Virtual Transactions

FERC ordered City Power Marketing to pay $15 million in penalties and repay almost $1.3 million in profits for making riskless up-to-congestion trades in PJM to cash in on line-loss rebates.

PJM's Market Monitor told FERC that proposals by the RTO and a marketer to change the FTR forfeiture rule would weaken protections against market manipulation.

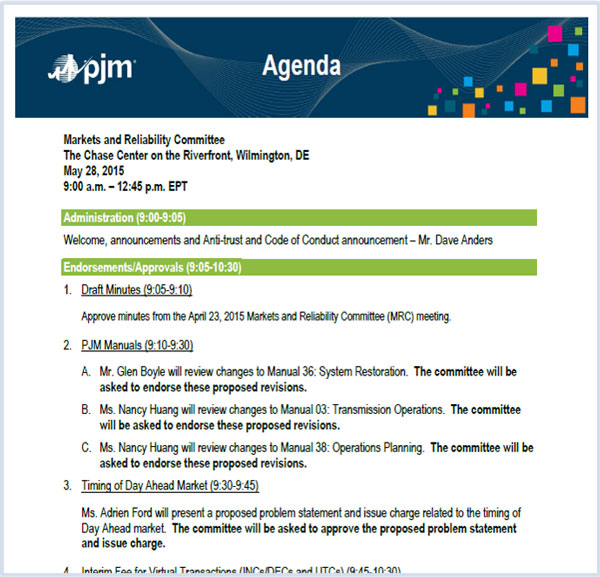

A summary of the issues discussed and measures approved by the PJM Markets and Reliability Committee on May 28, 2015.

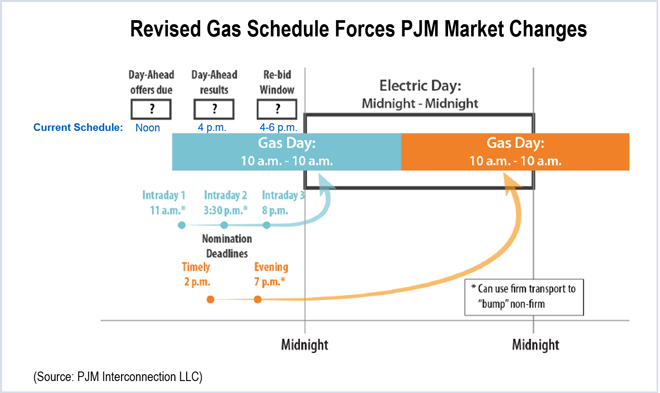

PJM and the Monitor are considering the changes to reduce uplift and gaming opportunities and allow quicker solving of the day-ahead energy market.

Our summary of the issues scheduled for votes at the PJM MRC on 05/28/15. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage.

PJM Market Monitor Joe Bowring had a lively debate with one of the consultants for Powhatan Energy over the “duty” of market participants to self-police against market manipulation.

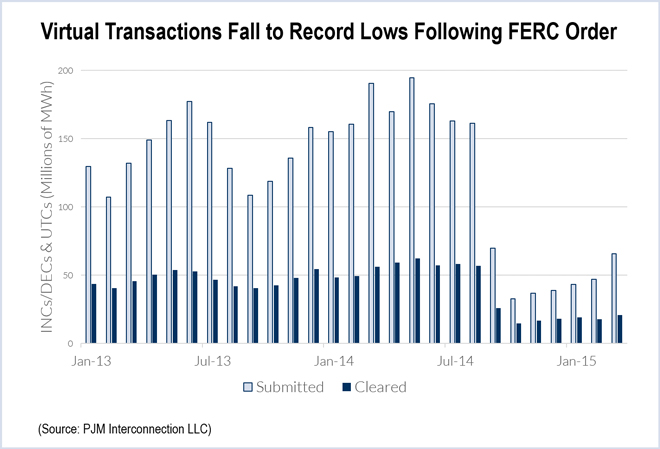

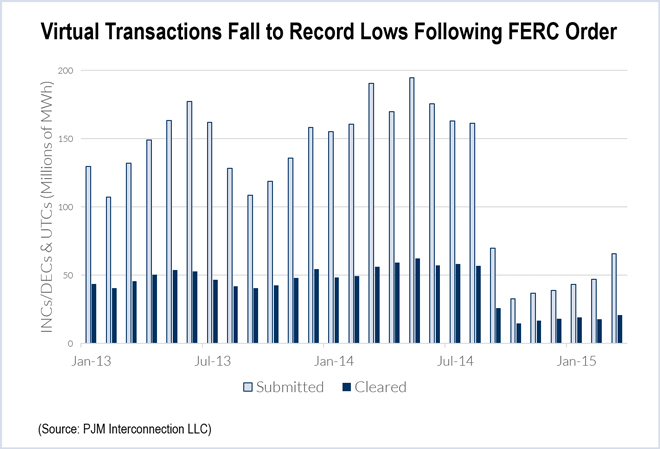

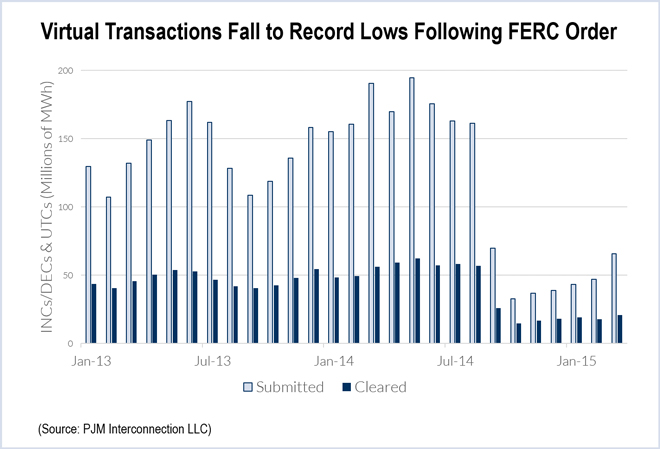

If FERC keeps its word, virtual traders in PJM should have clarity by the end of October on whether up-to-congestion transactions will be subject to additional charges.

A proposal to impose a temporary $0.07/MWh uplift charge on all netted virtual transactions received a cool response from PJM members Thursday — including a rebuff from the attorney for the Financial Marketers Coalition.

Attorneys for Powhatan Energy Fund and Kevin Gates accused FERC's Office of Enforcement of withholding information that could exonerate their clients in a high-profile market manipulation case.

The RTO stakeholder process came under fire last week at a FERC technical conference on the treatment of financial transactions in PJM.

Want more? Advanced Search