Transmission

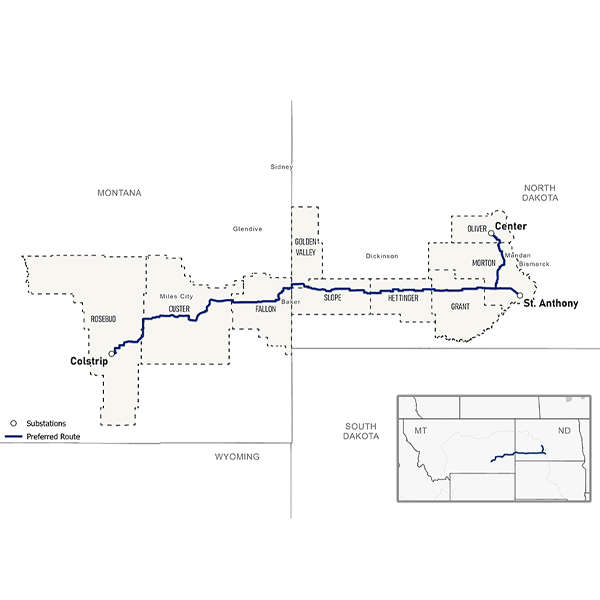

Puget Sound Energy became the latest utility to stake a claim in the North Plains Connector, a 420-mile transmission line from central North Dakota to southeast Montana.

SPP’s Board of Directors has approved the winter-weather staging of a pair of transmission projects that have been held up since October by stakeholder concerns.

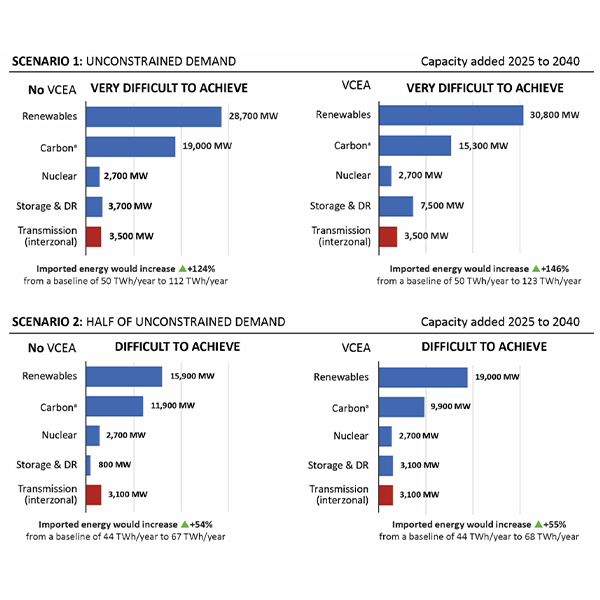

A report from the Virginia legislature released shows how quickly data centers are growing in the state and addresses how to meet that demand, with some suggestions for policymakers.

The PJM Planning Committee endorsed revisions to Manual 14H to clarify the changes developers can make to the site control requirements for their projects at different phases of the interconnection process.

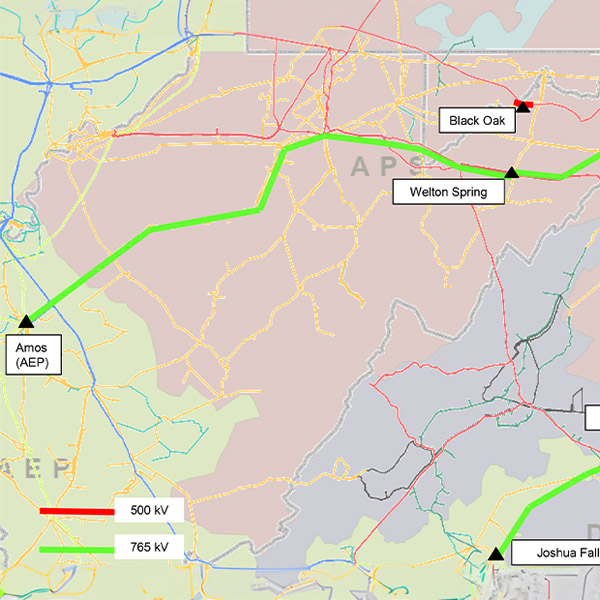

FERC's Office of Enforcement and PSE&G reached an agreement imposing a $6.6 million penalty on the utility over allegations it provided PJM with inaccurate information about the condition of a transmission line in New Jersey.

FERC rejected proposals from PJM and its transmission owners that would have changed regional planning, by moving those rules to the tariff from the operating agreement, while also giving transmission owners more authority over the process.

Stakeholders urged the Bonneville Power Administration to provide more transparency regarding the agency’s multibillion-dollar initiative to build and upgrade transmission to address evolving challenges for the region's grid.

ERCOT’s Board of Directors signed off on staff’s recommendation to move forward with executing an RMR contract for CPS Energy’s Braunig Unit 3, deferring a decision on the gas plant’s other two smaller units.

Former FERC commissioners discussed Order 1920-A and its accommodations to states, which could complicate compliance processes but also lead to more support for expanding the grid.

Clean energy organizations are prodding MISO to contemplate prospective load and generation simultaneously, with Clean Grid Alliance asking MISO to coordinate its annual transmission studies with its interconnection queue studies.

Want more? Advanced Search