CAISO/WEIM

CAISO Board of GovernorsCalifornia Agencies & LegislatureCalifornia Air Resources Board (CARB)California Energy Commission (CEC)California LegislatureCalifornia Public Utilities Commission (CPUC)EDAMOther CAISO CommitteesWestern Energy Imbalance Market (WEIM)WEIM Governing Body

The California Independent System Operator serves about 80% of California's electricity demand, including the service areas of the state's three investor-owned utilities. It also operates the Western Energy Imbalance Market, an interstate real-time market covering territory that accounts for 80% of the load in the Western Interconnection.

PacifiCorp said it will sign an implementation agreement to join CAISO’s EDAM, making it the first entity to formally commit to either of the two day-ahead markets being offered in the West.

FERC approved CAISO’s request to increase its capacity procurement mechanism soft offer cap from $6.31 per kW-month to $7.34.

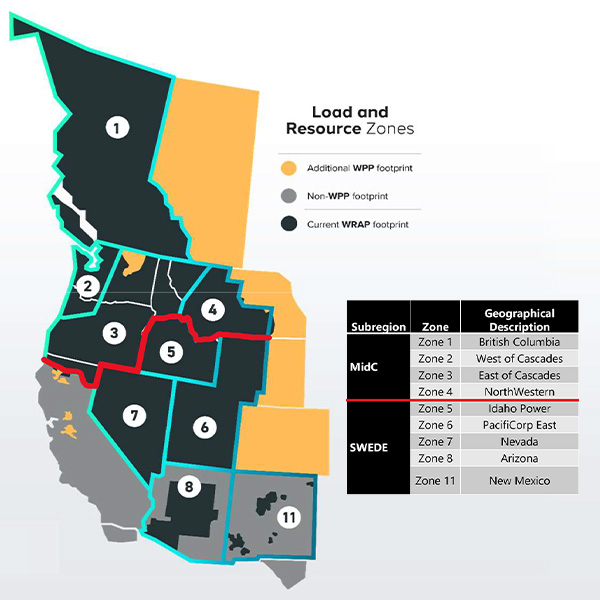

Western Resource Adequacy Program participants still strongly support the program despite recently appealing to delay its “binding” penalty phase by one year due to concerns about capacity shortages, WPP's Sarah Edmonds said.

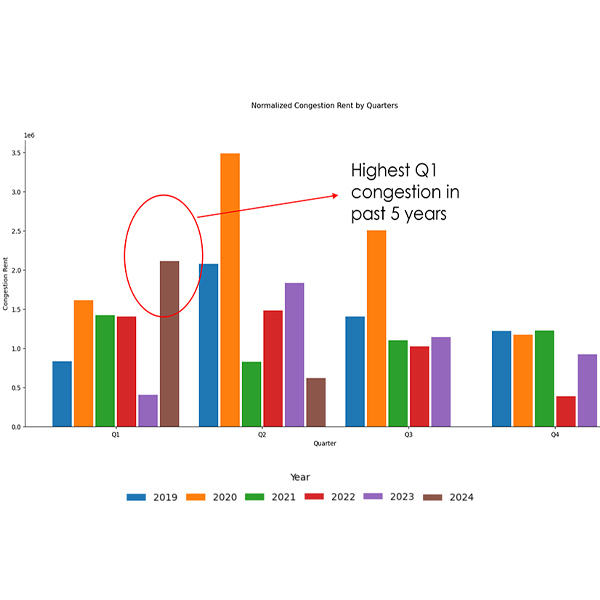

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

Citing “significant new headwinds” to securing energy resources, participants in the Western Resource Adequacy Program are seeking to delay the program’s “binding” penalty phase by one year, to summer 2027.

