Markets

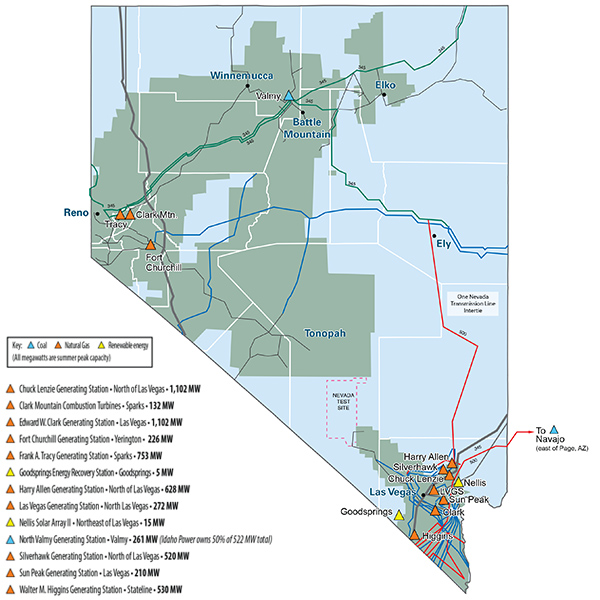

NV Energy plans to make its intention to join the CAISO EDAM public on May 31 when it files an integrated resource plan with the Public Utilities Commission of Nevada.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

The PJM MRC endorsed a proposal to revise how capacity obligations for serving large load additions are calculated to limit capacity assignments to areas where the LLAs are forecast to actually interconnect.

ERCOT stakeholders plumbed the depths of Robert’s Rules of Order and amended motions before endorsing a rule change that allows the grid operator to manually release contingency reserve service from economically dispatched resources after repeated violations of the system power balance constraint.

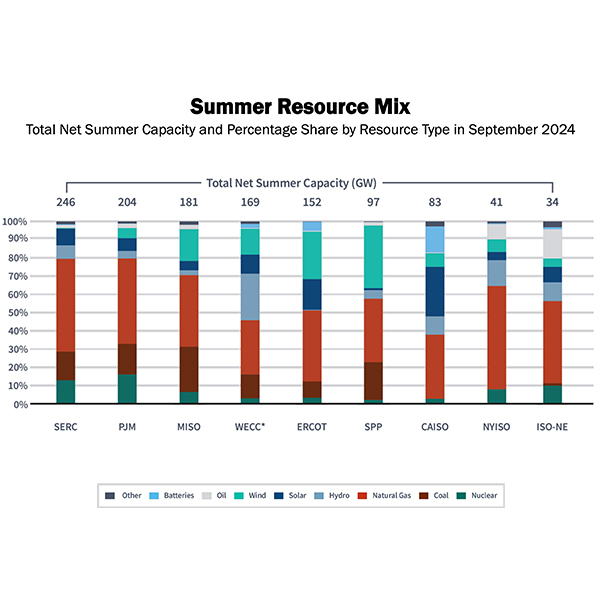

This summer should bring high temperatures and electricity demand but flat power prices as cheaper fuel offsets heavy load, according to a FERC assessment.

An NV Energy executive provided the strongest public indication yet as to why the utility is poised to choose the ISO's Extended Day-Ahead Market over SPP’s Markets+.

Five years after it introduced rules to curb generators’ uninstructed deviations from dispatch instructions, MISO said such departures are worse than ever and it likely needs to strengthen rules and software.

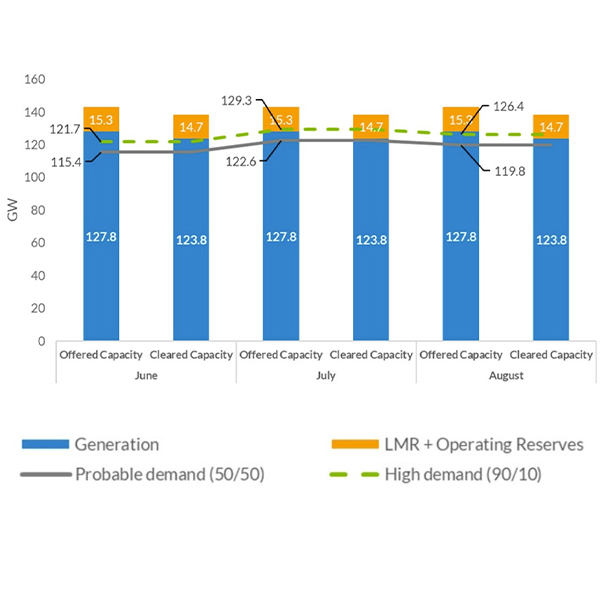

MISO expects a hot summer and should be able to survive load peaks into the 120-GW range, but the system could be on the brink if a scorching day produces demand near 130 GW.

As a next step in deciding which of two competing Western day-ahead markets to join, two of the state's utilities are commissioning a study of transfer capability under different market scenarios.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

Want more? Advanced Search