CAISO/WEIM

CAISO Board of GovernorsCalifornia Agencies & LegislatureCalifornia Air Resources Board (CARB)California Energy Commission (CEC)California LegislatureCalifornia Public Utilities Commission (CPUC)EDAMOther CAISO CommitteesWestern Energy Imbalance Market (WEIM)WEIM Governing Body

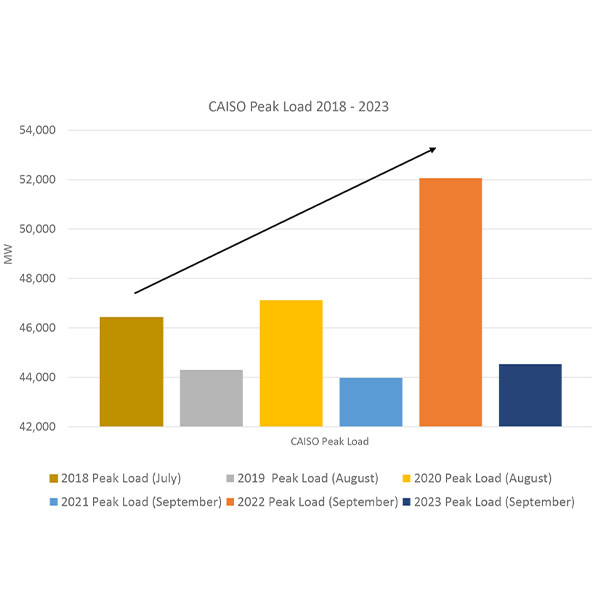

The California Independent System Operator serves about 80% of California's electricity demand, including the service areas of the state's three investor-owned utilities. It also operates the Western Energy Imbalance Market, an interstate real-time market covering territory that accounts for 80% of the load in the Western Interconnection.

FERC denied a complaint by energy conglomerate Saavi alleging CAISO unlawfully terminated the full capacity deliverability rights for its gas-fired generating unit in Mexico that previously was interconnected with the ISO’s grid.

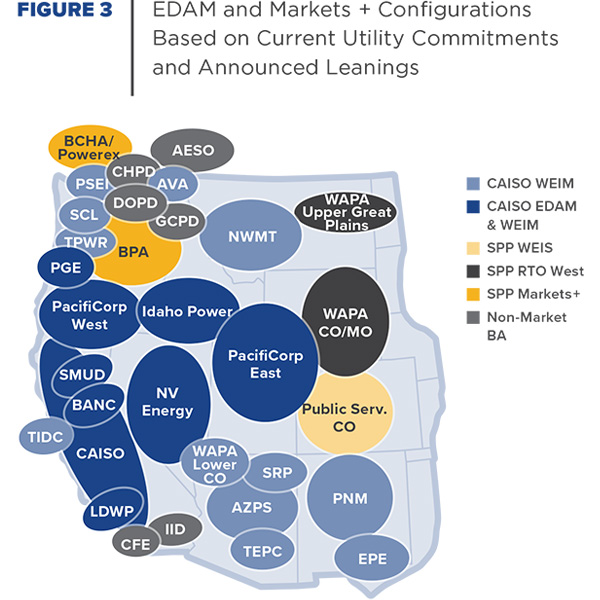

As NV Energy moves forward with plans to join CAISO’s Extended Day-Ahead Market, Nevada regulators have laid out a framework for how the company can seek approval for EDAM participation.

A new study commissioned by Renewable Northwest says Powerex is poised to benefit if the West ends up divided between CAISO’s EDAM and SPP’s Markets+.

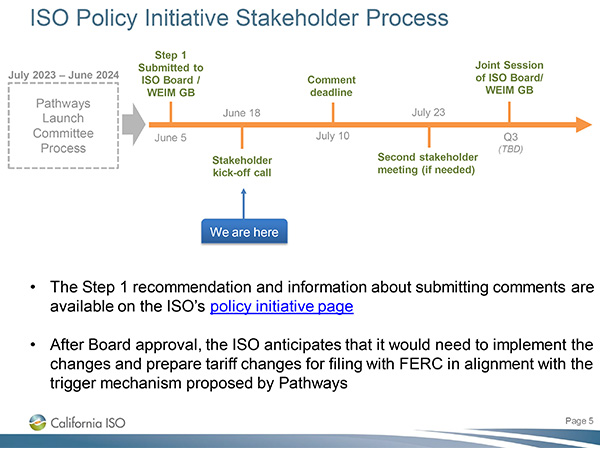

CAISO kicked off the West-Wide Governance Pathways Initiative stakeholder process required to shift the ISO’s governance structure to an independent entity within the Extended Day-Ahead Market.

The Western Area Power Administration’s non-jurisdictional Open Access Transmission Tariff does not meet the standard of an “acceptable reciprocity tariff,” despite recent revisions the federal power agency incorporated into the tariff, FERC ruled.

Arizona regulators are under fire for decisions on the expansion of a UNS gas-fired plant and third-party IRP audits.

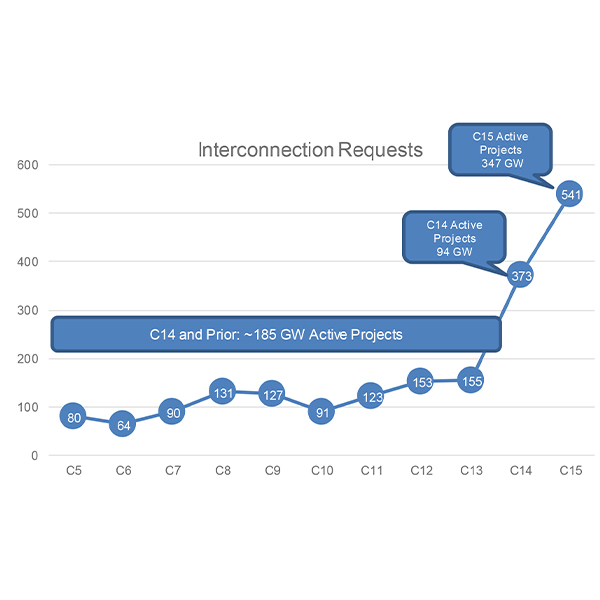

The CAISO board unanimously approved the ISO’s Interconnection Process Enhancements proposal, the product of more than a year of stakeholder engagement and troubleshooting.

FERC approved CAISO tariff revisions that will allow transmission owners to recover transmission revenue shortfalls attributed to transitioning their assets into the Extended Day-Ahead Market.

TerraPower broke ground on its Natrium reactor demonstration project in Wyoming, making it the first advanced reactor to enter construction.

Want more? Advanced Search