EDAM

A California senate committee voted unanimously in favor of the Pathways bill, bringing the Golden State closer to allowing CAISO to cede oversight of its energy markets to an independent RO.

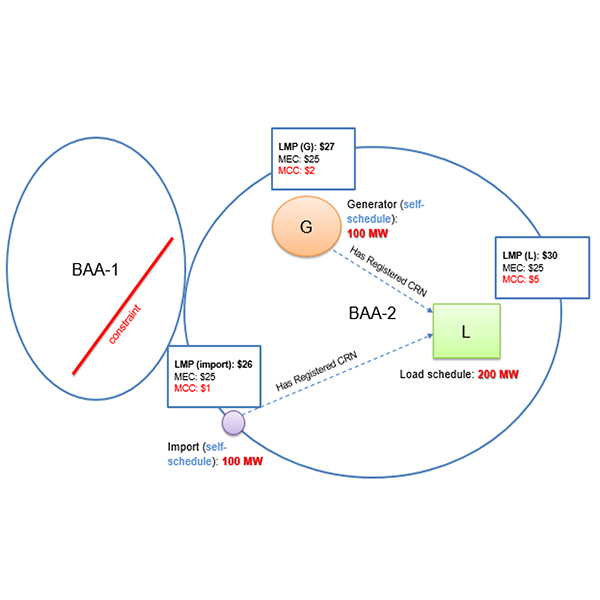

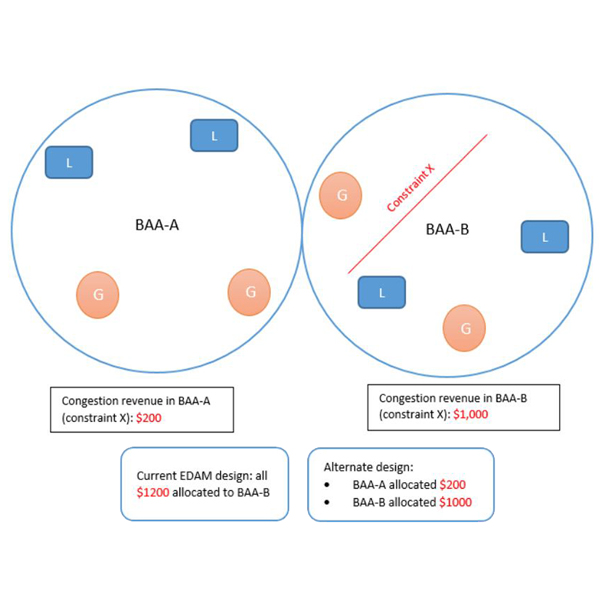

CAISO released a draft final proposal detailing how EDAM will allocate congestion revenues in circumstances when a transmission constraint in one BAA produces “parallel” flows in a neighboring BAA also participating in the market.

CAISO sidelined a proposal to provide an additional market run for gas resources due to a lack of information on the subject and a need for operational experience with the ISO’s Extended Day-Ahead Market.

The complex issue regarding congestion revenue allocation in CAISO’s Extended Day-Ahead Market continues to raise questions and cause some confusion for market participants.

The Bonneville Power Administration elicited nearly 150 comments in response to the draft policy outlining its decision to join SPP’s Markets+ rather than CAISO’s Extended Day-Ahead Market.

The dispute over how CAISO’s Extended Day-Ahead Market will allocate congestion revenues to market participants continues, even as the ISO moves to address stakeholder concerns.

BPA's day-ahead market decision will have “major reliability and affordability impacts” on electricity customers in the Northwest and across the West, CAISO CEO Elliot Mainzer told the ISO’s Board of Governors

The West-Wide Governance Pathways Initiative’s Launch Committee said it hopes to seat a permanent board by either next year or 2027 for the regional organization that will govern energy markets in the West.

For the Balancing Authority of Northern California, a positive experience with CAISO’s Western Energy Imbalance Market was a key factor in the decision to also join the ISO’s Extended Day-Ahead Market.

CAISO launched an “expedited” initiative to address stakeholder concerns about how EDAM will allocate congestion revenues when a transmission constraint in one balancing authority area causes congestion in a neighboring BAA.

Want more? Advanced Search