Reserves

PJM’s markets provided reliable service in 2024, but tightening supply and demand are laying bare design flaws that have inhibited the competitiveness of the RTO’s markets, the Independent Market Monitor wrote in its 2024 State of the Market Report.

MISO emerged from winter 2024/25 without turning to emergency procedures despite wide-ranging winter storms Jan. 6-9 and again Jan. 20-22.

PJM gave more detail on its plan to scale back a 30% adder it added on the synchronized and primary reserve requirement in May 2023.

PJM stakeholders voted for a third consecutive meeting to delay acting on revisions to Manual 14H intended to clarify when developers may add or remove parcels from their project footprint.

PJM’s Market Implementation Committee narrowly endorsed a PJM proposal to use ELCC to model the availability of demand response resources in all hours, along with other changes to how DR accreditation is determined.

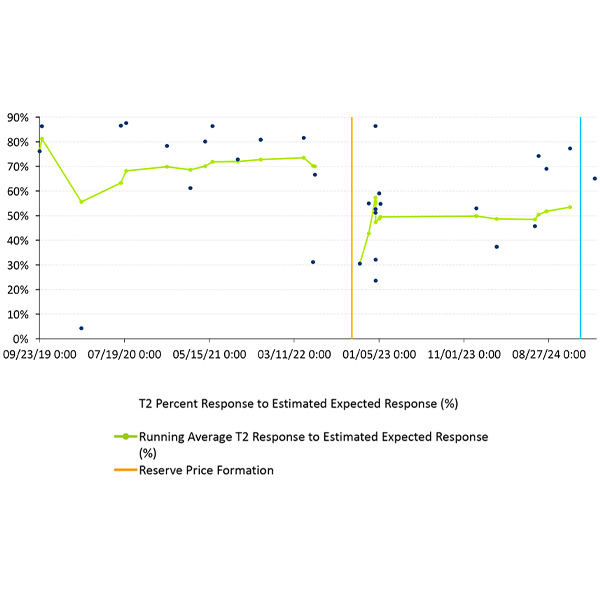

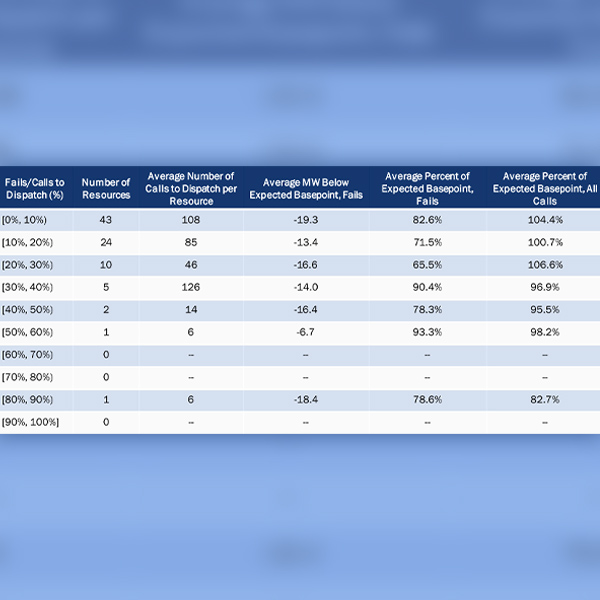

NYISO laid out for the Installed Capacity Working Group its proposal to remove operating reserve suppliers that consistently underperform from the market until they pass a requalification test.

PJM and its Monitor presented a joint proposal to rework the balancing operating reserve credit structure to address a scenario they say results in generators receiving uplift payments despite not following dispatch orders.

MISO will waste no time in 2025 trying to blunt the threat of a shortage that could arrive in the summer months by encouraging new generation and enacting further resource adequacy measures.

Two initiatives that have bedeviled discussion at NYISO committees in the last few weeks of the year reared their heads again at the final Budget Priorities Working Group meeting of the year.

During its last meeting of the year, the NYISO Management Committee approved two proposals that would institute a new design for the reserve market and alter a calculation used in the regulation service market.

Want more? Advanced Search