Energy Market

Labor groups that blocked past California legislative efforts to “regionalize” CAISO told state lawmakers they “look forward” to working with the legislature next year to pass a bill to implement the governance changes being developed by Pathways.

A new CAISO proposal seeks to address unwarranted BCR payments to storage resources, an issue that has stirred controversy over the last month.

One thing has become abundantly clear after three intensive workshops this summer: there’s no blueprint for developing the stakeholder process for the “regional organization” envisioned by the West-Wide Governance Pathways Initiative.

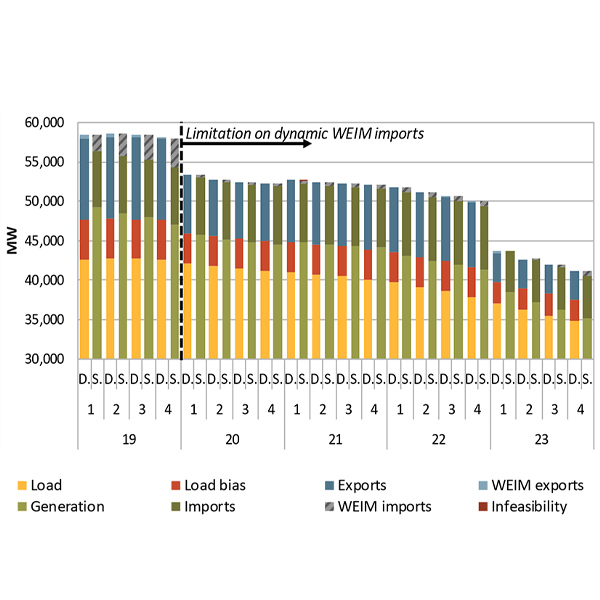

CAISO’s own systems may have contributed to a set of “operational surprises” that forced it to declare a series of energy emergency alerts in July 2023, a member of the ISO’s Market Surveillance Committee said.

SPP’s Markets+ hit a snag after FERC issued a deficiency letter outlining 16 problems the RTO must address in the tariff it filed for the proposed Western day-ahead market in March.

FERC accepted CAISO’s proposal to allow for storage resources to bid above the ISO’s $1,000/MWh soft offer cap in the real-time market to account for their intraday opportunity costs.

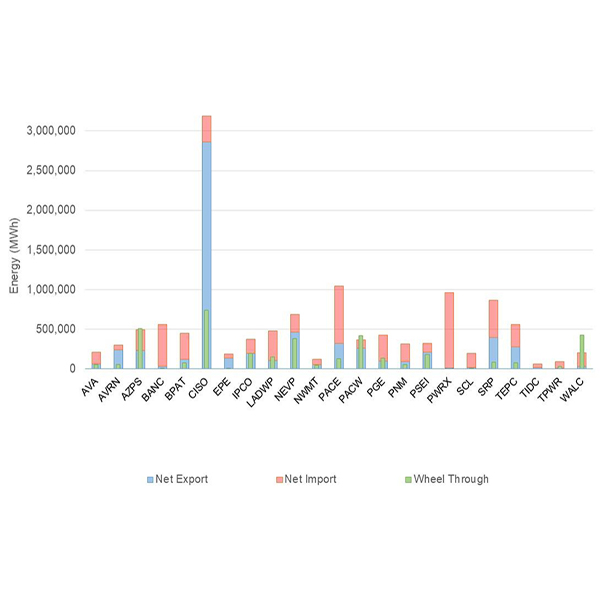

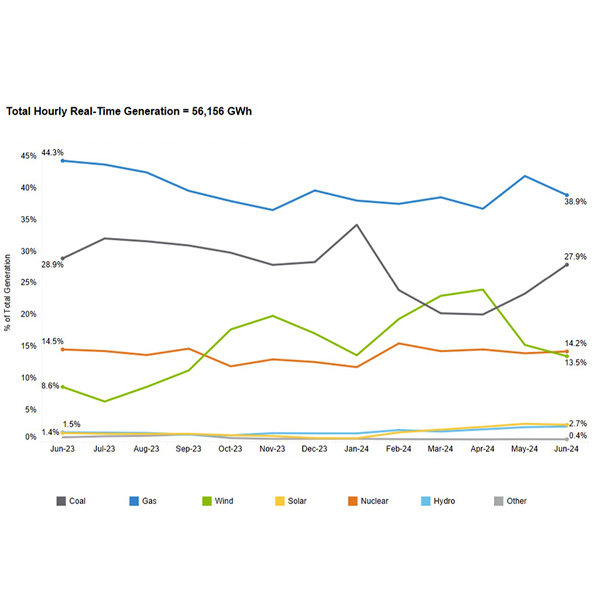

CAISO’s Western Energy Imbalance Market provided its 22 participants with $365.04 million in economic benefits from April to June down 4% from the same period a year ago.

June brought a 2-GW lower peak than anticipated and unchanged real-time and fuel prices from last year, MISO said in a monthly operations report.

The PJM MRC endorsed one of two proposals to revise how the RTO uses reserve resources, approving a deployment scheme where instructions are sent by basepoints, while rejecting a parallel proposal to grant operators the ability to dynamically increase market procurements.

The new "RO" envisioned by the West-Wide Governance Pathways Initiative might be based near CAISO’s headquarters in Folsom, Calif., according to a straw proposal.

Want more? Advanced Search