Capacity Market

FERC approved a PJM proposal to limit capacity prices to between $175 and $325/MW-day for the next two Base Residual Auctions, resolving a complaint from Pennsylvania Gov. Josh Shapiro.

The committees are expected to vote on manual revisions and hear a proposal to rework how resources providing black start service are compensated.

Two power industry CEOs at the Gulf Coast Power Association’s spring conference offered two different takes on ERCOT load growth over the rest of the decade — and how the sector should deal with a potential doubling of peak demand by 2031.

An appeals court has denied Entergy’s repeat attempt to revive a 50% minimum capacity obligation rule for MISO’s load-serving entities, concluding Entergy lacked standing.

The Maryland Office of People’s Counsel filed a complaint alleging the rules used in PJM's 2025/26 Base Residual Auction would require consumers to pay twice for capacity provided by generators operating on RMR agreements.

MISO said its next capacity auction in spring 2026 will feature more rigorous testing for its demand response that registers to provide capacity.

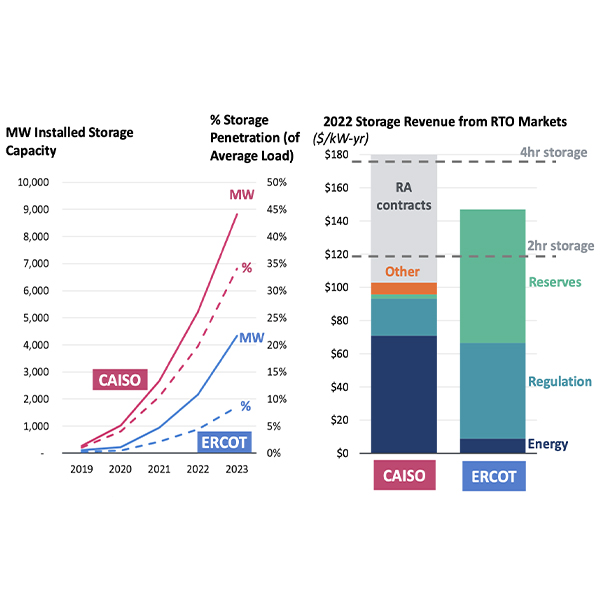

ACP released a report produced by The Brattle Group laying out how organized markets can replicate the success CAISO and ERCOT have had in deploying energy storage resources.

The NEPOOL Markets Committee convened a two-day meeting focused on ISO-NE’s capacity auction reform project, along with other business.

ISO-NE discussed its plans for preventing and mitigating market power as it overhauls its capacity market and resource retirement processes at a NEPOOL Markets Committee meeting.

The Market Implementation Committee endorsed a joint PJM and Independent Market Monitor proposal to rework how uplift and deviation charges are calculated for market sellers.

Want more? Advanced Search