Demand Response

PJM Members voted Thursday to approve a problem statement to consider modifying the design of the RPM to reduce speculation on the capacity auction.

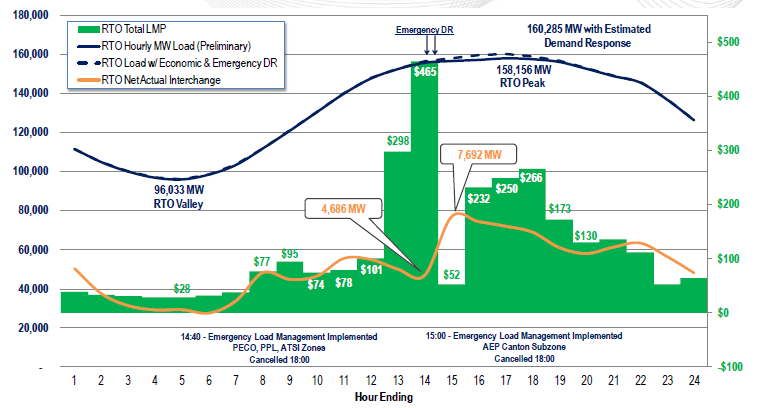

Unexpected imports from New York — not the mobilization of demand response — caused the heat wave price crash July 18 after spiking to $465/MWh amid the hottest day of the summer.

PJM wants to eliminate incentives for generators and demand response providers that fail to perform when called on for spinning (synchronized) reserve.

Today's PJM Liaison Committee meeting with the Board of Managers is at 4pm EDT in Chicago. It's open only to members and regulators. No public. No press.

Last week, PJM's MRC approved one problem statement and deferred a vote on a second that would impact DR. Meanwhile, the MC approved a tariff change increasing DR providers’ documentation requirements.

Below is a summary of the issues scheduled to be brought to a vote at the Markets and Reliability Committee and Members Committee meetings Thursday, 6/27.

With its reliance on demand response and heavy concentration in PJM, EnerNOC has seen its fortunes wax and wane based on decisions made by PJM and FERC.

