NEW ORLEANS — New York’s latest misadventure with offshore wind was impeccably timed, going public three days before a major industry summit.

Its latest attempt to bounce back was equally well timed, announced one day before the head of the agency leading the state’s offshore wind development gave a keynote speech at the summit.

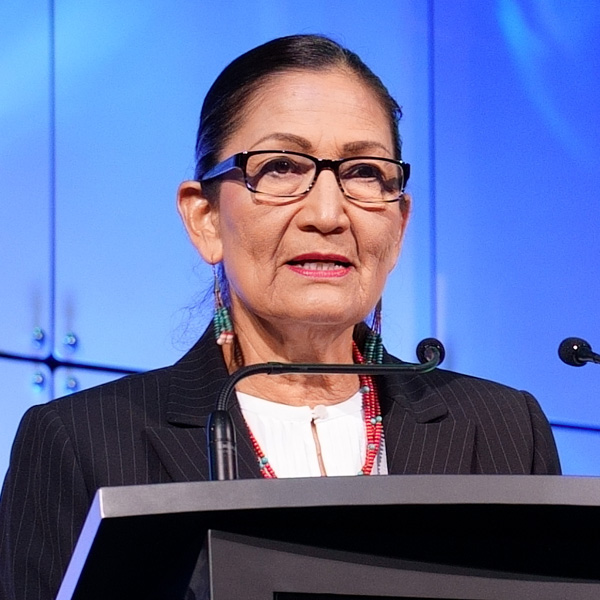

New York State Energy Research and Development Authority President Doreen Harris said at the 2024 International Partnering Forum that the state is pushing forward and so should the industry.

“I believe we need to take a pragmatic approach to how we face these challenges together, and how we find solutions together that will set us up for long-term success. Now is not the time to be complacent or wait it out, or hope these challenges will go away, or hope that someone else will find an answer.”

Every Atlantic state pursuing offshore wind development from Maryland to Massachusetts has suffered contract or project cancellations. New York, with some of the loftiest goals, arguably has had the worst of it.

Contracts totaling more than 4 GW awarded in the state’s first and second solicitations were doomed in October 2023 when the state rejected a request for higher compensation to developers facing soaring costs. (See NY Rejects Inflation Adjustment for Renewable Projects.)

Provisional contracts totaling just over 4 GW awarded in the third solicitation were canceled because General Electric opted not to bring to market the large turbines planned for those wind farms. (See NY Offshore Wind Plans Implode Again.) That was announced April 19, three days before Oceantic Network convened IPF24.

The steps in response were numerous and prompt.

In November 2023, NYSERDA announced an expedited fourth solicitation to backfill the crater left by the October decision, and that solicitation has since yielded two provisional contracts.

On April 23, NYSERDA issued a call for stakeholders to provide input on its fifth solicitation, which it plans to issue this year. Within that solicitation will be a request for proposals on how to reallocate $300 million in state funding for development of major supply chain components.

Also on April 23, NYSERDA requested proposals for allocating $200 million in funds available for supportive manufacturing and logistics.

“So many of you should see yourselves in the solicitation because it’s focused on the suppliers and how to build them domestically,” Harris told the audience at IPF24’s plenary session April 24.

Meanwhile, the state is looking several years ahead, working on version 2.0 of its Offshore Wind Master Plan, and is looking farther out to sea, in deep water where floating wind turbine technology would be needed.

New York’s offshore wind target still officially is 9 GW by 2035, but that increasingly seems like a placeholder while new lease areas are designated, the supply chain develops, onshore infrastructure is built and better deepwater technology is developed.

“My friends, this is just the beginning,” Harris said.

Multiple Iterations

Each of New York’s offshore wind solicitations has been different from its predecessor. The Request For Information issued April 23 will help determine how different the fifth solicitation is, and in what ways.

The RFI suggests some significant changes. NYSERDA may:

-

- switch to a two-step bid process, with developers submitting initial proposals stripped of any dollar figures and follow-up proposals with price tags after NYSERDA provides feedback on the initial proposals;

- impose an information blackout, with no public disclosure of details of proposals or price tags all through the process until after the contract is finalized;

- require an award security of $10,000 per megawatt upon contract award;

- allow contract delivery term extensions for delays for reasons beyond the developer’s control, such as unavailability of key components or installation vessels;

- double the contract security sums;

- retain a portion of the contract security if the developer misses project milestones, rather than terminating the contract;

- define interconnection cost-sharing thresholds and cost-share allocation consistently across all proposals;

- make all offer pricing subject to inflation adjustment to protect ratepayers and limit attrition; and

- modify the formula for calculating the inflation adjustment to make it more accurately reflect offshore wind’s levelized cost of electricity.

Harris told NetZero Insider that NYSERDA wants input from the industry on the potential framework for the fifth solicitation outlined in that RFI.

“One of our goals in taking in that feedback is how to accelerate our timeline, our procurement timeline,” she said. “And one of the proposals that we have is to run our generation solicitation separate from the $300 million supply chain solicitation. It will have the benefit of accelerating the timeline of the generation procurement, but it will also — at least as we are theorizing it in this RFI — allow more flexibility for the developers to identify and advance supply chain investments.”

New York has a continuing interest in working with other states to expand that supply chain, she said. The hope is that a region can accomplish more than one state.

“The parochialism of the states has diminished somewhat, and very much we’re seeing this integrated supply chain emerge in ways that could be quite useful,” Harris said. “So, for example, if we have a $300 million supply chain focused on primary components, it very much could be the case that an OEM uses those funds to invest in New York for components that will serve another market. And that’s a good thing.”

Harris said there is a dual role for NYSERDA in focusing on the long goal — preserving a livable state and planet — while dealing with the day-to-day bumps in the road to that goal.

“Focusing on the projects that are under construction, focusing on the jobs that are being obtained, focusing on the benefits that we see coming to our communities, those are tangible and real,” Harris said. “And to me if your eye’s on the horizon, it allows you to pay less attention to the twists and turns that are naturally part of a transition. But you know, we’ve got to respond.”

One thing she is less worried about is an increasingly frequent topic of conversation in the industry: the potential victory in the November presidential election of self-professed wind energy hater former President Donald Trump.

Offshore wind spending is infrastructure spending that enjoys bipartisan support, Harris said, and the money flows freely to red states.

“We actually launched our offshore wind goals during the Trump administration. And it has been extraordinary, actually, how much the industry has grown and changed since that time.”

But no offshore wind projects were permitted during the Trump administration, Harris is reminded.

“Permitting is a different matter,” she acknowledged. “Certainly, we need projects to advance through permitting to enter operations. Yes, we pay close attention to the federal context in that matter, because there’s a necessary intersection.”

Additional IPF24 Coverage

Read NetZero Insider’s full coverage of the 2024 International Partnering Forum here:

Central Atlantic Region Prepares for OSW Development

How Best to Address OSW’s Effects on Fisheries

Interior Announces Updated OSW Regs, Auction Schedule at IPF24

Louisiana Manufacturers Expand into Offshore Wind

Moving Offshore Wind Beyond Contract Cancellations