Markets

PJM's Adam Keech told the Market Implementation Committee the RTO plans to file governing document revisions with FERC to expand the requirement that resources must offer into the capacity market to also apply to all resources holding capacity interconnection rights.

The PJM Operating Committee endorsed a pair of manual revisions, updating definitions to be more clear and approving a quick fix proposal.

CAISO is considering how to apply fast-start pricing to the Extended-Day Ahead Market — a topic that has been a sticking point for some as entities across the West decide which day-ahead market to join.

BPA hit all its reliability goals in fiscal year 2024 despite massive wildfires, peak load records and public safety power shutoffs, according to agency staff.

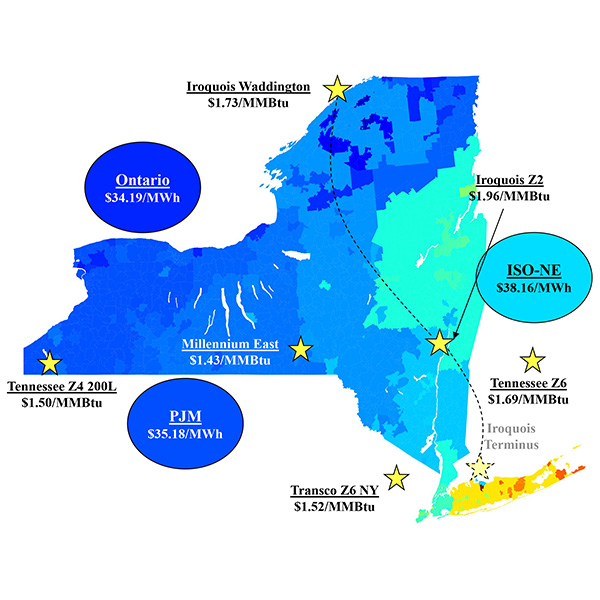

The Market Monitoring Unit said that even though all-in prices were slightly down, NYISO energy costs generally were up by 4 to 26% in most areas.

FERC was not persuaded by environmental nonprofits, utilities nor Mississippi regulators to order MISO to rework the sloped demand curve it’s been cleared to use in the spring capacity auction.

Portland General Electric’s rate hikes largely stem from increased wholesale power market costs, the utility wrote after Sen. Ron Wyden voiced concern that Oregon customers are struggling to pay their electricity bills.

NYISO stakeholders expressed skepticism of an ISO proposal to levy financial penalties against underperforming generators, saying it was not developed enough to be voted upon by the end of the year.

MISO experienced an October peak load of 84 GW, which was lower than its 99-GW peak during the same period in 2023.

Four environmental nonprofits insist MISO’s recently approved capacity accreditation is incomplete unless the RTO details how it will conduct its loss of load modeling the new approach relies upon.

Want more? Advanced Search