Company News

FERC rejected Dominion Virginia Power’s request to push back the effective date for a rate revision by more than year, a change that would have cost transmission customers $11.1 million.

This week's company briefs include news on Tennessee Valley Authority, Xcel Energy, AEP, FirstEnergy, Dominion, PSEG and NextEra.

Trial staff at FERC has recommended approval of a settlement that would reduce the return on equity of Niagara Mohawk to 10.03% from the current 11.5%.

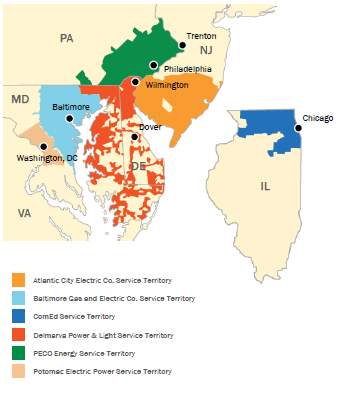

Two key Maryland counties have agreed to support the controversial takeover of Pepco by Exelon in return for promises of bill credits, reliability improvements and other concessions.

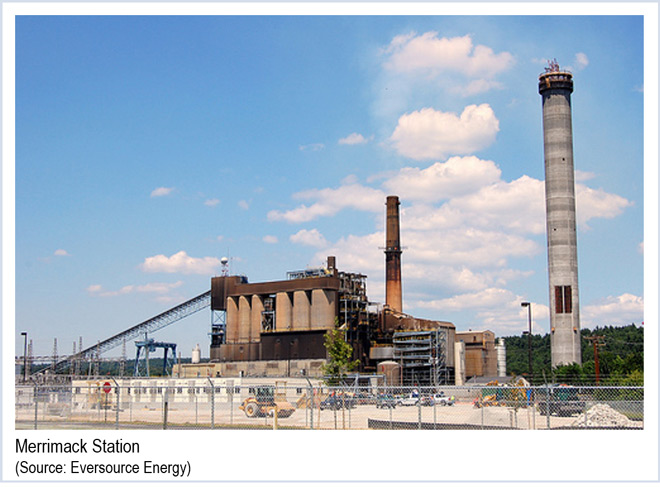

Eversource will sell its New Hampshire plants to satisfy regulators’ divestiture demands and resolve a long-standing dispute over the cost of pollution controls.

News briefs on companies doing business with RTOs. This week we include FirstEnergy, NRG, PPL, Exelon and the TVA.

NRG Energy will continue to focus on its residential solar and renewable energy technology businesses, despite posting losses in those units in 2014.

D.C.’s consumer advocate asked the PSC last week for more time to respond to Exelon’s sweetened offer in its proposed $6.8 billion acquisition of Pepco.

Ameren reported a 30% jump in fourth-quarter earnings and said it expects future growth from new transmission projects, even as FERC considers lowering the rate of return on such investments.

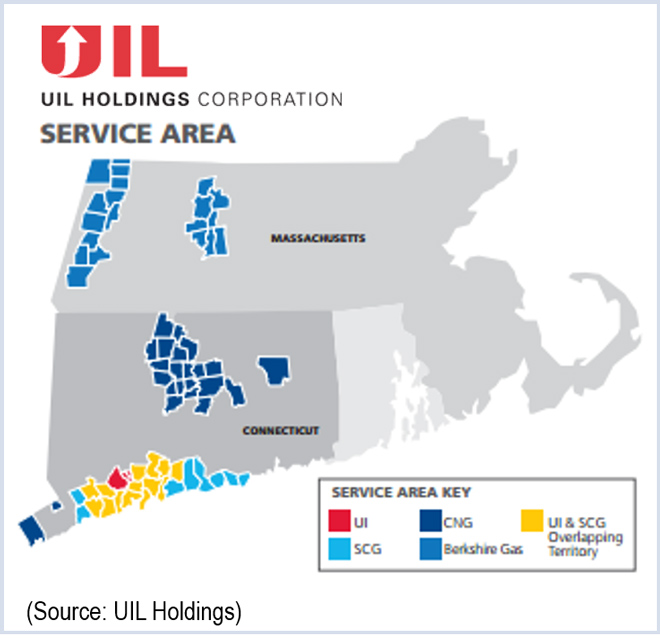

Iberdrola SA announced it is acquiring UIL Holdings, which has electric and gas distribution companies in Connecticut and Massachusetts, in a cash and stock deal valued at $3 billion.

Want more? Advanced Search