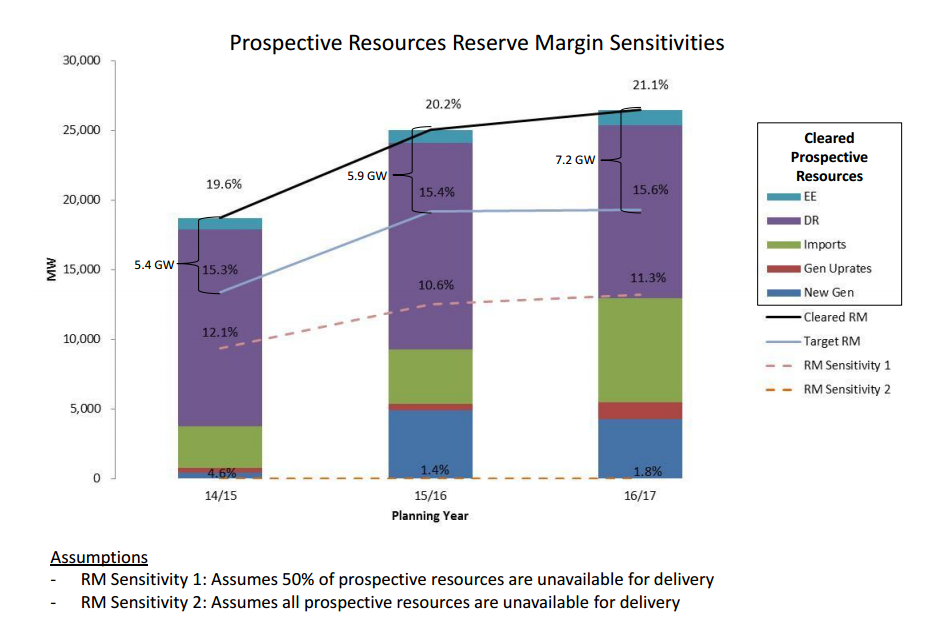

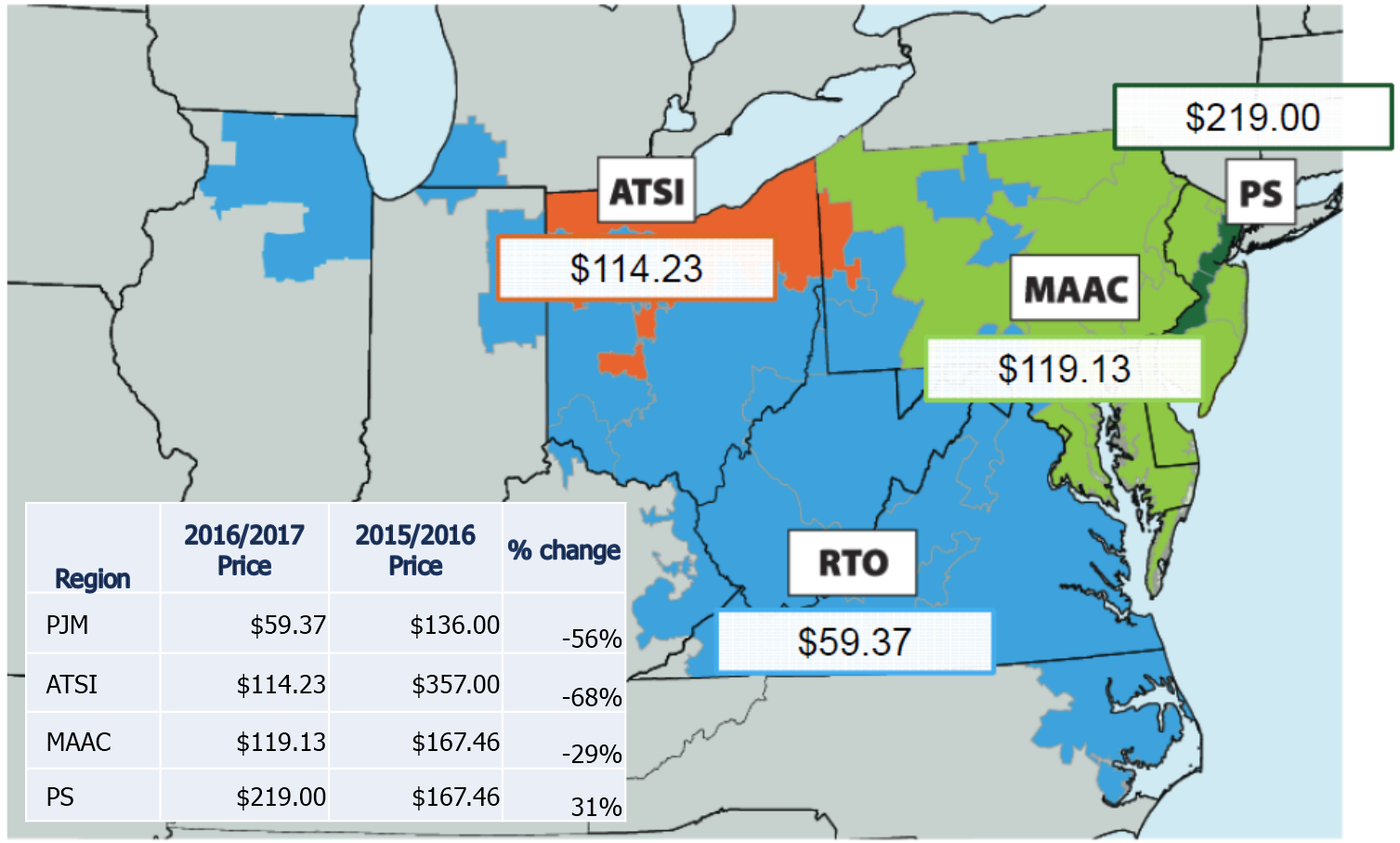

PJM Insider: Capacity Auction Results and Analysis: New Generation, Imports Up; Prices, DR down

Public interest groups scolded PJM for excluding them from the MOPR stakeholder process and for setting its annual meeting at the Greenbrier. The public interest groups and state regulators also praised PJM for its handling of generation retirements and lobbied it to increase use of demand response and energy efficiency.

The Operating Committee voted last week to consider certification requirements for resources providing Tier 2 synchronized reserves and increased penalties f...

Want more? Advanced Search