Financial Transmission Rights (FTR)

PJM members approved Operating Agreement revisions that would eliminate the requirement that the RTO liquidate a member’s FTRs when it falls into default.

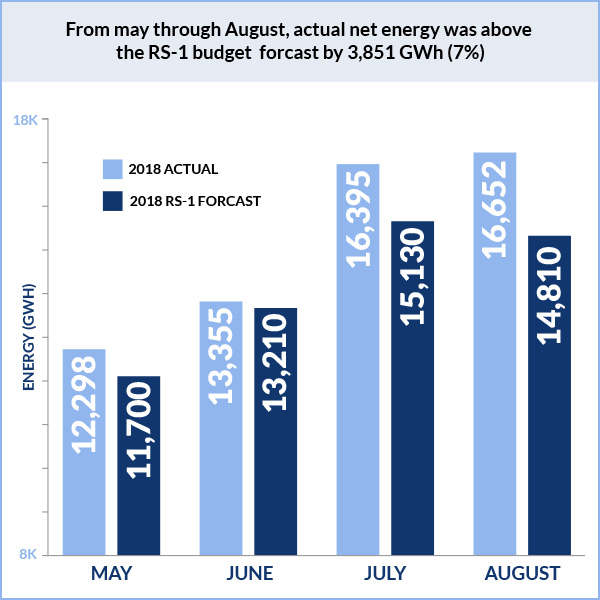

NYISO experienced six days with peak loads of more than 31,000 MW this summer, compared with last summer’s actual peak of 29,677 MW.

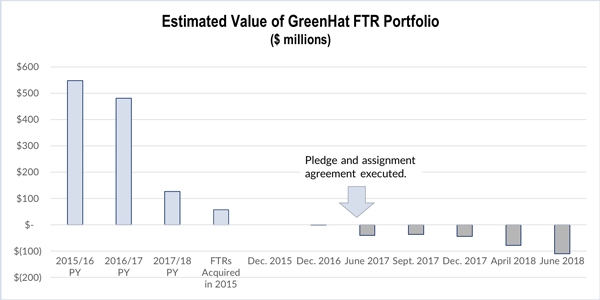

PJM’s lax credit policy allowed Greenhat Energy, whose traders had a history of market manipulation, to run up as much as $140 million in FTR losses.

After earlier forecasts of a small year-end overage, MISO is now on track to be $1.2 million under its $265 million expected budget in December.

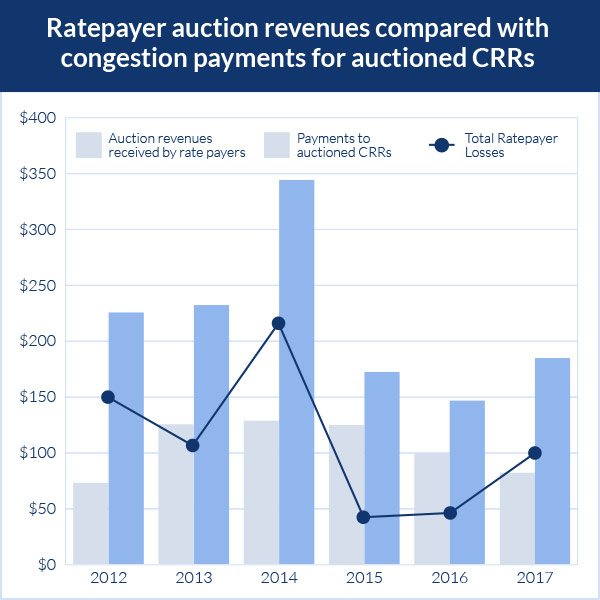

FERC approved CAISO’s plan to reduce the capacity available in its congestion revenue rights auctions but rejected a proposal to cut CRR payments.

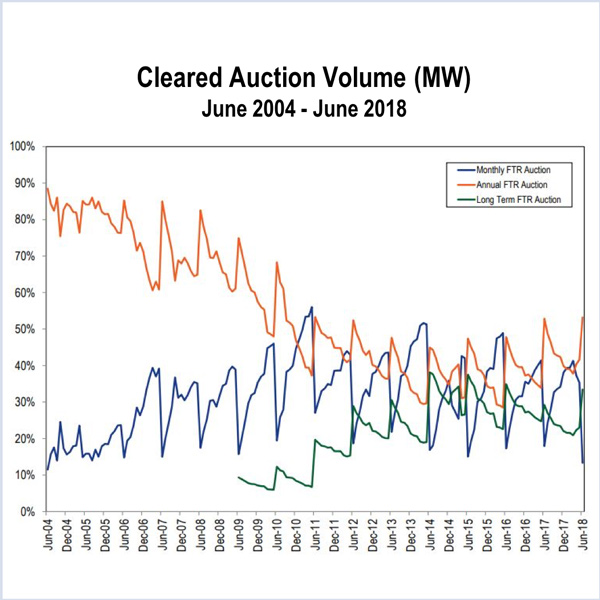

FERC accepted revisions to long-term PJM FTR auctions to correct current processes that might overstate available system capacity and harm ARR holders.

PJM and MISO said they plan to partner on an extra study to better coordinate their incremental auction revenue rights (IARRs) processes.

PJM asked members to decide whether to liquidate GreenHat Energy's FTR portfolio now or let the positions run their natural course over the coming months.

PJM staff are still working on how to respond to GreenHat Energy’s default in the financial transmission rights market.

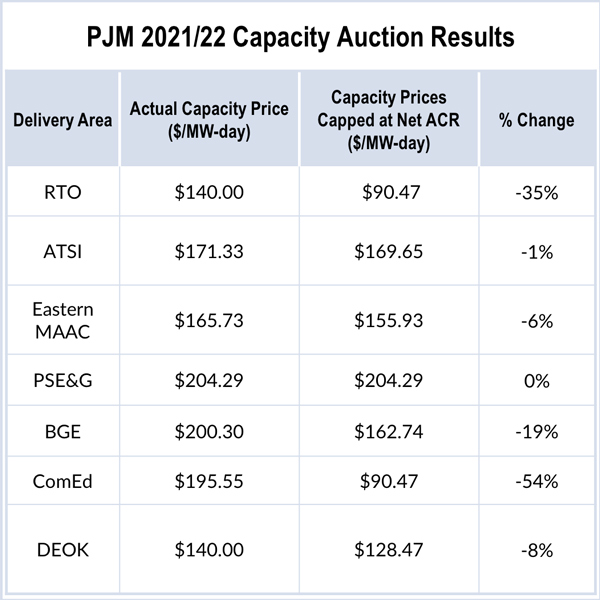

In his quarterly state of the market report, the PJM IMM said the results of the 2018 Base Residual Auction show the need to change its capacity offer cap.

Want more? Advanced Search