Financial Transmission Rights (FTR)

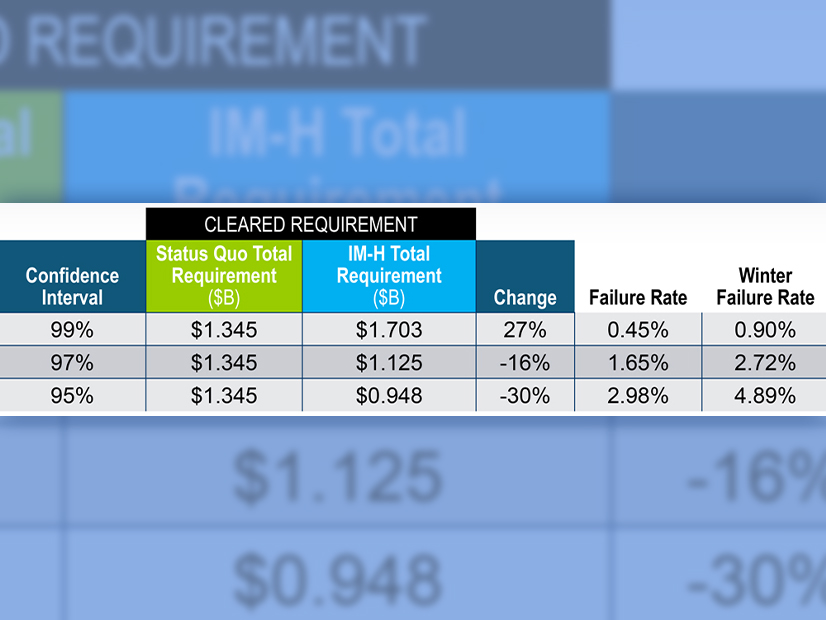

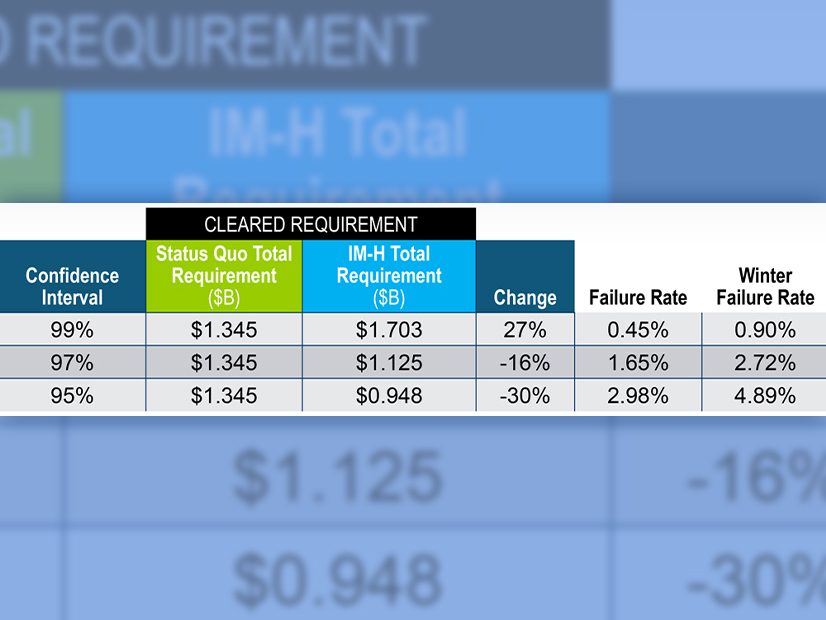

FERC wants more information to determine whether it should require a 99% confidence level in setting collateral for FTR traders or the 97% level PJM sought.

FERC proposed allowing RTOs to share credit information about market participants, fulfilling a request the grid operators made at a 2021 technical conference.

