue to grow, so will the need for reliable, affordable and “ever cleaner” power, Gustavson said. “To grow these new global businesses, we need collaboration; we need to lower the cost of these resources; and we need all of the capabilities that companies like ours have today and more to make this successful.”

He pointed to CCS projects Chevron has in the works ― often partnering with other companies, including Shell ― where the company can use its “deep … technical, commercial [and] operating capabilities.”

Shell is looking for markets in transition where “we feel we can play [to] our strengths,” Mascolo said; for example, the niche market for lower-carbon aviation fuel. “We won’t be everything for everyone, and we’re looking for products as well as customers in sectors where we can really have a competitive advantage and … [can] build on the current customers we have today.”

The company also is focused on “making sure [it] gets the pace right,” Mascolo said. “So, then you are investing as your customers progress and as society progresses, as the regulatory environment progresses, and then the utility position is different in different places.”

Last year, Shell invested $5.6 billion in low-carbon solutions, or about 23% of its capital spending, Mascolo said.

Gustavson said Chevron continues to be “inundated with opportunities” in the low-carbon sector, but to invest billions in any new technology, the company expects to see “attractive returns. So, for us, that’s double-digit returns. …

“We look for two things,” he said. “Will it scale? Is it a solution that works? And that comes down to cost primarily. And do we offer something that adds value,” where the company can use its capabilities for competitive advantage?

Right now, the answers to those questions are “yes” for renewable fuels, hydrogen and CCS, he said.

“Scaling CCS is the next challenge, and I see that happening in the years to come,” Gustavson said. “Hydrogen is the most exciting. It’s also the hardest to effect because you’re changing an entire energy system and entire value chain, from production [and] transport to consumption.”

Methane

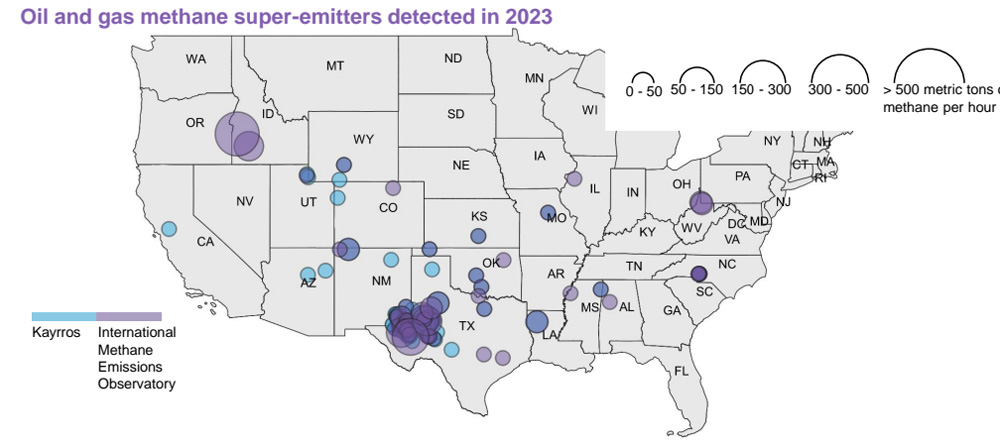

With 84 times the warming power of carbon dioxide but a much shorter lifespan, methane sets the pace of global warming and could have a major impact on whether the world’s nations can limit climate change to 1.5 to 2 degrees Celsius, said David Doherty, BNEF head of oil and renewable fuels research.

The problem, he said during his April 17 talk, is that methane emissions are difficult to measure and therefore almost universally underestimated.

EPA has produced two different measurements of methane emissions, one from its Greenhouse Gas Reporting Program (about 3 million metric tons (MMT)), and another from its inventory of greenhouse gas emissions (close to 9 MMT), according to BNEF.

Those figures may not include outliers, such as super emitter events in which significant amounts of methane are emitted in a short period of time. Super emitters account for only 5% of emission events but as much as 50% of emissions, Doherty said.

Similarly, low-production, or marginal, wells pump out just 7% of the nation’s oil and gas but make up 80% of total wells, and they also produce “a disproportionately large amount of methane,” Doherty said. He cited a study from the Department of Energy, which found that marginal wells produce an estimated 1 million tons of methane emissions per year, 60% from natural gas and 40% from oil.

The reason for this wide range of figures is that counting methane “is very complicated,” Doherty said. “It works off of a series of very simplistic estimations and assumes that business is operating as normal, continuously, with minimal methane leakage. We know this is actually not the case. …

“You can have a barrel of oil with very similar specifications but completely different methane emission profiles,” he said.

Getting a solid grip on methane emissions will require a set of best practices, such as the standards developed by the U.N.’s Oil and Gas Methane Partnership (OGMP) 2.0, which includes 95 oil and gas companies producing 35% of the world’s oil and gas.

The partnership has developed a five-phase, measurement-based reporting system, going from country or state level to specific site level, backed up with satellite or other monitoring systems, Doherty said.

