Capacity Market

PJM and its stakeholders continue to jostle over the impact of the proposed replacement for the expanded MOPR as responses continue to be filed at FERC.

PJM is recommending using an installed reserve margin of 14.6%, slightly up from 14.4% required in 2020.

Crispins C. Crispian, CC BY-SA-4.0, via Wikimedia

NEPOOL stakeholders and ISO-NE continue to work on eliminating the MOPR from the capacity market, discussing multiple proposals on transitional mechanisms.

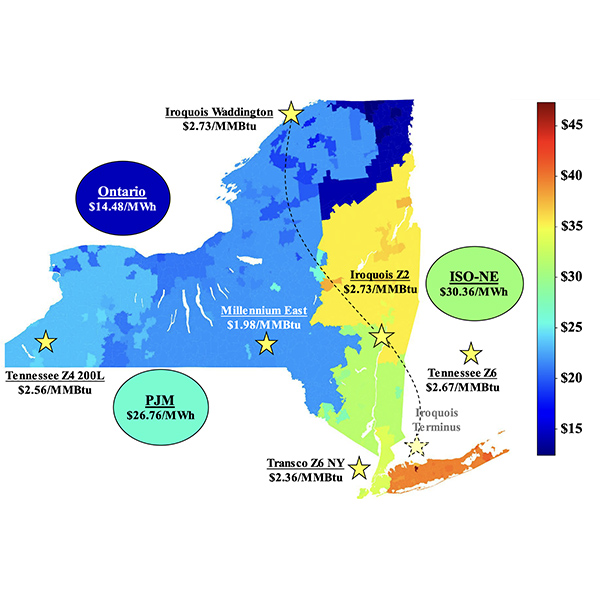

The NYISO Market Monitor reported energy markets performed competitively in the second quarter of 2021, with all-in prices ranging from $21 to $67/MWh.

MISO is confirming final details of its bid for seasonal capacity auctions & availability-based accreditation while some stakeholders continue to criticize it.

More than two dozen comments poured in to FERC regarding PJM’s proposed replacement for the extended minimum offer price rule.

Energy prices in PJM increased “significantly” in the first half of 2021 compared to 2020, but prices remained lower than historical levels, the IMM reported.

The PJM MIC OKd changes on fast-start pricing, 5-minute dispatch, solar-battery hybrids and an issue charge over energy efficiency in the capacity market.

Stakeholders discussed ISO-NE’s revised proposal for FERC Order 2222 compliance and removal of the MOPR at NEPOOL's three-day summer meeting.

Panelists at a recent NECA webinar discussed the highs and lows of working to refine offer review trigger prices for offshore wind and storage resources.

Want more? Advanced Search