Financial Transmission Rights (FTR)

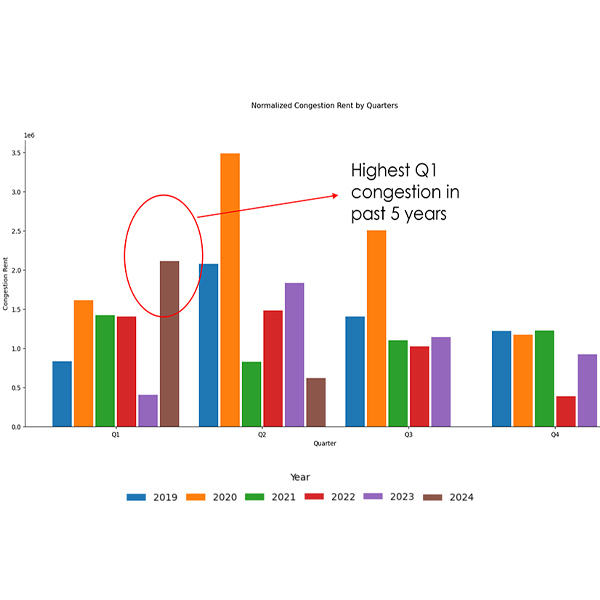

The dispute over how CAISO’s Extended Day-Ahead Market will allocate congestion revenues to market participants continues, even as the ISO moves to address stakeholder concerns.

FERC accepted SPP’s proposed tariff revisions to incorporate a mark-to-auction collateral requirement for its transmission congestion rights market but did not terminate a show-cause proceeding.

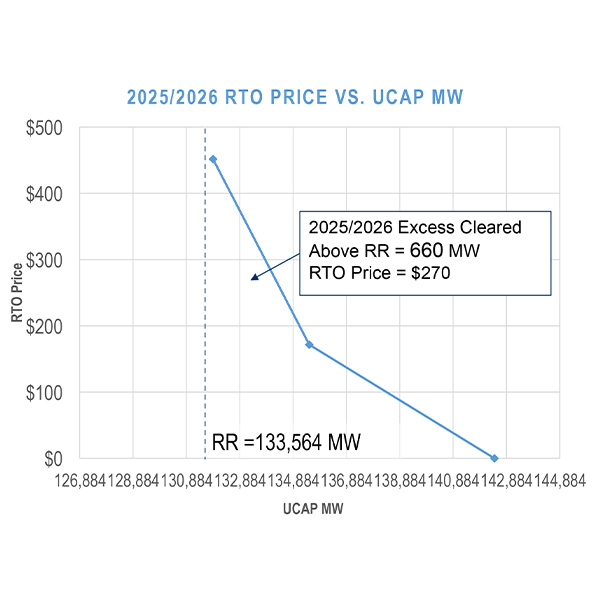

PJM’s markets provided reliable service in 2024, but tightening supply and demand are laying bare design flaws that have inhibited the competitiveness of the RTO’s markets, the Independent Market Monitor wrote in its 2024 State of the Market Report.

FERC is expected to rule on SPP’s proposed tariff revisions adding a winter season resource adequacy requirement and several other issues related to the grid operator.

Consumers and electric distributors in PJM opposed a proposal to revise two financial parameters used to calculate the cost of new entry input to the 2027/28 Base Residual Auction.

PJM has decided not to refile several components of its proposed capacity market redesign that was rejected by FERC in February.

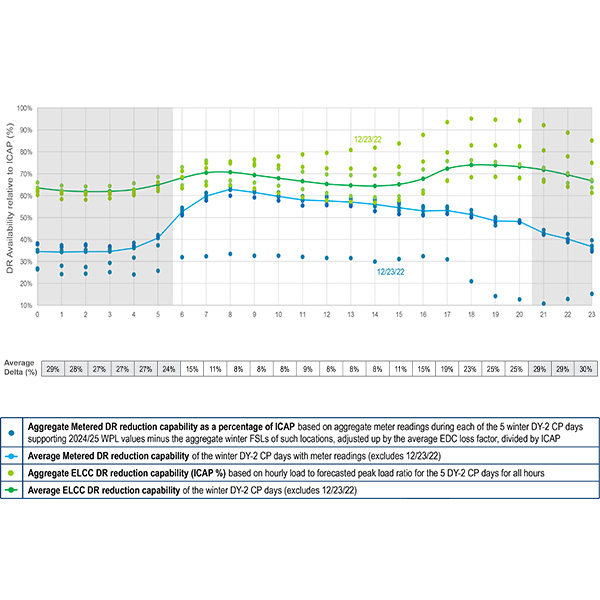

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

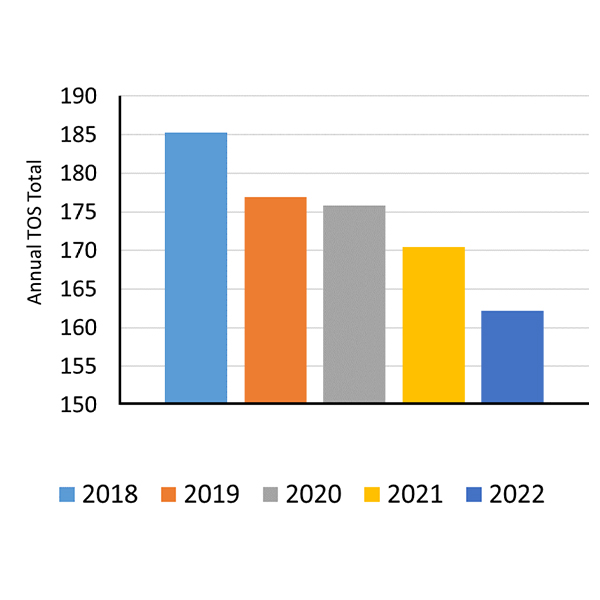

Average load-weighted electricity prices in PJM fell by around half in 2023, the Independent Market Monitor said in its annual State of the Market Report.

Columnist Steve Huntoon says a recent Moody’s report uses misleading data to make its case for investing in transmission to solve reliability problems.

Want more? Advanced Search