Energy Market

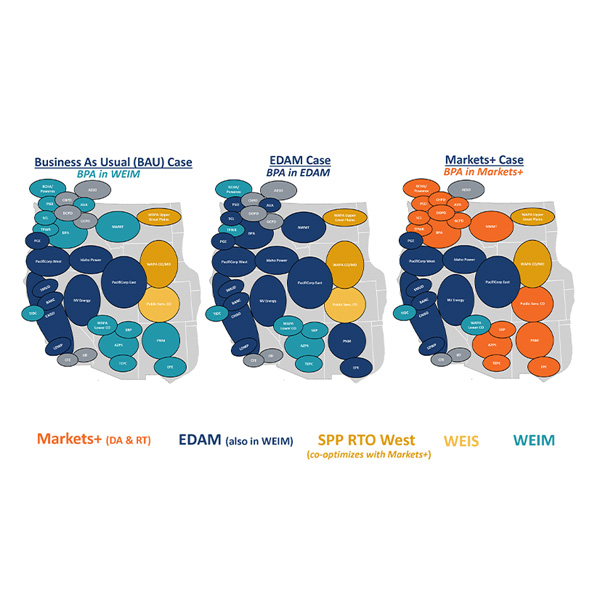

BPA would earn $65 million in annual benefits from joining CAISO’s EDAM but face $83 million in increased yearly costs from participating in SPP’s Markets+, according to a new Brattle study.

Washington's Department of Ecology kicked off its first virtual electricity forum to provide updates on recent electricity sector rulemaking efforts related to the state’s carbon market.

CAISO described to stakeholders how it will apply the Extended Day-Ahead Market transmission revenue recovery mechanism to its own balancing authority area.

State utility commissioners who launched the West-Wide Governance Pathways Initiative in July 2023 have praised the initiative’s “Step 2” proposal to create a “regional organization.”

The white paper by The Brattle Group offers a point-by-point comparison of CAISO’s Extended Day-Ahead Market and SPP’s Markets+ that leans in favor of EDAM but stops short of endorsing either market.

MISO reported relatively lower costs and outages in August while it served its annual peak late in the month.

The next phase of the Price Formation Enhancements Initiative will look to address issues around market power mitigation, scarcity pricing and fast-start pricing.

Thomas Gleeson, chair of Texas’ Public Utility Commission, spoke at the Texas Clean Energy summit about the challenges he has faced during his tenure.

CAISO focused on CRRs when it served up the latest volley in the ongoing dispute over what played out on the Western grid during the January cold snap that forced Northwest utilities to import high volumes of energy to avoid blackouts.

NYISO’s Market Monitoring Unit, Potomac Economics, presented recommendations for addressing what it calls inefficient market outcomes caused by setting locational capacity requirements based on the transmission security limit.

Want more? Advanced Search