Markets

One thing has become abundantly clear after three intensive workshops this summer: there’s no blueprint for developing the stakeholder process for the “regional organization” envisioned by the West-Wide Governance Pathways Initiative.

Generation owners say the increase in PJM capacity prices is the signal they need to invest in new development, while consumer advocates say the backlogged interconnection queue could limit the ability for market participants to react.

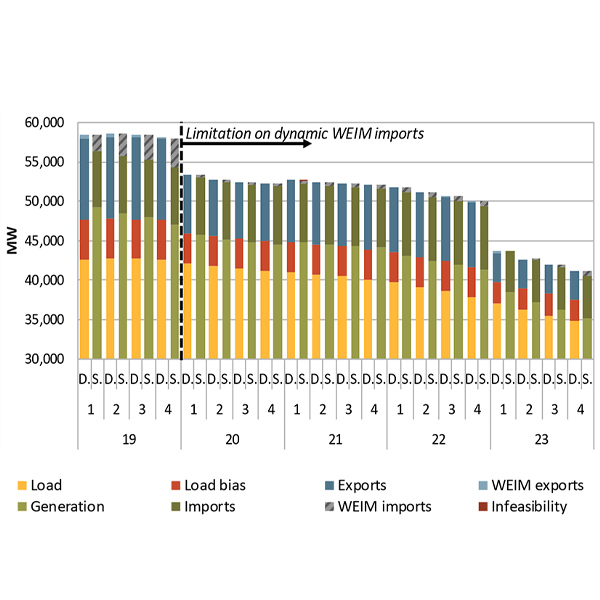

CAISO’s own systems may have contributed to a set of “operational surprises” that forced it to declare a series of energy emergency alerts in July 2023, a member of the ISO’s Market Surveillance Committee said.

PPL reported GAAP earnings of $190 million for the second quarter and executives focused on changing market dynamics in PJM during a teleconference with analysts.

The Sierra Club, Natural Resources Defense Council and the Sustainable FERC Project are seeking a rehearing of MISO’s sloped demand curve in its capacity auction.

SPP’s Markets+ hit a snag after FERC issued a deficiency letter outlining 16 problems the RTO must address in the tariff it filed for the proposed Western day-ahead market in March.

FERC accepted CAISO’s proposal to allow for storage resources to bid above the ISO’s $1,000/MWh soft offer cap in the real-time market to account for their intraday opportunity costs.

PJM capacity prices increased nearly tenfold in the 2025/26 Base Residual Auction as a trifecta of load growth, generation deactivations and changes to risk modeling shrank reserve margins.

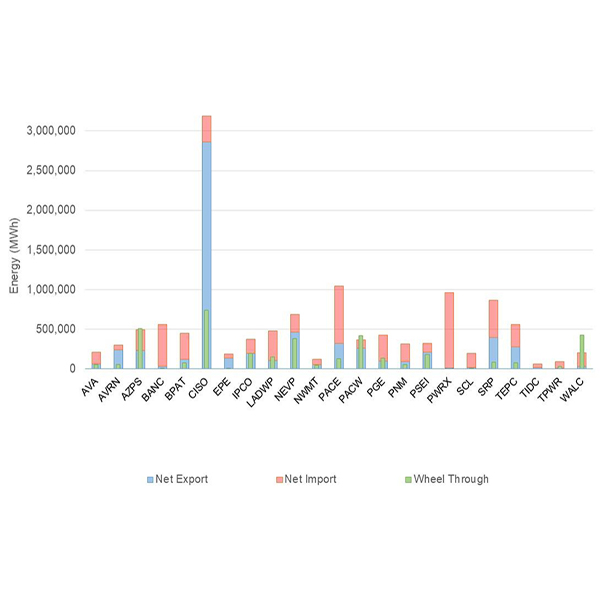

CAISO’s Western Energy Imbalance Market provided its 22 participants with $365.04 million in economic benefits from April to June down 4% from the same period a year ago.

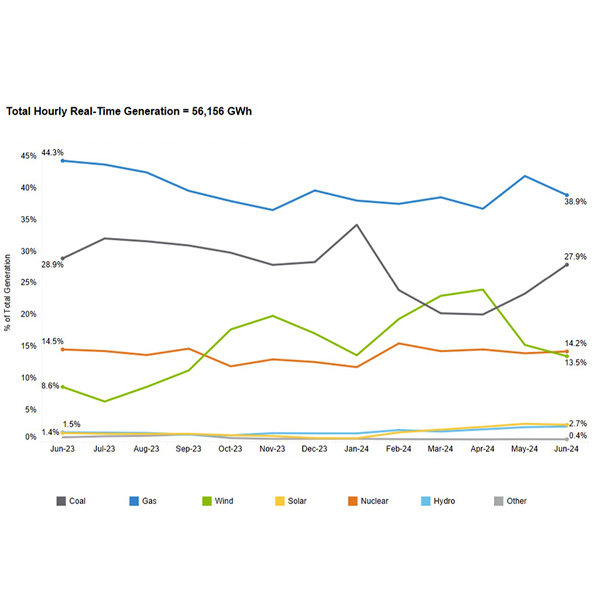

June brought a 2-GW lower peak than anticipated and unchanged real-time and fuel prices from last year, MISO said in a monthly operations report.

Want more? Advanced Search