Capacity Market

MISO said it will finalize an availability-based accreditation for nearly 12 GW of load-modifying resources over the first quarter of 2025 ahead of a filing with FERC.

FERC has ordered American Efficient to defend its energy efficiency programs in PJM and MISO or pay a $722 million penalty and return $253 million in profits to ratepayers.

Voltus filed a complaint at FERC over MISO's interpretation of a recent rule change that led the grid operator to stop accepting replacements for customers who sign up to provide demand response but retire.

MISO expects its in-service solar capacity to grow to 12 GW by the end of winter, a 50% increase over its existing fleet.

PJM's Adam Keech told the Market Implementation Committee the RTO plans to file governing document revisions with FERC to expand the requirement that resources must offer into the capacity market to also apply to all resources holding capacity interconnection rights.

FERC was not persuaded by environmental nonprofits, utilities nor Mississippi regulators to order MISO to rework the sloped demand curve it’s been cleared to use in the spring capacity auction.

Four environmental nonprofits insist MISO’s recently approved capacity accreditation is incomplete unless the RTO details how it will conduct its loss of load modeling the new approach relies upon.

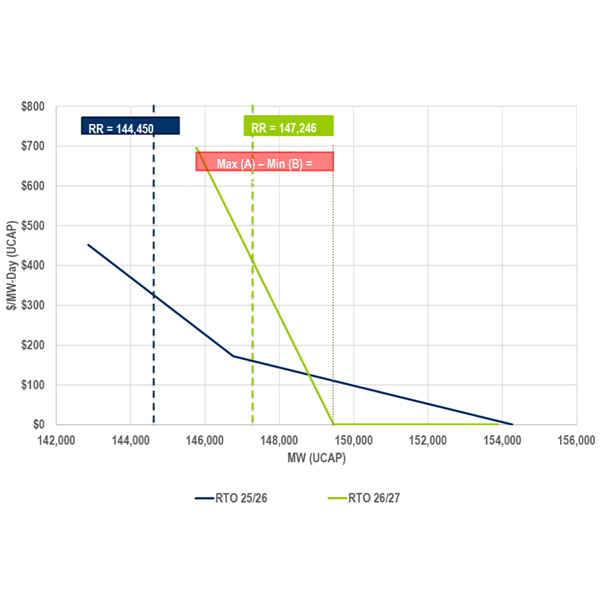

Pennsylvania regulators hosted several panels to discuss PJM's tightening reserve margins and how the PUC should respond to the situation, which at least promises more high prices in the near future before new supplies can come online.

Stakeholder opinions were sharply divided at the PJM Members Committee’s meeting regarding RTO proposals to allow high capacity factor resources to be sped through the interconnection queue and revise aspects of the capacity market.

Several state consumer advocates filed a complaint at FERC alleging PJM’s capacity market is failing to mitigate market power, overestimating future load and producing high clearing prices that generation owners cannot act on.

Want more? Advanced Search