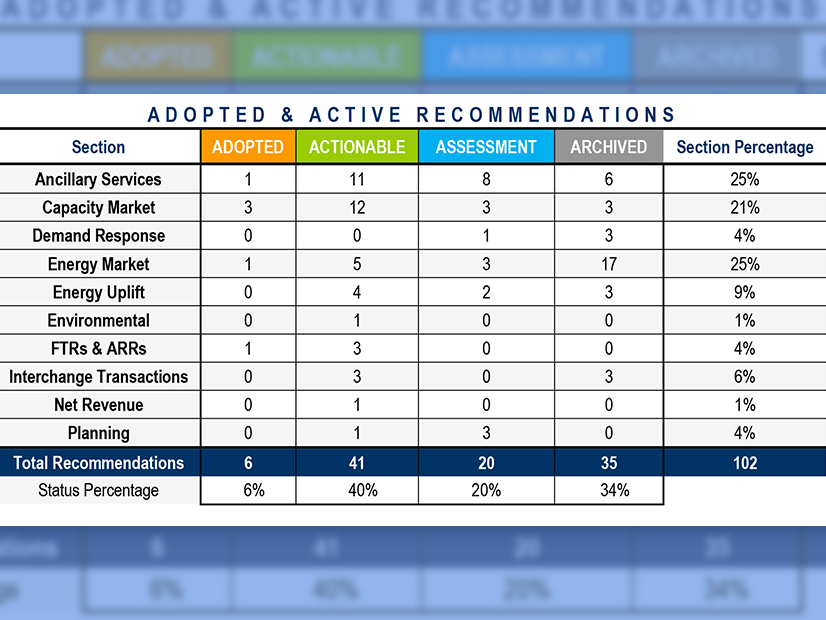

PJM responded to its Market Monitor’s latest recommendations, noting that many of the issues are in the scope of current stakeholder discussions.

Stakeholders and staff are continuing to drive to consensus over ERCOT's methodology for approving and denying planned generation maintenance outages.

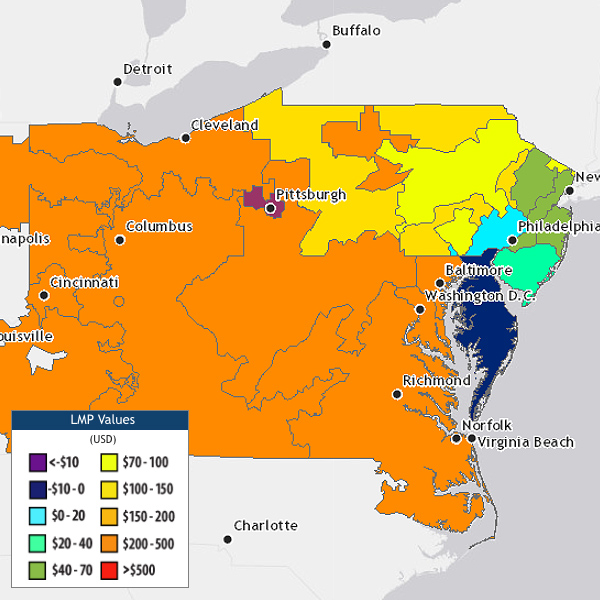

Energy prices in PJM increased by 75.5% in the first quarter of 2022 from a year ago, the Market Monitor reported, driven primarily by higher fuel costs.

FERC denied PJM’s rehearing request of its rejected FTR credit requirement calculation, but it said it would address the RTO’s arguments in a future order.

SPP’s Board of Directors approved the RTO’s fourth competitive transmission project, awarding a $55 million, 345-kV facility to NextEra Energy Transmission.

SPP stakeholders have rejected a recommendation to stick with the status quo when it comes to adding counterflow optimization to the congestion-hedging process.

PJM asked FERC to rehear a decision that rejected the RTO’s plan to modify its financial transmission rights credit requirement calculation.

FERC accepted PJM’s revisions intended to increase transparency into and the efficiency of the RTO’s ARR and financial FTR markets.

Want more? Advanced Search