Virtual Transactions

A brief primer on virtual trading: INCs, DECs and UTCs.

FERC ordered PJM and financial traders to submit briefs in a long-running dispute over excess line-loss revenues.

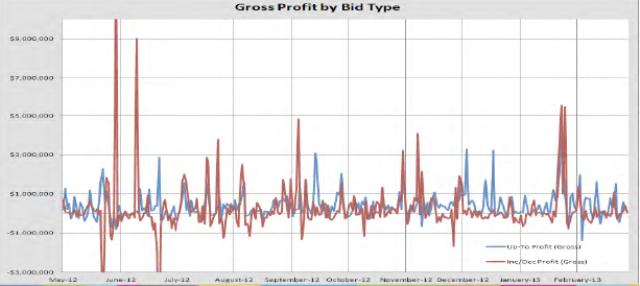

Financial marketers are pleased with PJM’s proposal to change the way uplift charges are assessed on virtual trades but aren’t convinced by a PJM analysis that the RTO says justifies extending the charges to up-to congestion trades (UTCs).

PJM wants to change the way virtual trades pay for uplift, replacing the current unpredictable charges with a flat per megawatt fee and assessing them for the first time on up-to congestion trades (UTCs).

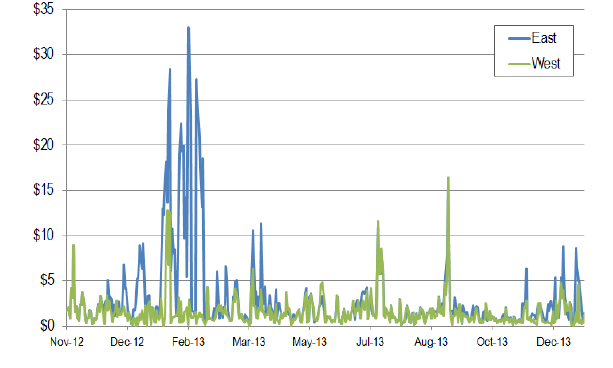

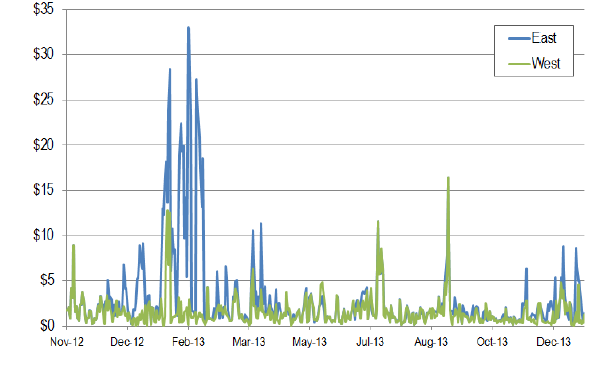

Members agreed last week to move forward with an initiative that could result in reduced restrictions on Up-to Congestion transactions.

PJM will consider relaxing rules for up-to congestion transactions under a problem statement approved last week.

PJM's market monitor released data showing that up-to congestion (UTC) transactions are increasing shortfalls in Financial Transmission Rights (ftr) funding.

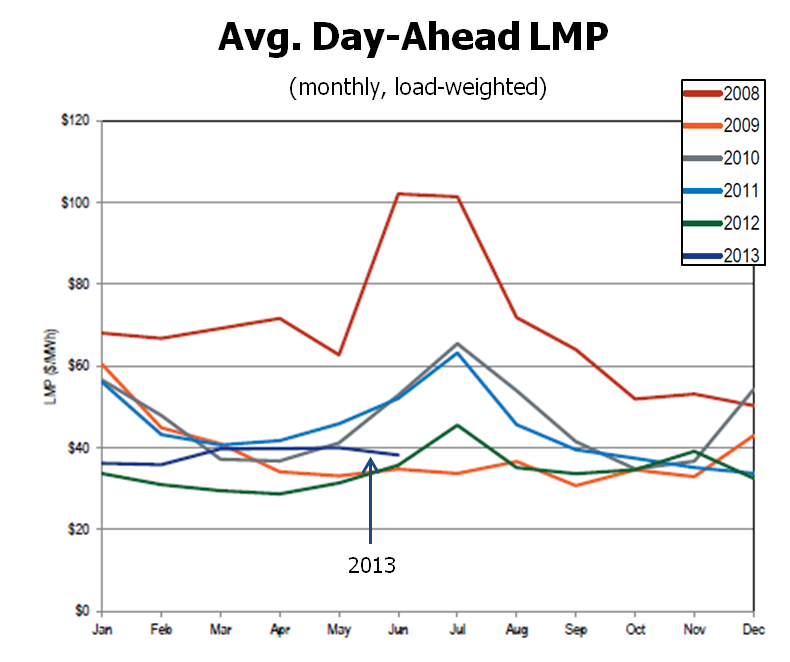

The PJM Market Monitor's mid-year report detailed rebounding energy prices and coal generation in the first half of 2013 as natural gas costs increased from record lows.

In a split decision for financial traders, an appellate court Monday sent a dispute regarding PJM’s line-loss collections back to FERC.

Below is a summary of problem statements and manual, Operating Agreement and Tariff changes approved by the PJM Markets and Reliability Committee (MRC).

Want more? Advanced Search