Energy Market

The CAISO Board of Governors and Western Energy Markets Governing Body passed two proposals that address different issues within Western markets.

MISO, PJM and SPP have failed for years to find a suitable replacement for a 20-year-old system reference they use to portion out flow rights on their system, the so-called freeze date.

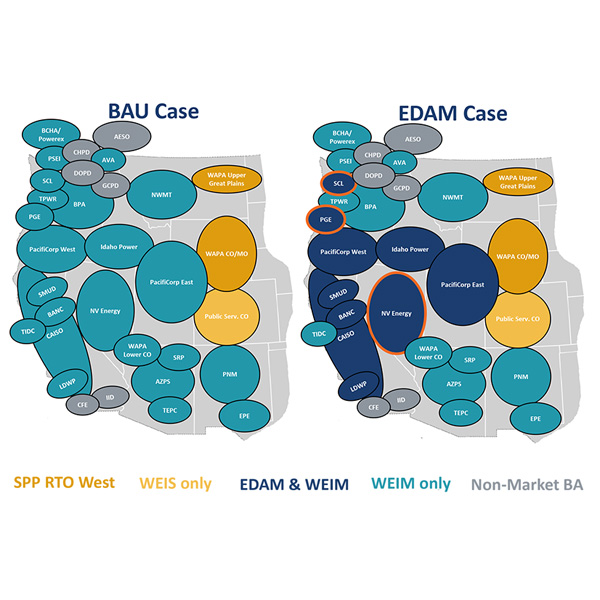

FERC granted CAISO a waiver allowing PGE to join the ISO’s Extended Day-Ahead Market a few months beyond the timeline set out in the market’s standard participation agreement.

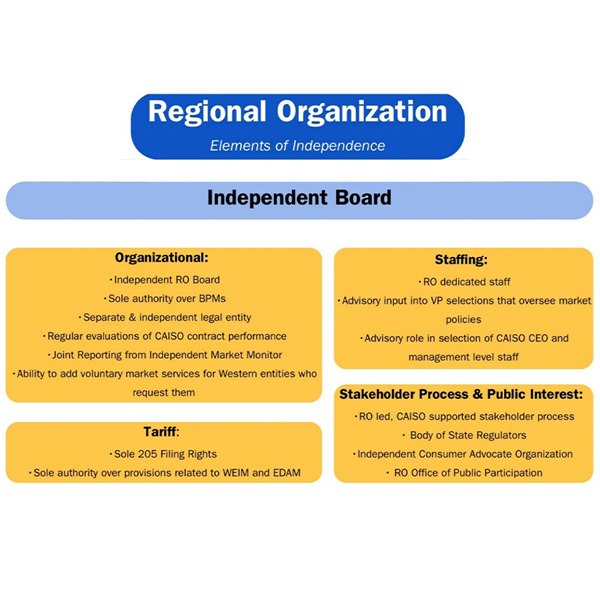

Pathways released its Step 2 draft proposal for dividing up functions between CAISO and the new “regional organization” that initiative backers are seeking to create to oversee the ISO’s Western real-time and day-ahead markets.

PacifiCorp is poised to realize up to $359 million a year in net benefits from participating in CAISO’s EDAM, nearly double a previous estimate, according to a newly updated study by The Brattle Group.

MISO and the Tennessee Valley Authority are poised to strike an agreement on emergency energy transactions after months of RTO leadership complaining that TVA doesn’t return the favor of energy transfers in times of need.

Stakeholders appear wary of MISO’s proposed, availability-based accreditation it plans to file with FERC by the end of the year for the RTO’s approximately 12 GW of load-modifying resources.

ERCOT stakeholders have endorsed changes to the grid operator's ancillary services methodology as part of the annual process to determine the minimum amount of products that will be procured in 2025.

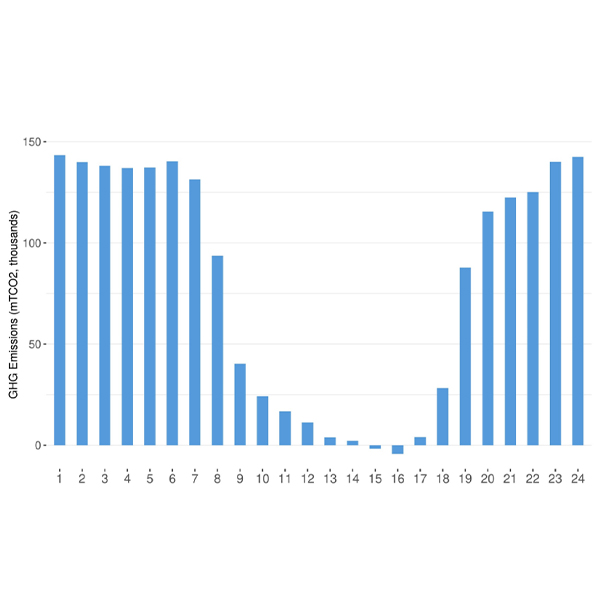

CAISO is recommending it implement a Western Power Trading Forum proposal that could help the EDAM track and account for GHG emissions in a way that considers the variety of carbon pricing programs across the West.

Three independent SPP board members providing oversight of the RTO’s Markets+ development in the West have called for policy- and decision-makers to allow the process to “follow its natural course.”

Want more? Advanced Search