Financial Transmission Rights (FTR)

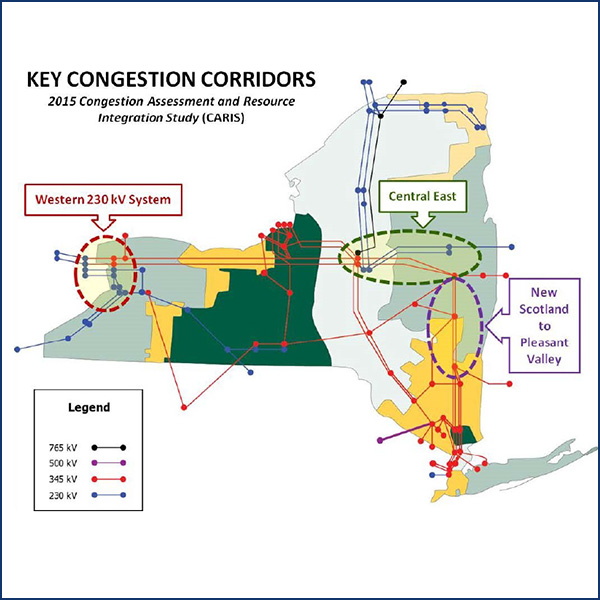

NYISO last month incorporated additional 115-kV transmission facilities in its energy market model, COO Rick Gonzales told the Management Committee.

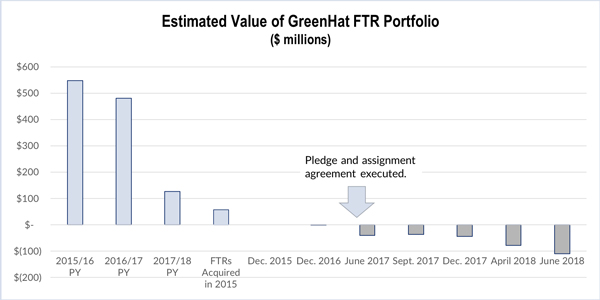

The cost of GreenHat Energy’s default could rise by $250-$300 million if PJM is forced to unwind settlements of the financial transmission rights portfolio.

PJM must unwind five months of settlements for GreenHat Energy financial transmission rights that should have been liquidated sooner, FERC ruled.

The MRC endorsed a change to align PJM’s Tariff with manual language on the process for requesting incremental capacity transfer rights calculations.

NYISO locational-based marginal prices averaged $40.31/MWh in Dec., down by about 7% from Nov. and slightly more than 30% from the same month a year ago.

Shell Energy came to the Market Implementation Committee to make its case against PJM recovering charges from FTRs it purchased from failed GreenHat Energy.

The PJM Board of Managers asked stakeholders for patience with the board’s ongoing investigation into the default of GreenHat Energy’s FTR portfolio.

The PJM Market Implementation Committee will discuss indemnification for financial transmission rights bilateral contracts at its Jan. 9 meeting.

CAISO’s efforts to rein in congestion revenue rights insufficiencies seemed to show progress, but fell short in the last months of 2018.

Stakeholders endorsed revisions that would align PJM’s price-responsive demand rules with the Capacity Performance construct.

Want more? Advanced Search