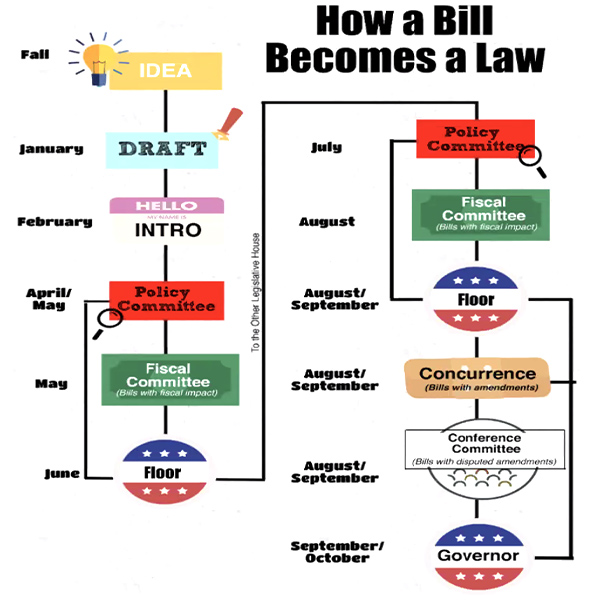

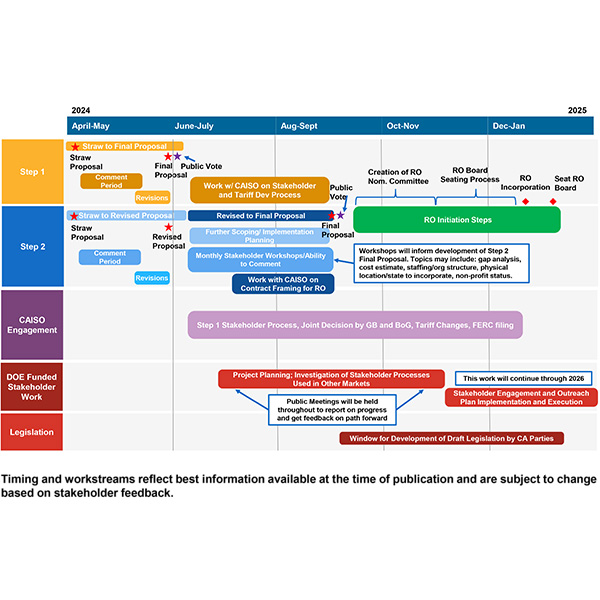

Reps from two groups that blocked past efforts to “regionalize” CAISO predict success for an upcoming campaign to change California law to allow the ISO to participate in an independent RTO.

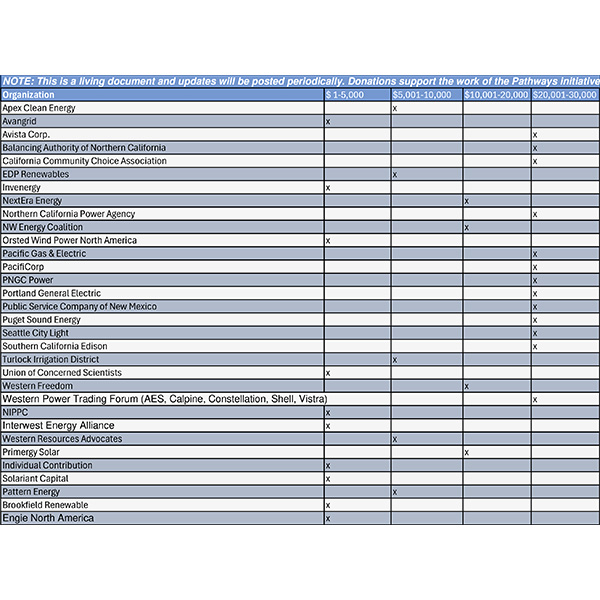

The West-Wide Governance Pathways Initiative applied for the money in January in response to a DOE Funding Opportunity Announcement, seeking two tranches of $400,000 each to be disbursed over two years to help support the effort build an independent Western RTO.

More than two dozen Western electricity sector entities sent a letter to SPP expressing support for the continued development of the RTO’s Markets+, which is competing for participants with CAISO’s Extended Day-Ahead Market.

California could significantly cut power costs through increased use of VPPs, according to the study by The Brattle Group and GridLab.

Backers of an initiative to create an independent Western RTO that builds on CAISO’s markets have floated a plan to untangle the snag that’s hung up past efforts to “regionalize” the ISO: a lack of independent governance.

Want more? Advanced Search