Financial Transmission Rights (FTR)

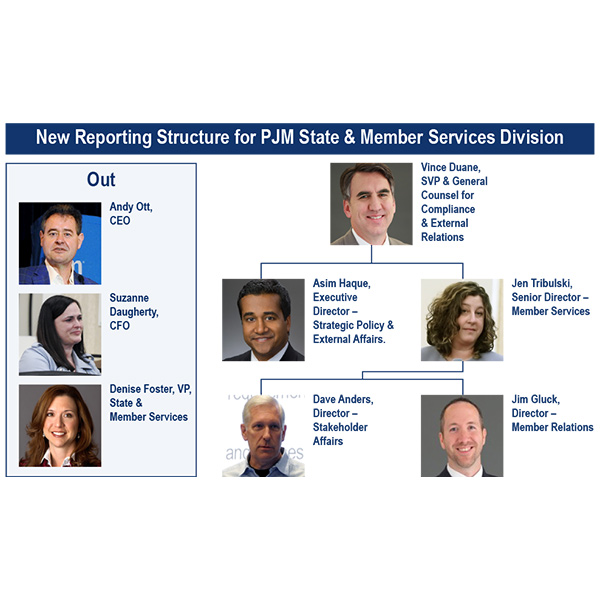

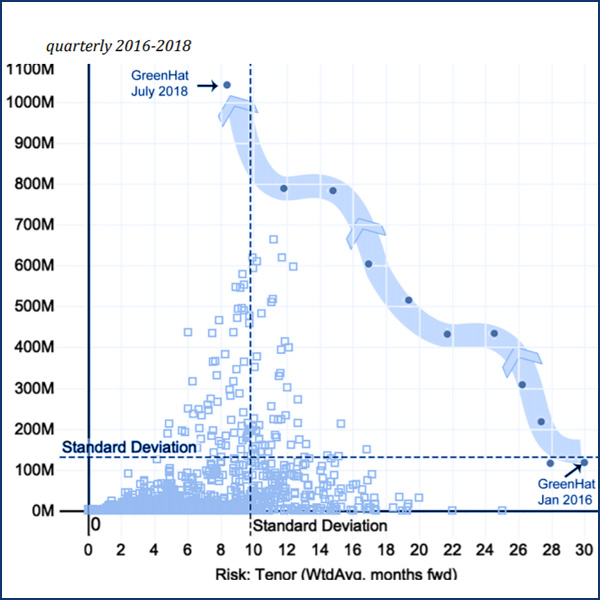

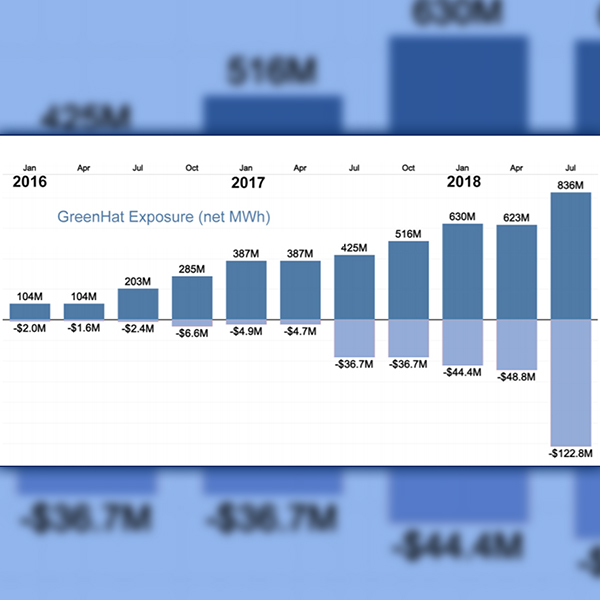

Interim PJM CEO Susan J. Riley announced a shakeup of the RTO’s State and Member Services Division, the latest change in the wake of the GreenHat default.

