Markets

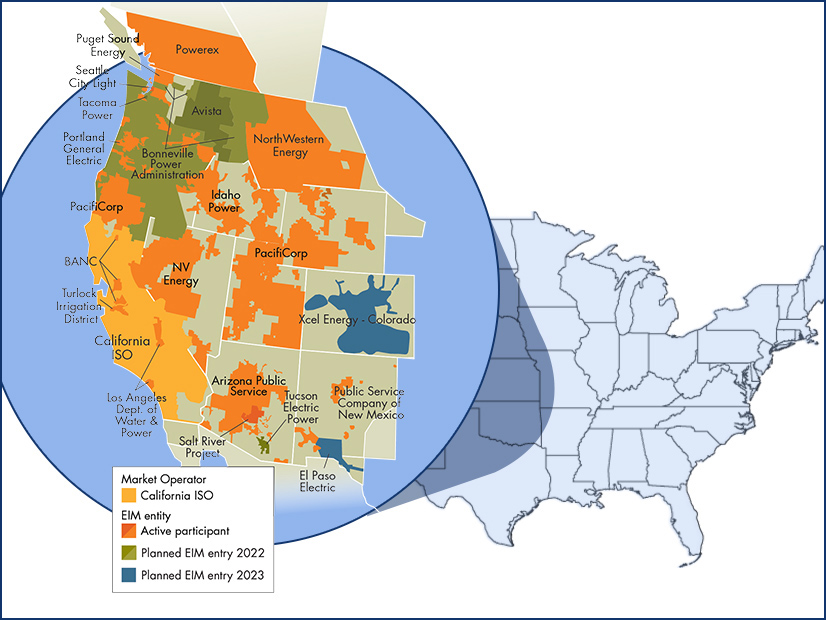

The WEIM approved participation by utilities within an entity's balancing authority area — a move intended to convince Xcel Energy Colorado to join the market.

PJM and its stakeholders continue to jostle over the impact of the proposed replacement for the expanded MOPR as responses continue to be filed at FERC.

PJM is recommending using an installed reserve margin of 14.6%, slightly up from 14.4% required in 2020.

Crispins C. Crispian, CC BY-SA-4.0, via Wikimedia

NEPOOL stakeholders and ISO-NE continue to work on eliminating the MOPR from the capacity market, discussing multiple proposals on transitional mechanisms.

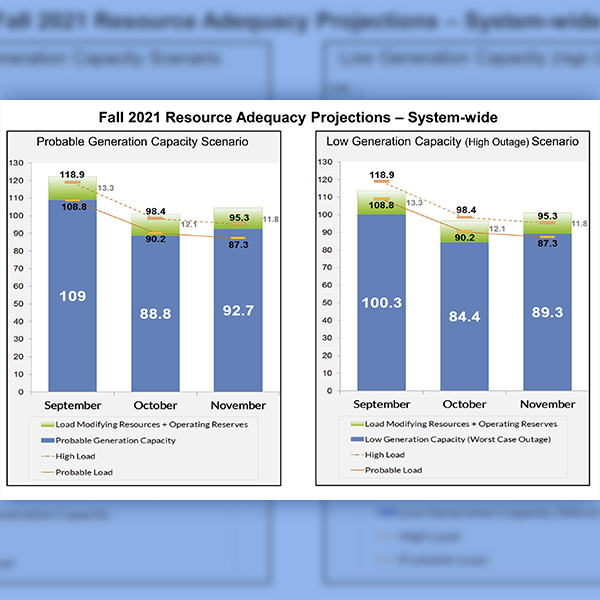

MISO expects a chance for an emergency every month this fall, with the possibility of burning through the entirety of its emergency resource reserves.

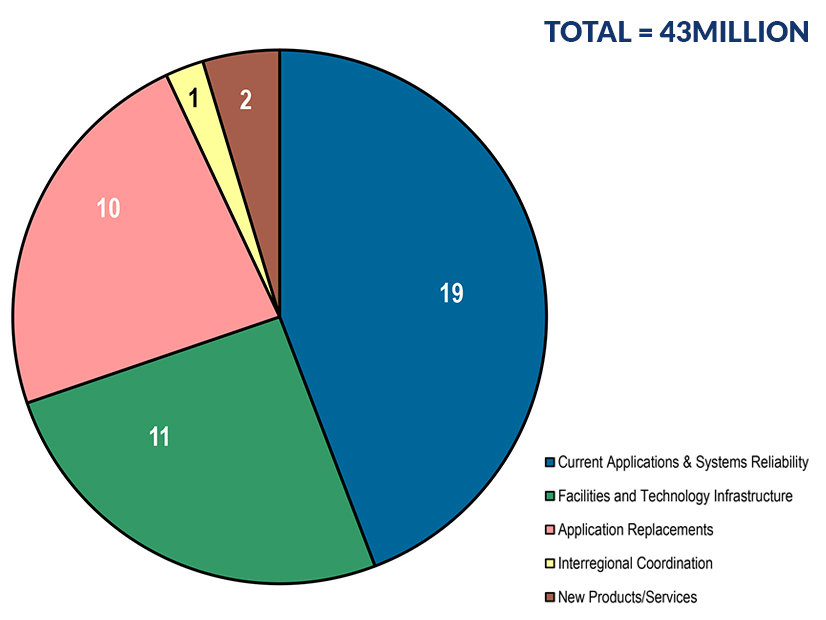

ISO-NE presented its proposed 2022 operating and capital budgets to the NEPOOL Participants Committee.

PJM stakeholders endorsed manual revisions implementing fast-start pricing even after some members questioned one of the changes.

Texas regulators discussed with ERCOT market participants potential changes to an energy market that has been virtually untouched for almost 20 years.

ERCOT staff says they plan to continue in 2022 their conservative operations approach of setting aside additional reserves by procuring ancillary services.

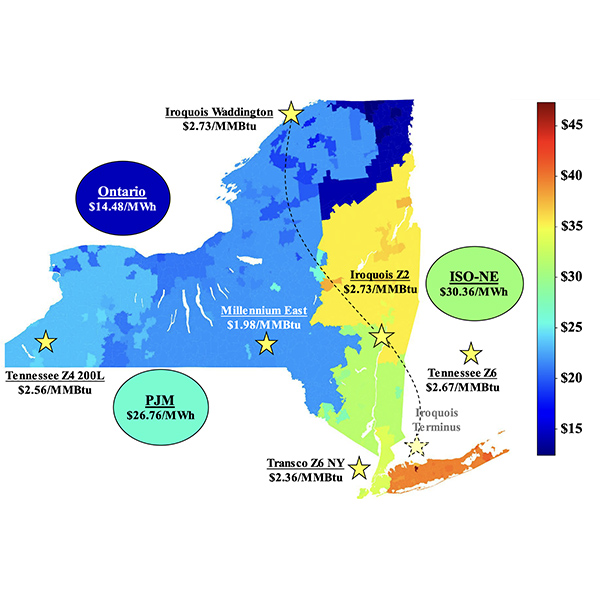

The NYISO Market Monitor reported energy markets performed competitively in the second quarter of 2021, with all-in prices ranging from $21 to $67/MWh.

Want more? Advanced Search