Markets

Powerex says it will fund the next phase of SPP’s Markets+ and “re-affirmed” its commitment to joining the Western real-time and day-ahead offering.

The SPP Markets and Operations Policy Committee has approved tariff revisions that would implement dispatchable transactions in the real-time energy market.

President Donald Trump, who appointed Mark Christie to FERC in 2020 during his first term, has now selected him as the commission's new chair.

Managing the often-at-odds priorities of affordability, reliability, and decarbonization will require a delicate balance of innovation, market reforms, and stability, industry experts said at the Northeast Energy and Commerce Association’s Power Markets Conference.

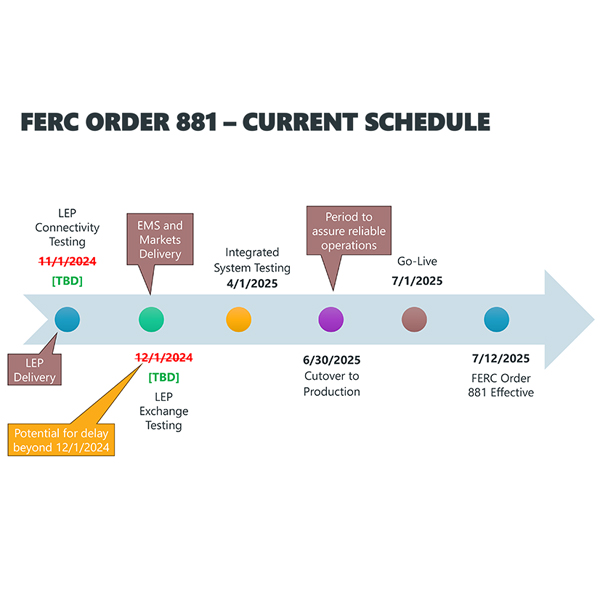

Among other actions, the PJM Markets and Reliability Committee and the Members Committee will consider endorsing various manual revisions.

MISO hopes to mete out different reserve margin obligations to its load-serving entities as it sees bigger perils on the horizon.

SPP reached a key milepost in its Western efforts when FERC conditionally approved its tariff for Markets+, a highly anticipated decision likely to ramp up the competition with CAISO’s Extended Day-Ahead Market.

FERC accepted MISO’s second try at Order 2222 compliance, allowing MISO time to prepare through mid-2029 before it fully accepts aggregators of distributed energy resources into its markets in 2030.

MISO revealed it will crack down on demand response testing requirements ahead of its spring capacity auction, while some stakeholders argued the stepped-up measures amount to a change that requires FERC approval.

FERC approved price formation reforms for SPP and set questions around resource accreditation for additional proceedings in a pair of orders issued at its regular monthly meeting.

Want more? Advanced Search