Capacity Market

NYISO and PJM officials discussed the future of their capacity markets as more renewables come online during GTM’s annual Power and Renewables Summit.

NYISO CEO Rich Dewey told stakeholders that staff are determining whether a technical problem related to the demand curve reset violates the Tariff.

The cost of the Greater Boston Project is expected to increase by $191 million, Eversource told the NEPOOL Reliability Committee.

Ratepayer advocates challenged the PJM board to take action against Exelon and FirstEnergy, accused of bribing legislators in Illinois and Ohio, respectively.

The New Jersey BPU held a technical conference to consider whether it should remain in PJM’s capacity market or go on its own through the FRR alternative.

PJM members endorsed a proposal to use the ELCC method to calculate the capacity value of limited-duration and intermittent resources.

With a challenging summer in the rearview, MISO expects more traditional reliability risks this fall while making blueprints for an industry roiled by change.

Industry representatives, state officials, legal scholars and analysts attended the annual Independent Power Producers of New York Fall Conference.

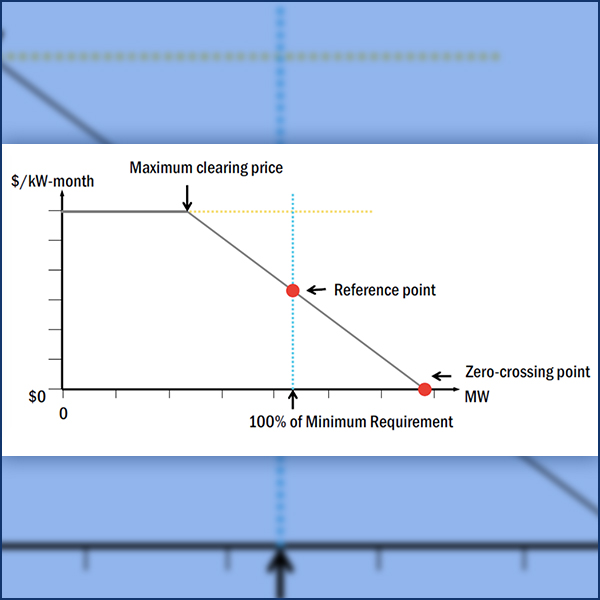

NEPOOL stakeholders proposed changes to Forward Capacity Market parameters and rules regarding the timing of delist bids.

ISO-NE will proceed with its proposal to eliminate capacity performance payments for energy efficiency resources.

Want more? Advanced Search