NEW ORLEANS — The headline session of the 2024 International Partnering Forum veered heavily toward celebration and optimism for the U.S. offshore wind energy sector.

There are other ways to view the industry, given its recent growing pains, but one after another, keynote speakers at the IPF24 plenary session emphasized the word “growing” while minimizing the word “pain.”

Roughly 3,400 people from 32 nations attended the four-day summit convened by the Oceantic Network, forming an appreciative audience for this positive message.

Millions of tons of averted carbon emissions and billions of dollars in capital expenditures are riding on the offshore wind industry’s progress, and most attendees at IPF24 have a keen interest in one or both.

“The days of talking about if and when are over. From this day forward, the discussion is centered on how fast and how much can we build,” Oceantic CEO Liz Burdock said. “Have you felt the shift from pilots and plans to industry and action? American offshore wind is venturing into a bold new era.”

Doreen Harris, president of the New York State Energy Research and Development Authority, spoke of both the difficulty of creating this new-to-America energy sector and the importance of succeeding. New York had seen both sides of the coin in previous weeks, with completion of the nation’s first utility-scale offshore wind farm and the collapse of contract talks for three more facilities totaling 4 GW.

“Turns out, doing hard things is hard,” Harris said. “So why in the face of unprecedented challenges should we carry on? Because deep down we know that even in the face of these hurdles, a clean energy future is possible and within reach, and we can very much do it together.”

Deputy U.S. Energy Secretary David Turk spoke of the taxpayer support poured into the renewable energy supply chain.

“This is something we’re not just doing in offshore wind, but we’re doing it in a variety of others. We actually have an industrial strategy,” he said. “Instead of just leaving things to the whim of the market we’re trying to actually influence the market, restore a lot of that capability here in the U.S.”

Turk added: “This is not a test that we can afford to fail … Let us know how we can be helpful, how we can do our part, how we can do even more as we face this absolutely, absolutely critical test.”

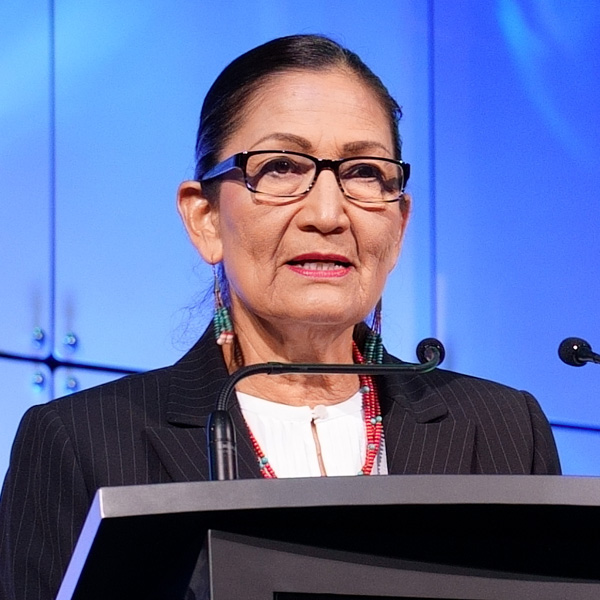

U.S. Secretary of the Interior Deb Haaland took the stage to emphasize the need to install offshore wind generation in national waters, saying: “Our reality today is abundantly clear. Our mission to build a better, cleaner, more sustainable future has never been more urgent.”

She also made two significant announcements: Interior has set the schedule for a dozen wind energy lease sales through 2028, starting in the Central Atlantic region in August 2024, and has streamlined the regulations on renewable energy development in U.S. waters. (See Interior Announces Updated OSW Regs, Auction Schedule at IPF24.)

Addressing Challenges

But what of the challenges that have proved so stubborn in the past two years?

Workforce, supply chain, ships, boats, transmission, factories, ports, delays, cancellations, inflation, interest rates?

The problems are real, but they will be overcome, speakers said. A panel discussion at the plenary focused on the lessons learned and moving forward from them.

Bloomberg News reporter Josh Saul, moderating the panel, noted setbacks including the cancellations of three provisional offshore wind contracts in New York, announced just five days earlier. But he also noted that analysts at Bloomberg NEF project a huge buildout in U.S. waters once the sector gets past its early challenges.

He asked BP Offshore Wind Americas President Joshua Weinstein what pinch point he sees, and Weinstein offered not one but two: grid interconnection and ports.

“These are highly localized in nature, both in respect to their footprint and impacts, and it’s really something that at the end of the day, the global supply chain can’t solve for us through balancing measures and other industry opportunities,” Weinstein said.

“But we’re seeing excellent progress, we’ve seen recognition on the part of the states. The Northeast has absolutely been a leader in port development sponsored at the state level, we’ve seen that in multiple states, and also on the grid interconnection side, we’ve seen multiple initiatives over the past couple of years recognizing those limitations … really a recognition of the current and future generation needs of the coastal grid.”

Saul asked Fugro Americas President Céline Gerson how to speed up projects. Better data integration and analysis would be a big help, she said. Uncrewed surface vessels also are very useful, she said. They are operating in the North Sea and could be operating in U.S. waters.

“We’re not able to scale up those types of uncrewed vessels fast enough,” Gerson said. “So, my call to action is, what can we do together so that we can push from a regulatory standpoint the adoption of this type of technology. We’re working closely with the regulators right now.”

Amanda Lefton, an RWE vice president, noted her company holds leases in three regions — the Atlantic, Pacific and Gulf of Mexico — that are very different and therefore have very different technical needs that must be addressed. The Gulf, for example, has lower average wind speeds than either ocean, except during hurricanes.

So, turbines in the Gulf must be able to handle both wind speed extremes.

“We’re going to need to partner with OEMs and others to develop that technology,” Lefton said. “And of course in California, we know that we need to evolve offshore wind for floating technology. And importantly from RWE’s perspective, we see floating technology not as a revolution but as an evolution.

“RWE is no stranger to coming into [a] market and helping develop it from the ground floor.”

Lefton, a former director of the Bureau of Ocean Energy Management, closed on an optimistic note, challenging use of the term “reset” as it so often is applied to the U.S. offshore wind sector.

In the 39 months since President Joe Biden took office, 10 GW of capacity has been permitted in U.S. waters, the Inflation Reduction Act was enacted, promising billions of tax dollars to help build it, South Fork Wind has been completed, construction of Vineyard Wind is well underway, and construction of two more wind farms off the Rhode Island and Virgina coasts is scheduled to begin shortly.

“We’re taking a massive step forward and some steps backwards, but we’re still progressing in the right direction, made really tremendous progress along the way,” Lefton said.

Additional IPF24 Coverage

Read NetZero Insider’s full coverage of the 2024 International Partnering Forum here:

Central Atlantic Region Prepares for OSW Development

How Best to Address OSW’s Effects on Fisheries

Interior Announces Updated OSW Regs, Auction Schedule at IPF24

Louisiana Manufacturers Expand into Offshore Wind

Moving Offshore Wind Beyond Contract Cancellations