Using OGMP figures, BNEF estimates that in 2024, 45% of U.S. gas will be certified as “responsibly sourced” or gas with a low methane footprint, which could provide a price premium as “emission-savvy and emission-sensitive buyers” seek out low-emission gas, Doherty said.

Certainly, greater scrutiny of methane emissions is coming, and companies that have yet to do so might want to get to work on measuring their methane footprints, he said. “Because if you don’t, somebody else is apt to do it for you.”

Direct Air Capture

Getting a clear idea of 1 billion tons of CO2 requires a serious exercise of the imagination, according to Brenna Casey, a BNEF carbon capture analyst.

BNEF’s target for DAC by 2050 is “equal to roughly 175 million male African elephants,” Casey said during her April 17 presentation. Lining them all up, trunks to tails, “you could stretch from the Earth all the way to the moon and then some.”

Right now, the sector is nowhere near on track for that target, she said. “All the direct air capture capacity is limited to these small-scale plants,” Casey said. The largest is Climeworks’ Orca plant in Iceland, which is capturing 4,000 metric tons (MT) of CO2 per year, she said.

The largest in the pipeline is 1PointFive’s Stratos project in Texas, which broke ground in June 2023 and will be able to capture 500,000 MT of CO2 per year when it is slated to come online in 2025. 1PointFive is a subsidiary of Oxy, formerly Occidental Petroleum.

According to Casey, scaling DAC likely will depend, first, on developing technologies that bring down cost and, second, building a market for the carbon credits produced by the monetization of the carbon captured and stored.

Early DAC projects have used amine and absorbent technologies, while other developers are working with metal oxides and zeolites, Casey said. Used in the Orca plant, amines are based on a derivative of ammonia and can capture carbon molecules. Zeolites combine silicon, aluminum and oxygen and can be used to absorb CO2.

The main difference between older and new DAC technologies is their energy use. Metal oxides and zeolites require about a third less power than amines and other older absorbent methods, according to BNEF.

BNEF pegs the average price for DAC right now around $1,100/MT. The target price point for reaching that 1 billion ton scale by 2050 is $100/MT, Casey said, with economies of scale and lessons learned through construction and operation playing a vital role in moving down the cost curve.

Most of the early, first-of-a-kind plants, like Stratos, are “large, fully integrated … like oil refineries in the sky,” she said. “So, they’ll achieve economies of scale naturally, but at the same time, this forfeits the ability to be highly modular, and we’re likely to see [lower] learning rates.”

Casey predicted prices for such projects to be about $200 to $300/MT. At least one obstacle to further cost cuts is a lack of a “leading technology,” she said. “So maybe the industry has to pick a winner and coalesce around one or two technologies and develop those supply chains in tandem.”

CCS, Make or Break

The case for CCS is rooted in the need to cut emissions from “hard to abate” industries such as cement and steel and has therefore been a focus for both federal and private funding. Technologies that can help move the sector down the cost curve will be vital for CCS as projects face make-or-break points, as detailed in another April 17 panel.

Kelly Cummins, acting director of DOE’s Office of Clean Energy Demonstrations (OCED), ran down a list of CCS projects that have received federal funding. Three of the seven hydrogen hubs OCED announced in October will be using “large-scale carbon capture,” she said.

OCED also recently announced $6 billion in funding for 33 industrial decarbonization projects, and “a large swath of those projects … are going to be using CCS,” she said. For example, Ørsted received funding for a carbon capture project that will turn the CO2 from an industrial plant into ethanol to be used to make an alternative fuel in the shipping and transportation sector, she said.

Projects in the private sector include U.S. Steel’s efforts to decarbonize its plant in Gary, Ind., which produces 5 million tons of steel per year, and the associated emissions, said Erika Chan, the company’s head of sustainability.

The company recently signed a memorandum of understanding with CarbonFree, a carbon capture developer focused on the industrial sector. According to CarbonFree, its technology will capture 50,000 MT/year at the Gary plant, turning it into nontoxic calcium carbonate that can be used for a range of manufacturing applications, from paper and plastics to building materials.

Summit Carbon Solutions has grabbed national headlines with its plans for a CCS project gathering CO2 emissions from 57 ethanol plants across Iowa, Minnesota, Nebraska and the Dakotas and transporting them via pipelines to an underground storage site in North Dakota.

CEO Lee Blank emphasized that local education and community engagement have been critical to getting the project close to shovel-ready, with 2,100 public meetings across the region. Summit now has about 75% of the rights of way it needs for the entire project, including 80% in North Dakota, he said.

But beyond cost and technology, Claude Letourneau, CEO of Canadian CCS developer Svante, said the industry needs a shift in perspective from the energy transition to an industrial transition that takes the whole CCS process into account, from collecting and transporting emissions to storing or reusing them.

The industry should focus on measuring and reducing the carbon intensity of emissions, he said. “Every single industry needs to have a carbon intensity target that is regulated, and then you’ve got to go down that curve over time,” he said. “You’ve got to manage the CO2 emissions associated with industries and … until we do this, it will be very difficult” to scale CCS.