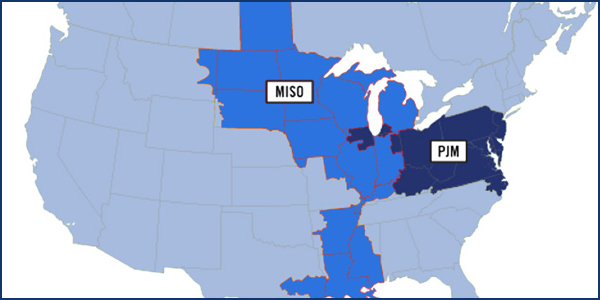

MISO is proposing to increase collateral requirements in its FTR markets and give itself discretion to ban a participant from joining or re-entering.

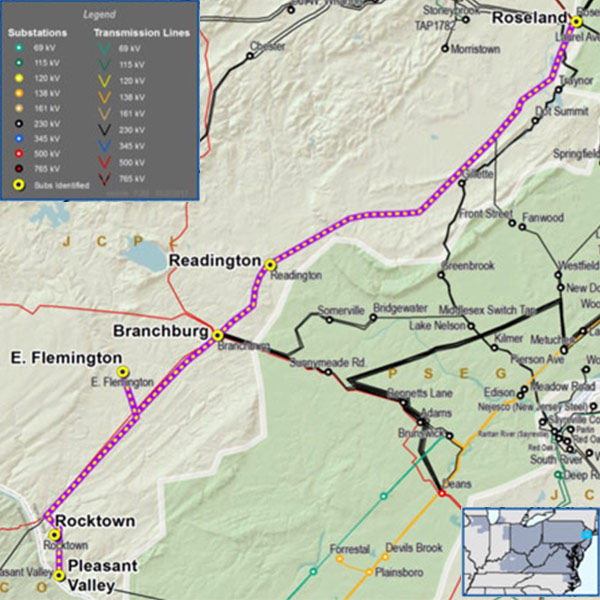

FERC rejected an ALJ’s finding that PJM’s transmission study process is unjust and unreasonable for developers seeking to secure IARRs.

MISO and PJM said they will propose changes to how they determine flowgate rights in a white paper in November.

The PJM Markets and Reliability Committee discussed the work of the Financial Risk Mitigation Senior Task Force and approved several manual changes.

Shell Energy and Old Dominion Electric Cooperative failed to make their case that they belong at the GreenHat Energy settlement table, FERC ruled.

Interim PJM CEO Susan J. Riley urged the Markets and Reliability Committee to move forward on “badly needed” credit policy reforms.

PJM announced the selection of its first chief risk officer — the official who will oversee the RTO’s credit policies in the wake of the GreenHat default.

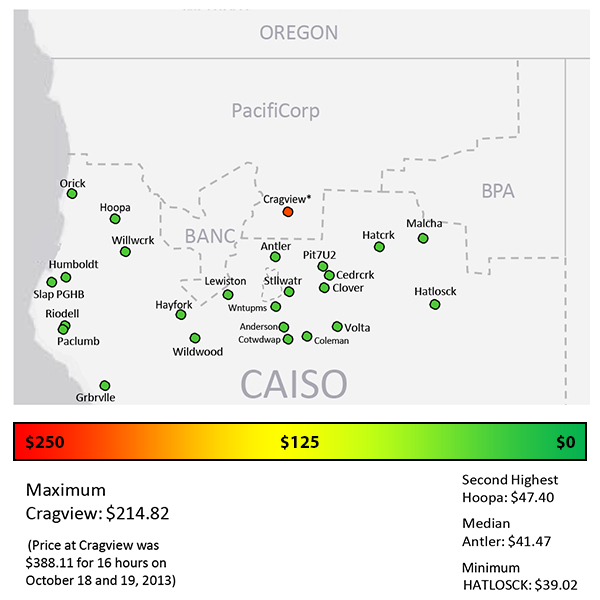

FERC ordered Vitol and a senior trader to show cause why they should not be fined for manipulating CAISO’s market to limit losses on the company’s CRRs,

Shell wants a seat at the GreenHat settlement table, saying it could bear a disproportionate financial burden based on its outcome.

Want more? Advanced Search